Investing… What’s In a Name?

Everything

This is it. You started your new job, hypothetically, at the SEC on June 1. Your first assignment is due Monday, June 26. You were asked to draft the next investor alert on crypto.

You have been researching rigorously the entire month. You have developed a point of view and can’t wait to share your findings with your supervisors.

Before you draft the alert and refine it, you want to put your thoughts down in raw form, as you generally do. Let the thoughts roam freely and put them on paper. You are not looking for perfection at this point. The editing will come later. This is your attempt to let the creative juices flow and hone in on the key points.

With that, you dive in:

It all started with gold. The shiny metal that everybody seems to love… A 4000+ year fascination… A word that has permeated languages across the globe and sports competitions… We “go for the gold” when we are trying to reach huge milestones and award gold medals to the winners of sports competitions. Gold, however, does not have any intrinsic value; standing alone, it does nothing. It does not produce any cash flows so it can not be valued. It has value because people believe it does. Having value and being valued sound very similar, but they are different things.

Bitcoin is polarizing. Just a few short years ago, we had fewer disagreements in the world of finance. Bill Miller was similar to Warren Buffett when it comes to investing, Mr. Wonderful didn’t like stocks that do not pay dividends and Goldman Sachs would not consider assets that are not generating any cash flows as an asset class. Bitcoin has changed all of that.

Bitcoin is a pretty good adoption story. Ok, perhaps it is not in the same league as gold just yet, but it has shown more staying power than tulips. Some people liked the technology pitch, for others, it appealed to their libertarian tendencies and others were drawn to the democratization of finance narrative. Before Bitcoin was sold as an investment, it managed to strike an emotional chord with many people.

People respond to incentives. There are people who truly believe in Bitcoin. It is hard to say who speaks their mind versus who is not, but, Michael Saylor for example, sounds like someone who truly believes. Then there are institutions who may or may not believe Bitcoin is an asset class, like Goldman Sachs or Wharton, but they have enough customers that do, so it means more business for them. How? Well, if you are Goldman Sachs, and if your clientele wants Bitcoin trading, you are incentivized to give it to them. If you are Wharton, and there are many people who want to learn how to value crypto, you are incentivized to give it to them. Sure, you can call Bitcoin worthless, and still separate the business from it, like Jamie Dimon infamously did, but the reality is most people won’t do that. Plugging into the popular “invest in Bitcoin” narrative is the path of least resistance.

Personal finance has become more difficult. What’s a good allocation in an investment portfolio? It used to be stocks and bonds, with varying percentages as one’s risk attitude changes over time (e.g., as somebody gets closer to retirement). America had a fascinating run in the last 70 years or so (unlike, say, Japan where the main stock market index, Nikkei, is still below its 1989 levels), so as long as people funneled enough money to a retirement account, they were probably fine. Retirement planning is harder now. A top personal finance expert recommends portfolio allocations to Bitcoin, a superstar financial historian believes that Bitcoin is the best investment opportunity, and a Bitcoin evangelist thinks people should mortgage their house and buy more Bitcoin.

Crypto and stocks are now on equal footing. They trade on the same platforms, they are both considered “risk-on” assets, some people think crypto should be regulated like stocks and bonds. The perceived equivalence is hard to break.

The crypto critics unintentionally make it stronger. Elizabeth Warren laments that crypto is a risky investment. Christine Lagarde and Janet Yellen agree. Bill Gates and Jim Cramer call it, correctly, an application of the Greater Fool Theory, but still label it, incorrectly, an investment.

All of this, ultimately, is a definitional issue. What is investing? You realize when the word investing, interpreted narrowly, has a very sensible framework; there are no contradictions and everything checks out. On the other hand, when it’s interpreted broadly, people are forced to take inconsistent positions. For example, Schwab acknowledged that Bitcoin doesn’t have any intrinsic value yet calls it an investment nonetheless.

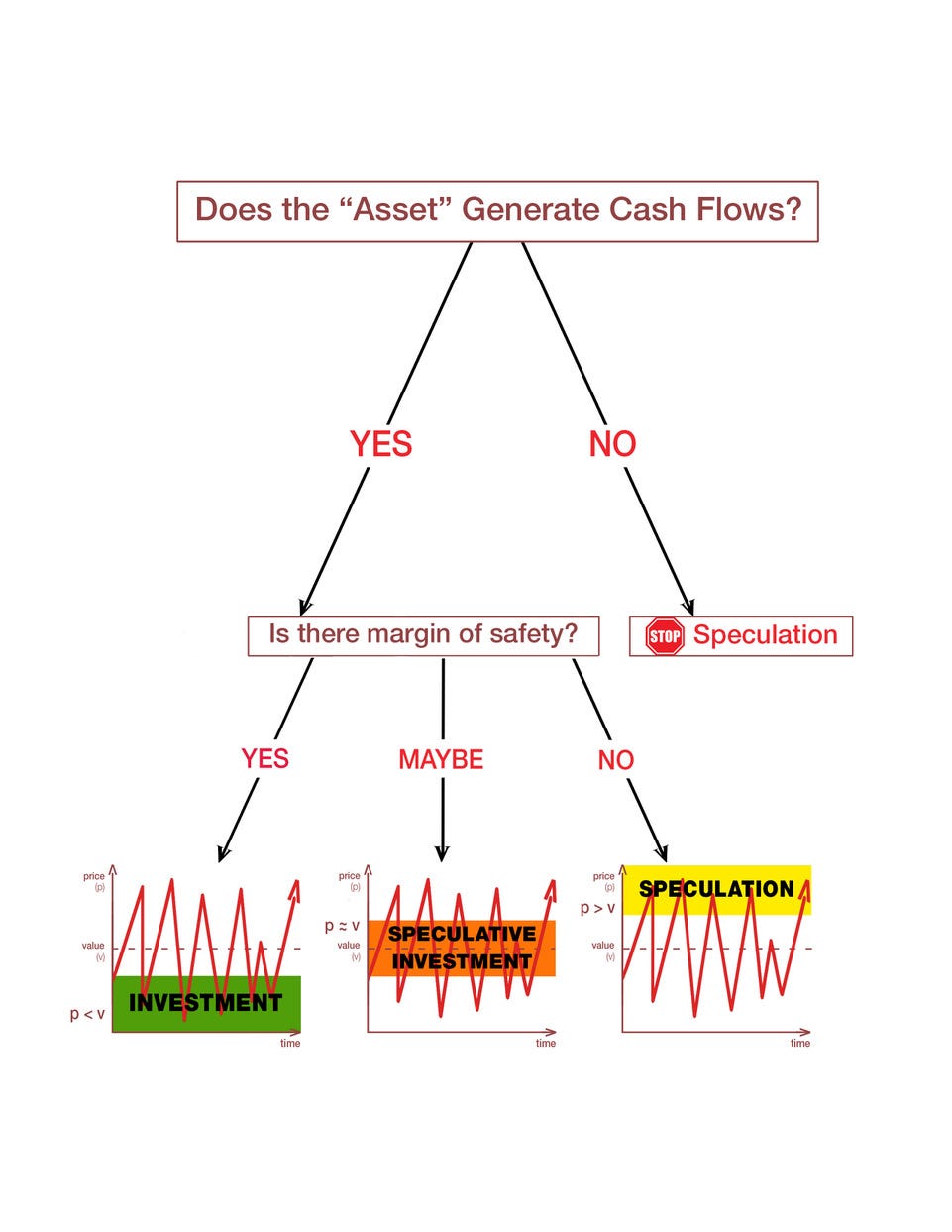

You approach the whiteboard. It is time for an infographic:

You take a step back and look at the picture. Your eyes are fixated on the word “speculation.“

You are well aware that there are two ways one could end up with this characterization: 1) buying cash-flow-generating assets that are too expensive (relative to value); and 2) buying assets that do not generate any cash flows.

“Is it the fact that it’s practically impossible to know when a stock trader is investing?” you wonder. “Sure, do it consistently, like Warren Buffett does, and over the course of 57 years, you can generate twice the returns of the S&P 500. That said, it is hard to say whether something was a good investment even after the uncertainty resolves and the outcome is realized. Was it a good investment because you were successful in estimating the value, realized that the price is substantially lower than the value, and acted on it? Or, did you just get lucky and others bailed you out in a bubble environment? How would you know?”

You continue with your brainstorming. “In people's minds, stock market = investing, even though the majority of what happens in the stock market today is, arguably, speculation. Did the word investing just expand so much that it first swallowed the entire stock market and then kept expanding to the right and swallowed an entire group of assets that don’t even generate cash flows? If so, what should we, the SEC, do about it?”

With those thoughts, you feel you have enough for the investor alert. It is time to write.