What Does the Spoon in the Matrix Movie Have To Do With Value Investing?

Part III - The father that isn't

Yesterday, we talked about how, mysteriously, the phrase “value investing” didn’t make its way into the subtitle of The Intelligent Investor, the seminal work of Ben Graham, until after he had died.

Why do you think that is? It is quite strange, especially since Graham is known for being the “Father of Value Investing.” Considering that fact, when you combine that with the current edition of the book containing “Value Investing” in the subtitle, it’s not unreasonable at all to assume that the phrase “value investing” would have been part of the subtitle all along.

Our detective work has proven that was not the case at all. Assumptions are a dangerous thing, even when they seem quite reasonable.

One might be inclined to dismiss the importance of this. “Who cares if it has not been in the subtitle originally,” you might say. “He is still the ‘Father of Value Investing.’ Perhaps Graham didn’t pick the most appropriate subtitle for the book; that was done by a marketing guru. Surely, though, he must have used the phrase “value investing” in The Intelligent Investor many times.”

So let’s play a guessing game. Here is our question:

How many times do you think Ben Graham, the “Father or Value Investing,” used the phrase “value investing” in The Intelligent Investor?

Zip. Zero. Zilch. Nada.

You read that right. “The Father of Value Investing,” in his seminal work, actually never uttered the phrase “value investing.” Not even once!

Yes, it’s a missing subtitle, but it’s also much more than that. The phrase is missing from the book entirely!

What could possibly have happened here? Let’s put our detective cap on again and dig in, shall we?

After the 1973 edition of The Intelligent Investor (Ben Graham’s final), came the 1986 version. The (inaptly titled) GrahamValue blog confirms:

The last version written by Graham himself is the Fourth Revised Edition from 1973. This edition was reprinted in 1986 with a Preface by Warren Buffett, and with the transcript of Buffett's 1984 talk The Superinvestors of Graham-and-Doddsville [PDF] as an appendix.

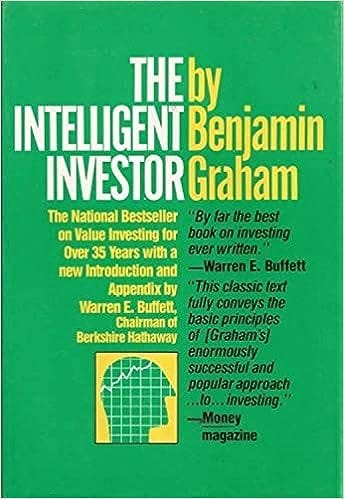

Here is the cover of the 1986 edition (clickable):

We’d like you to focus on the left panel here, where it says:

The National Bestseller on Value Investing for Over 35 Years with a new introduction and Appendix by Warren E. Buffett, Chairman of Berkshire Hathaway.

That left panel - it appears to be the exact moment that the official introduction of “value investing” came to the finance scene! Certainly, this is the first time that the phrase “value investing” ever appeared in the subtitle.

Recall that Buffett collaborated on the 1973 version with Graham, which Graham had acknowledged, yet, this is the first time Buffett actually put his footprint on the book, both through the preface and the appendix.

The preface is very good and we highly recommend everyone read it. That said, it does not talk about value investing and for the purposes of this post, there is nothing of consequence there.

The appendix, which sits on the servers of Columbia Business School (f/k/a Graduate School of Business), is where the early cracks began to start forming the first fault line. Remember, Ben Graham not only graduated from Columbia (1914), but was also an adjunct professor where he taught finance.

Notably, the .pdf appendix is mapped to a subdomain called “value investing.” Below is the full website address so you can see:

https://www8.gsb.columbia.edu/sites/valueinvesting/files/files/Buffett1984.pdf (emphasis added).

You can probably guess where we are going with this. This is a critical turn of events that arguably changed the trajectory of finance. In fact, one can argue that it has changed the trajectory of law as well. Believe it or not, one can draw a line from this appendix to the Ripple decision by Judge Torres, which we discussed here.

Let’s go back to the appendix though, shall we? Does it mention “value investing?” You bet it does.

The appendix uses the term “value investing” three times.

Together, the appendix and the subtitle mentioned above appear to be the start of the financial earthquakes.

The GrahamValue blog, like us, appears to have gone through a similar exercise, where they traced the evolution of The Intelligent Investor. In fact, they offer a position on which editions of the book are considered better reads. More specifically, they advise against the 2006 edition, which is the edition that has extensive commentary from Jason Zweig. The GrahamValue blog states:

To begin with, the commentary by Jason Zweig in the 2006 edition of The Intelligent Investor — and the resulting modifications of Graham's text — have made the book considerably harder to read.

And:

When one also factors in the poor opinion of theorists that Buffett and other notable Value Investors have expressed in matters of practical application of investment principles, this update was perhaps nothing more than a marketing gimmick.

What the GrahamValue blog does not realize, however, is that the 1986 edition inadvertently became the biggest marketing gimmick of all; we will talk more about this next week.

As for the phrase “value investing”…That’s like the spoon in the Matrix, there is no “value investing.” More precisely, the term is redundant, because all investing is value investing. In addition, if Ben Graham is considered the “Father of Value Investing,” then he is the father that isn’t. Graham never uttered the phrase “value investing,” so he can’t be the father! Further, since the term “value investing” is redundant, nobody is.