Misinformation Mondays: What Social Media Has Wrong

Bitcoin is not a stock—no matter how many billionaires imply otherwise

We gladly take credit when it’s due. Early on we flagged a fundamental problem with crypto–especially Bitcoin: the persistent myth that Bitcoin is somehow equivalent to equity in a wildly successful tech company.

We warned about the dangers of this false equivalence. We rang the alarm bells when a top financial advisor likened Bitcoin to a second chance at catching Google, Amazon, or Apple’s ascent. We raised eyebrows when CNBC featured Bitcoin on its Three Stock Lunch segment– a slot, as the name suggests, is reserved for actual stocks.

And yet, the narrative caught fire.

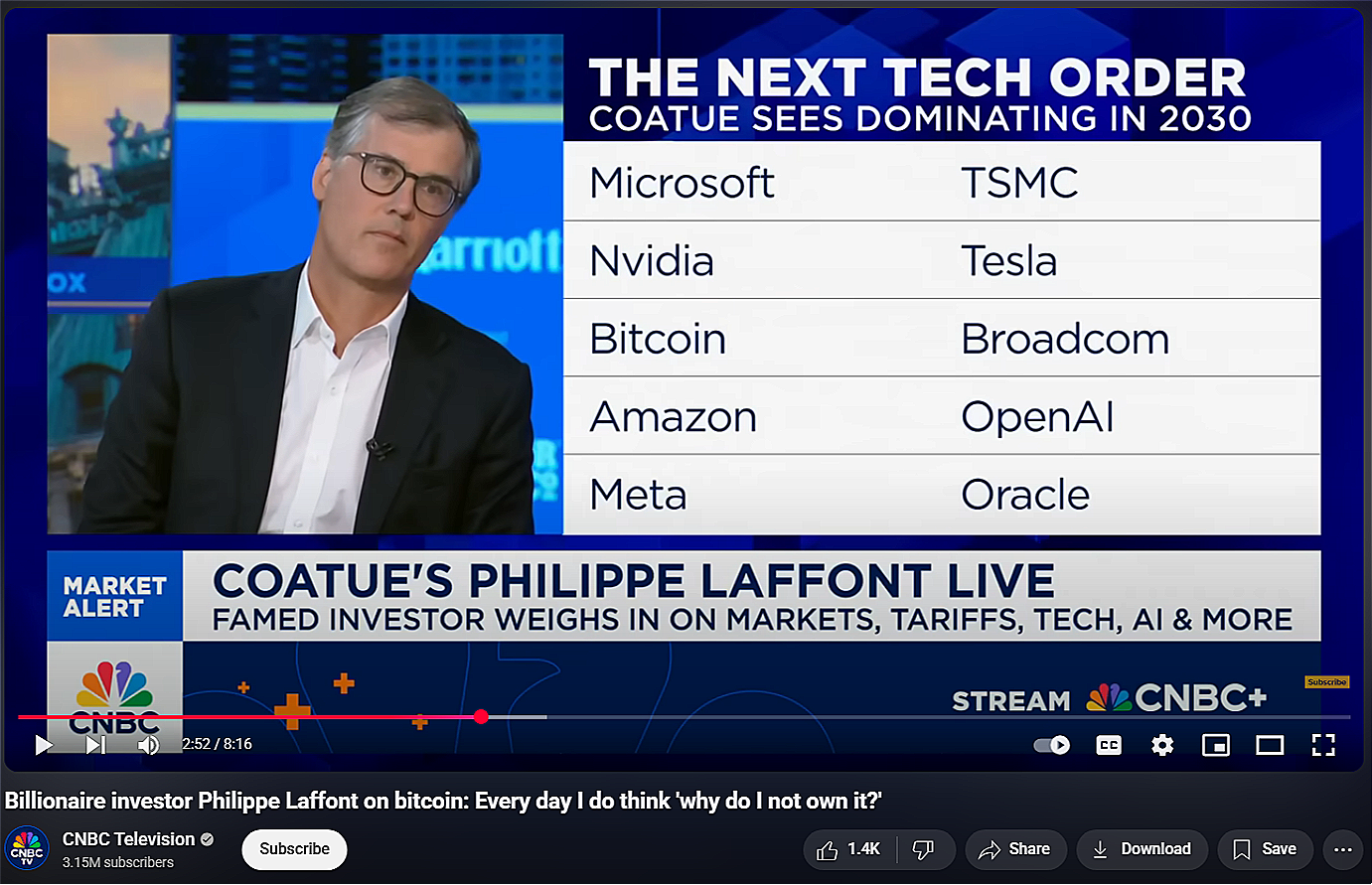

So much so that well-respected asset managers now casually slot Bitcoin between Nvidia and Amazon, as if it belongs in the same investment conversation. That’s why this week’s Misinformation Monday award goes to:

Philippe Laffont, founder and portfolio manager of Coatue, a tech-focused investment management firm, with over $54 billion in assets under management as of December 2024.

In this recent CNBC interview, Laffont mused, “Every day I do think 'why do I not own it?'”--referring to Bitcoin. He even said: “We thought of Bitcoin as a company.” Sure, he added the obligatory disclaimer: “Obviously, Bitcoin is not a company.” But let’s be honest–nobody cares about that footnote. The headline, the soundbite, the takeaway? That Bitcoin is the next big investment opportunity. Just like Amazon. Just like Nvidia.

And guess who jumped on the clip? Michael Saylor, Bitcoin’s most tireless evangelist, who wasted no time turning Laffont’s remarks into an amazing promotional moment:

Scroll through the comments. You’ll see exactly how Laffont’s words are being received. The nuance is completely lost. The disclaimer is ignored. In the eyes of many, Bitcoin isn’t just like a company–it’s better.

But here’s the truth: The hedges, the disclaimers, the half-hearted caveats–they don’t work. They’re fig leaves. And while they may soothe the conscience of the speaker, they’re misleading millions. An entire generation now believes Bitcoin is on par with stocks. It isn’t. And the fact that it might make you more money doesn’t change that.

We understand. The allure of getting rich quick is just too powerful. FOMO is real. It’s easier–psychologically and financially–to simply jump on the bandwagon than it is to ask the hard questions.

But let’s be very clear: Everyone who contributes to the myth that Bitcoin is an “investment” bears some responsibility for what comes next. When the tide turns–and it will–we’ll see who’s willing to own their role in the fallout.

We’re not holding our breath.