Many Pay Upwards of $25,000 For Bitcoin These Days. Jamie Dimon Thinks It’s Worthless

June 6, 2023

In our June 1 post, we created a hypothetical employee who just started their new job at the SEC and was tasked with reviewing a couple of recent alerts around crypto “investing.” After researching Warren Buffett’s and Aswath Damodaran’s positions on crypto, the hypothetical employee’s research efforts continue…

Today is the day when you decide to look at somebody in the financial sector. You look up the largest bank in the U.S., and it’s JPMorgan Chase, so you decide to use Jamie Dimon, its CEO.

JPMorgan Chase’s background story is quite interesting. J.P. Morgan, of course, is a central figure in the history of American finance, someone who is widely credited with stabilizing the U.S. economy in 1907, which ultimately led to the creation of the Fed in 1913. Jamie Dimon's story is interesting, too. He came to JPMorgan Chase with its Bank One acquisition in 2004, where he was the CEO, and shortly after, assumed the CEO role of the combined company. He has been involved with three large “rescue” operations, Bear Stearns and Washington Mutual in 2008, and more recently, First Republic.

“What are his views on Bitcoin?” you wonder. You remember this panel discussion from the 2017 Annual Meeting of the Institute of International Finance Meeting.

That was October 2017 and Bitcoin’s price was hovering around $5,500 at the time.

You keep looking for additional videos and you come across another one, four years later:

Dimon’s stance was the same. The price of Bitcoin wasn’t. It was now ten times higher, around $57,000. That probably explains why Dimon’s statements elicited chuckles on CNBC.

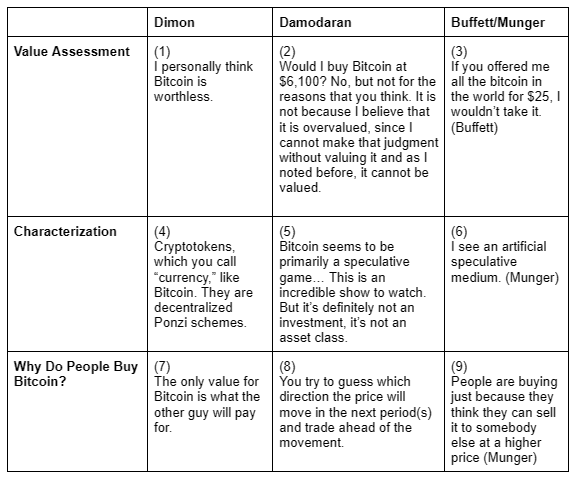

When comparing your three subjects, you begin to see some similarities between Dimon, Damoradan, and Buffett/Munger when comparing their views on Bitcoin. Time to hit the whiteboard again:

(Substack didn’t allow us to put the links in the table, so here they are: 1, 2, 3, 4, 5, 6, 7, 8, 9)

You are not sure about Dimon’s Ponzi claim (4) just yet. “Sure,” you think to yourself, “there are Ponzi schemes within the crypto industry, but does that make all of them a Ponzi? You are not sure about that so you file that thought away for further research.

You take a step back and read what you have compiled. Your eyes are fixated on the first row for some reason and you clench your teeth. You are overwhelmed with that uneasy feeling again. You are in need of an alternative explanation. Your gut is telling you that you are pushing it but you dig deep anyway.

“Would I pay more than zero for a Bitcoin now?” you ask yourself. “I could immediately turn around and sell it for $25,000. How is that worthless? Buffett is saying he would not pay $25 for all the Bitcoin in the world, even when one trades at a thousand times that price. That makes no sense.”

A somewhat plausible narrative emerges in your head: “Dimon must feel really threatened. He is a banker, after all, and crypto is trying to revolutionize the banking industry. If all these people put their money into Bitcoin, or other cryptos, the deposits will dry up. Since deposits are the lifeblood of the banking system, he won’t be a powerful banker anymore.”

That nagging feeling has stayed with you throughout the day and is still taking up real estate in your mind while climbing into bed for the evening, almost as if begging you to reconsider. You close your eyes and try to think of something else. A random memory from your MBA days is dancing through your mind. You remember selling your old sofa for $25 to your neighbor when you moved out of your studio into another apartment. You loved that sofa but it had to go and your neighbor thought he could flip it to one of the new tenants for $50. “It wasn’t worth much, but it was worth something to somebody else.”

The sofa memory is now replaced with something Jamie Dimon said in the video you watched earlier that day. “A lot of buyers out there are jazzing up every day so maybe you buy it too… And take them out.”

Then the light bulb goes off and you think to yourself, “Jamie is a smart man. He runs JPMorgan Chase, for God’s sake. He knows, as well as I do, that Bitcoin is not literally worthless; there is somebody else who will pay something for it.”

You immediately sit up in bed. Sleep is not an option for at least 30 more minutes; you are now too wired for sleep.

Your thoughts continue: “He doesn’t mean Bitcoin does not have any value. Anything you can sell, for even pennies, has some value. What he really means is what Damodaran said: that it can not be valued. It cannot be valued because it has no cash flows. It has no intrinsic value and only has ‘value’ to the extent somebody else is willing to pay for it. It didn’t really occur to you until now that “having value” and “being valued,” no matter how similar they sound, are two entirely different things.

An investing legend, the “Dean of Valuation” and the banker who runs JPMorgan Chase are, essentially, all saying the same thing: You can speculate on Bitcoin, but not invest in it. Yet, that’s not what your new employer is saying.

Now, sleep really is not an option…