Investing is Not About Making The Shot

It’s about taking the right shot

Once upon a time, Howard Marks was a staunch supporter of basic financial truths:

In my view, digital currencies are nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it. (emphasis original)

Assuming “pyramid scheme” means the Greater Fool Theory, this is 100% correct. Unfortunately, money has a habit of changing people, even the greats like Howard Marks. He has somewhat changed his tune on crypto recently, presumably because his son, Andrew holds Bitcoin.

Back in 2017, my memo There They Go Again . . . Again included a section on cryptocurrencies in which I expressed a high level of skepticism. This view has been a source of much discussion for me and Andrew, who is quite positive on Bitcoin and several others and thankfully owns a meaningful amount for our family. While the story is far from fully written, the least I can say is that my skeptical view has not borne out to date.

And:

In the case of cryptocurrencies, I probably allowed my pattern recognition around financial innovation and speculative market behavior – along with my natural conservatism – to produce my skeptical position. These things have kept Oaktree and me out of trouble many times, but they probably don’t help me think through innovation. Thus, I’ve concluded (with Andrew’s help) that I’m not yet informed enough to form a firm view on cryptocurrencies. In the spirit of open-mindedness, I’m striving to learn. Until I do, I’ll be referring all requests for comments on the subject to Andrew (although I’m sure he’ll decline).

Let’s go back to our Adam and Brian comparison. Number go up, so no reason to be skeptical, right? You may recall that we challenged Marks on his newfound stance and said

Why does it matter that his skeptical view has not borne out to date? It’s about process, not outcomes, isn’t it? Is Howard Marks letting a good outcome cloud his judgment?

It is very clear that Marks originally understood crypto was speculation. He had preached “trusting the process” when it came to investing, and he was right. Decisions should not be evaluated based on the outcomes:

You can’t tell from an outcome whether a decision was good or bad. It’s very important, most people don’t understand this, totally counterintuitive.

In that same video, Marks made it clear that this is a fundamental principle that also applies to finance:

In the real world, where there is randomness, good decisions fail to work all the time. Bad decisions work all the time. Investment business is full of people, who are, quote, right for the wrong reason.

It also happens to apply to basketball.

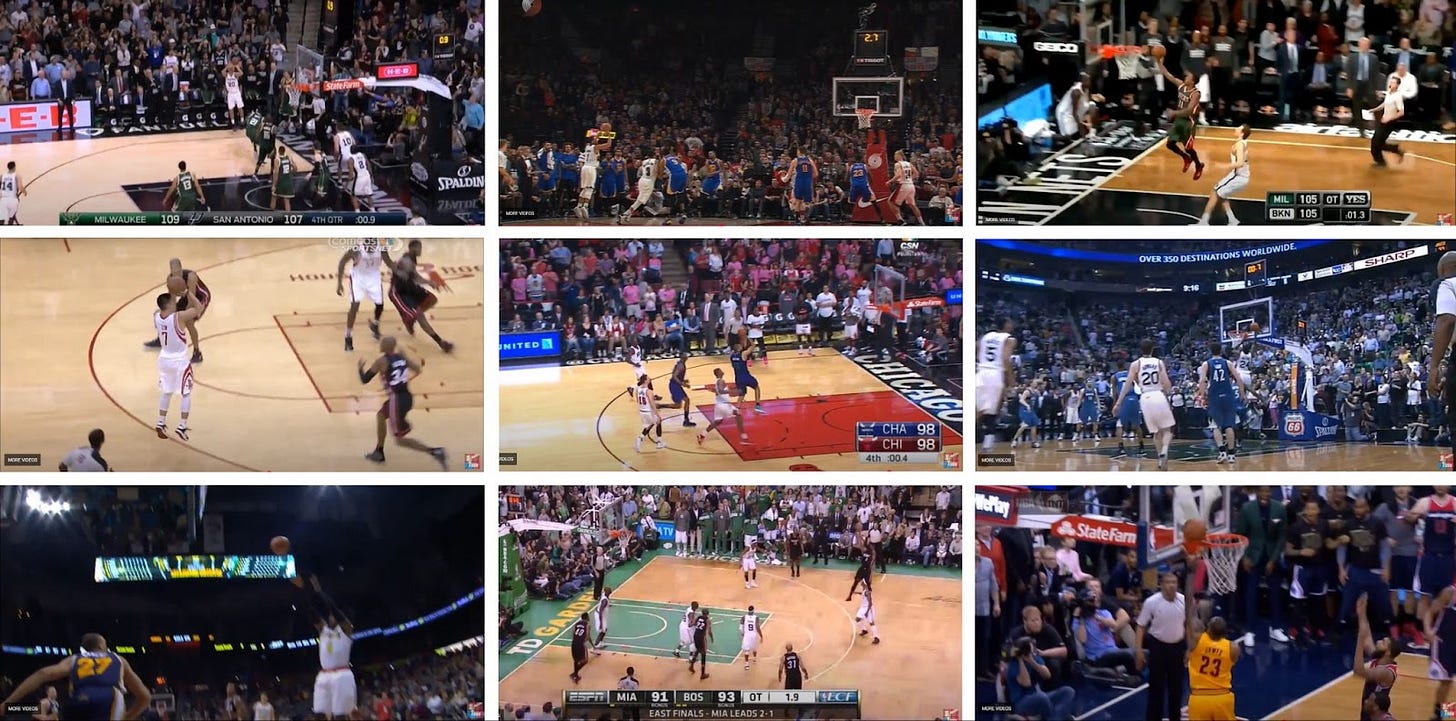

Let’s take a look at these shots. Do you think these are good shots?

Whether it was moving the ball, or just individual ability, these are some of the best shots you can take in basketball. Wide-open jumpers and bunnies at the rim are very high percentage shots. As a coach, one of your primary goals in a close game is to put your players in the position of having one of these opportunities at the buzzer.

The issue? The players pictured above actually did get those opportunities at the buzzer and none of them went in.

So be it. The next time you get that opportunity, you will still shoot that shot and still have a high percentage chance of hitting the winning shot.

The same scenario applies to investing. There is no good investing or bad investing, and dare we say it, no intelligent investing. Investing, by definition, is a good thing - it’s simply a matter of whether you’re actually doing it or not!

Remember what Howard Marks said about a trader who had a great return for the year:

For example, just a brief example, you see somebody and they report a great return for the year. The scientist who thinks that the investment world runs like the world of physics might think well, great return that means the guy is a great investor. But in truth, it might be somebody who took a crazy shot and got lucky.

Then, of course, you have the Rajat Sonis of the world, who commit precisely this error; i.e., evaluating a trade based on its outcomes:

Let’s take a closer look, Bitcoin’s annual return in 2024 was 121%.

Ok, that would normally be considered a great outcome. What about XRP? (disclaimer: we own a little bit of it, but that’s not the point). 233%.

So, we obviously don’t think one can invest in crypto but many do. Behind that thinking is the false equivalence that investing is all about making money. So, let’s roll with that thinking for a second.

If the return is what matters, XRP was the better “investment,” right? Not according to Rajat:

This is even worse than not understanding what investing means, it is contradicting yourself. If your definition of investing is making money, you are wrong, but at least own your stance and go where it leads you. Ric Edelman made the exact same mistake with respect to Dogecoin, which he characterized as a scam. Dogecoin’s return in 2024? 250%.

Rajat has a CFA charter but we take it he has not studied how the CFA Institute came about in the first place. The CFA Institute was actually the brainchild of Ben Graham. We don’t have the luxury of knowing what Ben Graham would think about crypto (he passed away in 1976), but read his work and the answer will be obvious. Of course, we know exactly what Ben Graham’s biggest disciple, Warren Buffett, thinks about crypto.

Crypto is like taking a wild, off-balance shot in basketball. True, you might get lucky and make a one-legged step back jumper but in the infamous words of Patrick Ewing: what kind of shot is that?

Sports always helps us understand finance, doesn’t it? This is why we are bullish on Court of Finance, our first book.

A helpful framework is that any trade is akin to taking a shot. This applies not only to stocks but to anything that is a financial instrument. Even a backward, one-handed shot from the half-court can go in but that does not make it an investment. Investing is akin to a wide-open layup or uncontested jumper that has a high chance of success. Said more succinctly:

Investing is not about making a shot, it’s about taking the right shot.

This begs the question: What makes a shot the right shot?