The Tom Brady of Investing

Why Warren Buffett’s legacy can’t be dismissed

Few athletes in history embody long-term dominance more than Tom Brady. Across two decades in the NFL, he amassed seven Super Bowl victories, multiple MVP awards, and an unparalleled reputation as a quarterback who thrived under pressure. His career wasn’t defined by a single moment or a single game—it was the sum of years of preparation, consistency, and an ability to adapt to changing conditions. Even when doubters questioned his longevity or criticized his performance in certain seasons, Brady stayed focused on the bigger picture: sustained excellence over time.

Warren Buffett’s investment career mirrors this same philosophy. While some critics attempt to cherry-pick periods where his returns weren’t record-breaking or try to diminish his success by selective comparisons, Buffett’s true legacy is measured over decades, not medium-term snapshots. Just as Brady didn’t need to lead every quarter or win every game to be considered the greatest quarterback of all time, Buffett didn’t need to outperform gold or the S&P 500 in individual or even decade-long stretches to be one of history’s most successful investors; he was successful over a lifetime. Both built empires through patience, strategy, and an unmatched ability to deliver results over the long haul.

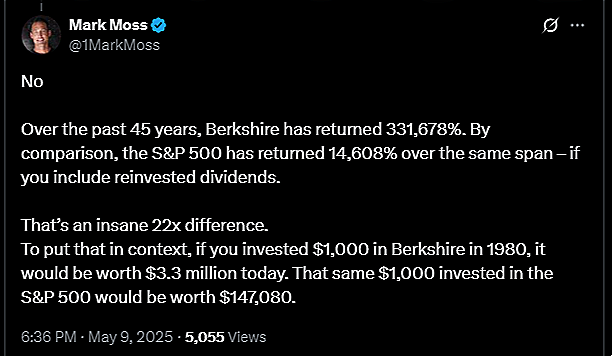

A curious theme has emerged within the X community lately, trying to discredit Warren Buffett’s investment performance. We saw multiple posts on this, but let’s just pick this one by Mark Moss:

This reminds us of The Pope Visits Las Vegas joke:

The Pope was making a widely publicised and controversial visit to Las Vegas. His publicity advisors warned him that the trip would be fraught with risks, but the holy man insisted that the gambling capital of the world was exactly the kind of place that the church should be trying to spread its message. After a long flight, the Pope stepped off the plane to find himself face to face with a horde of television cameras and newspaper journalists. One eager young news hound thrust a microphone at the Pope and asked, "Pope, what is your opinion of the large numbers of brothels in this city?" Mindful of the warnings he'd received from his advisors, he thought carefully for a second and replied tactfully, "Are there any brothels in this city?" The next day he was distraught to see the newspaper's headline which read "Pope's first question: 'Are there any brothels in this city?'"

If this joke is offensive to you, we apologize. The joke is too powerful not to present; it is one of most powerful narratives that shows how even literal truths can be taken out of context and result in widely misleading conclusions. The real shame is trying to discredit respectable figures by cherry picking and ignoring valuable context, the presence of which would turn the conclusion upside down.

This is exactly what has been happening with Warren Buffett and his supposed performance against gold.

Just the Facts, Ma’am

So, what are the facts here? Is Warren Buffett not as good as advertised? This was where one particular poster was leaning:

Ahh the good old value investing fallacy. Good try, though. I guess, like many others, this poster forgot (or maybe never realized) that Warren Buffett himself does not believe in value investing.

That said, the post wasn’t particularly useful for Mark Moss. The discrediting wouldn’t work, at least, it wouldn’t be as powerful if Warren Buffett was just another investor. So, his extraordinary track record needed to be re-established:

Furthering that point, Buffett’s track record is available over an even longer horizon, and Berkshire’s 2024 letter provides those numbers. Let’s recalibrate Mark’s post using those numbers instead:

Over the past 60 years, Berkshire has returned 5,502,284%. By comparison, the S&P 500 has returned 39,054% over the same span – if you include reinvested dividends.

That’s an insane 140x difference.

To put that in context, if you invested $1,000 in Berkshire in 1964, it would be worth $55 million today. That same $1,000 invested in the S&P 500 would be worth $390,540.

Impressive, right? Imagine a family who in 1964, decided to skip a portable TV purchase (which retailed at around $100) for their 10-year old despite the child’s protests, and invested it in Berkshire instead. Today, their child would be 70 years old, with a nest egg of $5.5 million; enough to retire comfortably anywhere in the world. The same $100 invested into the S&P turned into something too, a high-end Toyota Corolla. Hey, nothing against Corolla, it was my first car and I absolutely loved it! I still remember the license plate even. But wouldn’t you much rather have the $5.5 million nest egg?

What about inflation? $100 in 1964 (as of January 1, 1964) is equivalent to $1021.38 (as of December 31, 2024) according to this calculator. So, inflation, which was slightly under 4% (on average) since 1964, was responsible for 10x. The S&P was 390x on top of that and Berkshire’s return was 140x of the S&P. That’s the power of compounding for you. 10.4% vs 4% matters significantly over the long haul. Similarly, 19.9% over 10.4% matters considerably as well. The S&P outpaced inflation by a wide margin and Buffett outpaced the S&P by even more.

What about gold? The story Mark is trying to tell is that Buffett, with all his might, simply matched the performance of gold. Let’s take a look.

Comparing a similar time frame, since 1960, gold has returned 8.4% annually. It didn’t come close to Buffett’s performance and it didn’t even beat the S&P 500 but hey! At least it outpaced inflation.

If you “invested” $100 into gold in 1964, it would be worth a little over $7,400 (we used this table to calculate the return between 1964-2023 and then added the 2024 returns of 25.5%). Its value would be roughly equivalent to a 12-year old Mazda 6 that has over 100,000 miles on it. Again, this is not a shot at Mazda, it was the car I happily drove for about 12 years.

The math is the math. $100 put into the S&P 60 years ago would put you into brand new car territory. $100 put into gold 60 years ago fits you into used car territory and $100 invested in Berkshire at the same point in time secured you a comfortable retirement, one even Mr. Wonderful would feel good about.

Is the grand plan to discredit Buffett, and plant the crypto seed into unsuspecting minds? We can see the argument from a mile away: “Look at Buffett, he couldn’t even beat gold. How is he going to compete with Bitcoin?” Mark Moss, if you aren’t aware, is an advisor to a Bitcoin fund.

If so, this act feels comparable to the journalist in the joke who was trying to bury the Pope in pursuit of a good headline.

As the saying goes, if you torture the data long enough, it will confess to anything. It’s not hard to find a random slice of some length where Buffett’s performance was comparable to that of gold, but that means absolutely nothing. Do you want a used car or do you want a happy retirement? That’s the real comparison.

The other point is a bit more subtle. Consider this post in the same chain:

Sure. Let’s remember the analogy we made last week:

If you and I both work in the same office and live in the same community 60 miles away, we have choices when it comes to our evening commute. Perhaps for you, going home as fast as possible is the most important thing, risks be damned. I want to go home as fast as possible, too, but I don’t think it’s worth risking my life. So, you can drive at 120 miles per hour and get there in 30 minutes (for the sake of this example, let’s assume speed limits are pretty lax). I’ll stick with 60 miles per hour so it’ll take me an hour. Every single day, you will have 30 more minutes at home. You can even tell me to have fun driving slow (a play on “have fun staying poor”). Chances are though, you will blow up one day and it won’t be pretty. You are choosing speed, perhaps with the Lambo you bought from your Bitcoin profits, and I am choosing safety.

It is hard for people to wrap their minds around the fact that not everyone wants a Lambo. Some people just want to preserve what they have, which investing allows them to do; speculation doesn’t. Buffett is not competing with speculators, he is competing with other investors.

If you insist on going for the Lambo, by all means, go for it. Just don’t look to Mama Government to bail you out when it turns out badly.