Surprise, Surprise. The Use of Bitcoin in Money Laundering is Actually About the Same as USD

Bitcoin maximalists and anti-crypto crowds, take note

A fool threw a Bitcoin stone in the money laundering well, and CNBC’s Joe Kernen ran with it, which made us ask: Is Bitcoin Really Used 606 Times Less than USD To Launder Money?

So, where are we now in the debate on whether Bitcoin is used more or less than USD in money laundering? Nowhere, as far as we can tell. Somebody needs to fill this gap, so this post is our attempt to estimate the respective frequencies of Bitcoin vs USD in money laundering. Admittedly, this is still somewhat “back of the envelope” but we do believe it is more robust than anything else out there.

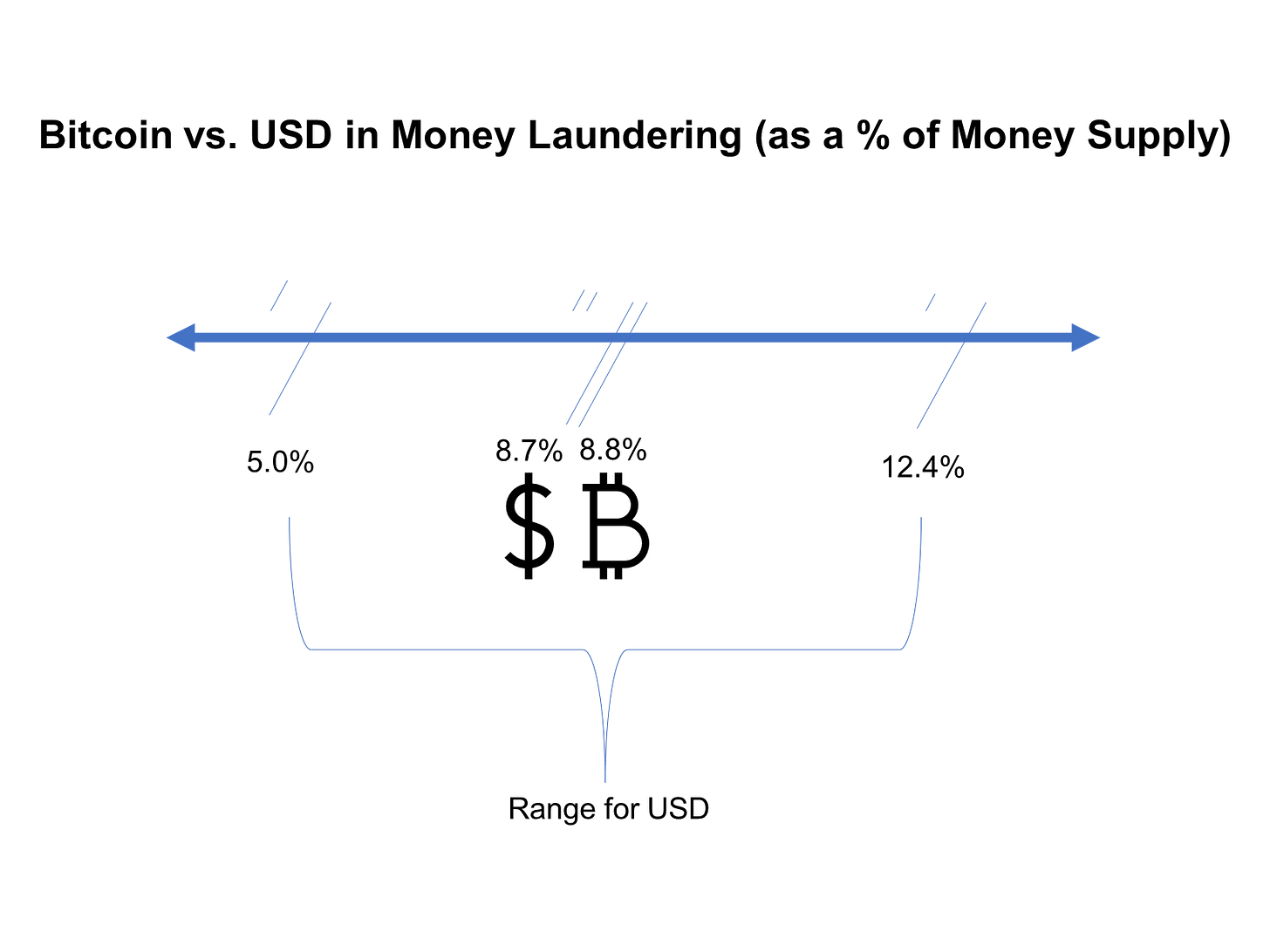

Let us spill the beans and give you what we have found. Our model estimates that during the 2017-2021 period, USD is used (as a percentage of its average money supply), between 5.0 percent and 12.4 percent, with the midpoint being 8.7 percent. Bitcoin, as a percentage of its average circulating supply over the same period, is used…. Drumroll, please. 8.8 percent!

It is funny how these numbers shook out. Here is the visual illustration:

Thus, we conclude that the use of Bitcoin in money laundering is about the same as USD. Here is how we came to that conclusion:

Executive Summary

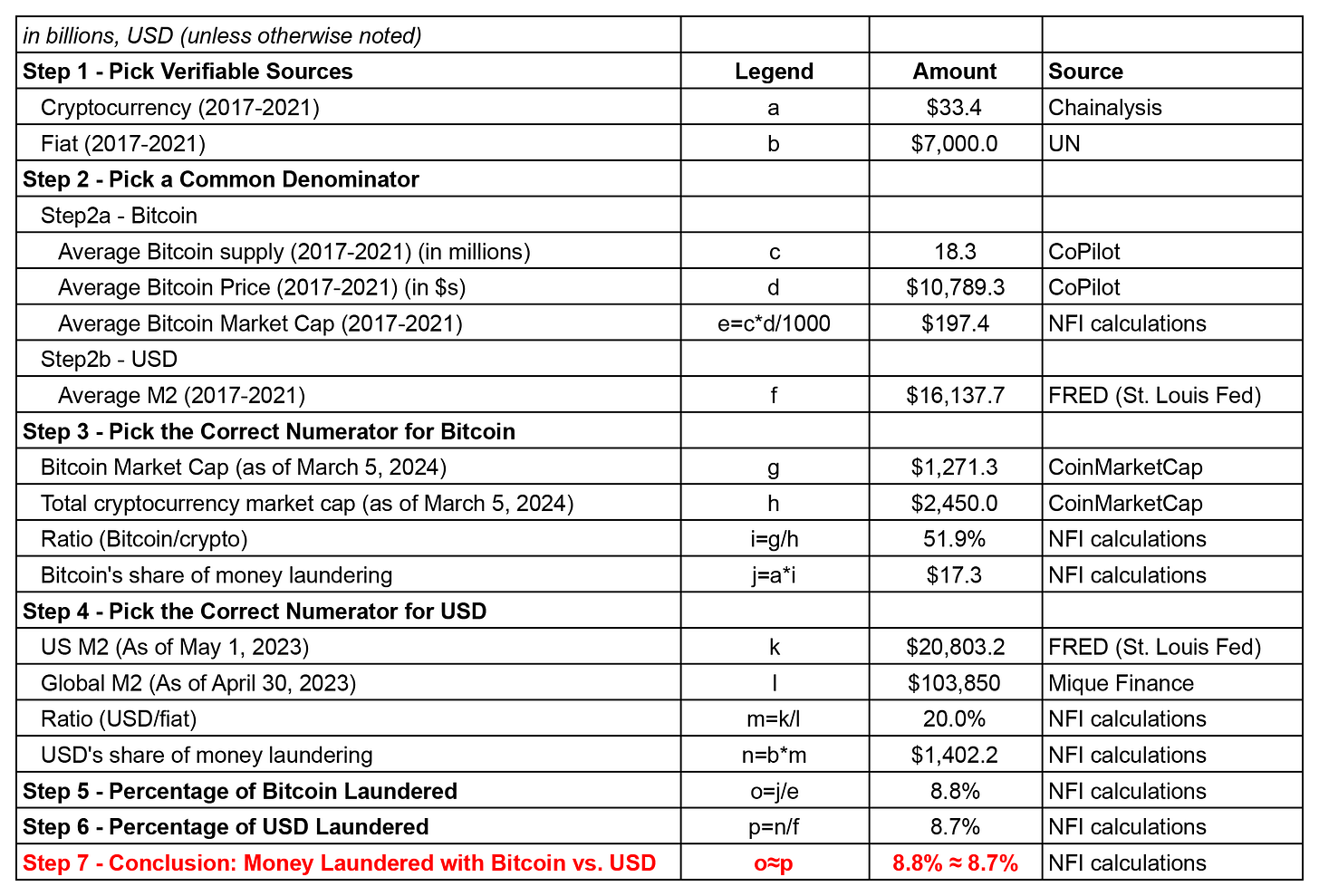

Let us share our summary table first. Then, we will elaborate on each step in more detail.

Now that you have seen the numbers, we are ready to elaborate on each step.

Step 1 - Pick Verifiable Sources

We need estimates of money laundering through Bitcoin and USD. That, surprisingly, does not seem to be available, so we must start with global estimates for cryptocurrency and fiat, and work our way from there.

For cryptocurrencies, we will use the Chainalysis report and go with the $33.4 billion figure over the 2017-2021 period. For fiat, we used the annual UN estimate of $800 billion - $2 trillion, chose the midpoint ($1.4 trillion) and multiplied it by five so both estimates cover five-year periods.

We can’t comment on how reliable either of these estimates are, but they do pass the minimum bar of verifiability and somebody made (hopefully a good faith) estimate. As of now, there does not seem to be any better verifiable information available, so this is our starting point.

Step 2 - Pick a Common Denominator

One cannot compare ½ to 19/40 without picking a common denominator first. Neither can one divide Bitcoin by transaction volume, and USD by GDP and compare the ratios. Alison Jimenez pointed this out in her congressional testimony. Our only criticism is that she should have made that the headline.

One could presumably use transaction volumes for both, but two issues need to be considered: First, the Bitcoin transaction volume is likely inflated (something else that Alison Jimenez pointed out in her testimony). Second, it is difficult to reliably estimate USD transaction volumes. Because the estimates seem problematic on both ends, a better alternative seems to be using the money supply.

Step 2a - Bitcoin Supply

Bitcoin’s maximum total supply is famously fixed at 21 million (Jamie Dimon is a skeptic), a common talking point. Its circulating supply was a little less than that during 2017-2021, so we need to figure out what the average circulating supply was and turn that into dollars using Bitcoin’s average market price over the 2017-2021 period (that’s what the Chainalysis report covers). Maybe AI will kill us all, but it is quite good for this type of thing. CoPilot comes to the rescue with an average supply of 18.1 million over the 2017-2021 period with an average price of just under $11,000 (we’ll give you a second to gather yourself if this triggers your FOMO). Multiply the two, and we get the average market cap of Bitcoin (effectively its supply translated to USD)

Step2b - USD Supply

What is the measure needed to estimate the USD money supply? If you took introductory macroeconomics Econ 102 at some point, you may remember (or you may not, it wasn’t the sexiest topic in our opinion) that there are various ways of measuring it, M0, M1, M2, M3, etc. We picked M2 (cash and other deposits that are highly liquid) and relied on the data provided by the St. Louis Fed via its Federal Reserve Economic Data (“FRED”) database. Over the 2017-2021 period, average M2 stood at a little over $16 trillion.

Step 3 - Pick the Correct Numerator for Bitcoin

$33.4 billion is the estimate for all cryptocurrencies laundered, not just Bitcoin (a fact that Joe Kernen seems to have missed). How do we prorate this amount for Bitcoin? There is no perfect way of doing this, but one can calculate the market cap of Bitcoin (in USD) relative to the total market cap of all cryptocurrencies. Enter coinmarketcap.com. As of March 5, 2024, that calculation yields a little over 50%.

Step 4 - Pick the Correct Numerator for USD

Similarly, the 800 billion to 2 trillion range provided by the UN is all fiat currencies, not just the USD, so we need to similarly prorate it. One resource we found on the web has the information for global M2 as of April 30, 2023, which stood at over $100 trillion. USD M2, as of the same date (based on FRED) was a little over $20 trillion. Dividing the latter by the former, we obtain a 20.0 percent share of USD over all fiat.

Step 5 - Percentage of Bitcoin Laundered

Now that we have both the numerator and denominator for Bitcoin, we simply divide the figure we calculated in Step 3 by the figure determined by Step 2a. This calculation yields 8.8%.

Step 6 - Percentage of USD Laundered

Same for the USD. Simply divide the figure we calculated in Step 3 by the figure determined by Step 2b. This calculation yields 8.7%

Step 7 - Conclusion: Money Laundered with Bitcoin vs. USD

How do these numbers compare? Well, they are roughly the same. In other words, when it comes to money laundering:

Surprise, surprise. Our analysis (admittedly, somewhat back of the envelope, but still more robust than anything we see out there) leads to the conclusion that the amount of money laundering is actually about the same for Bitcoin and USD. Sure, one can nitpick and there can be refinements, but we doubt a refinement would lead to a very meaningful difference.

All things considered, this conclusion shouldn’t be that surprising. Why wouldn’t money laundering with Bitcoin and USD be comparable? Somebody who wants to launder money arguably doesn’t care how money is laundered, just that it’s able to be laundered. The chosen method is perceived to be the quickest and most productive. When people make these decisions globally, given how ubiquitous both USD and Bitcoin are, one would expect these ratios to converge, no?

So, no, USD laundering is not 606 times that of Bitcoin. Joe Kernen doesn’t seem to be on solid footing, but, to be fair, neither do the anti-crypto critics. For example, this is the conclusion that John Reed Stark offered:

Clearly, the scale of crime in crypto is orders of magnitude greater than what it is in traditional finance.

John Reed Stark puts thoughtful observations out there. On this one, though, the requisite support is missing. The scale of crime in crypto may be clear to him, but that’s not clear to us, at all. At a bare minimum, there should be something that involves a “back of the envelope” calculation that we’ve offered in this post. Until a better analysis comes along, our working hypothesis remains that money laundering is largely agnostic to the type of specific medium.

We don’t want to minimize the issue of money laundering in any way, shape, or form. One cent laundered is one too many. The point is to reject unsubstantiated arguments of any kind. If you believe that society is hopelessly fractured, well, this post will arm you with yet another example of the sad state of affairs. Bitcoin maximalists take unsubstantiated analyses and run with them. Crypto critics do the same, making statements without offering legitimate support.

Hopefully, this post will serve as a common sense wake-up call. The more we share this information on social media, the better the chances are in providing legitimacy to accurate reporting and deflating the outlandish headlines.

The primary use case for Bitcoin is not money laundering, it’s speculation. However, there is too much confusion around that and unfortunately, the SEC is contributing to that very issue, which we will cover in our next post.