When Exactly, Did the Finance Train Start to Derail?

A historical journey offers some clues

In our previous post, we likened the world of finance to earthquakes. We stated:

As we mentioned before, the concept that investing was only a sliver of trading activity was well-understood 100 years ago. Then the “tectonic plates” in finance started to move, in large part due to complicated incentive structures.

Pinpointing significant milestones in any evolution story is not always easy, even in retrospect. Nonetheless, there is typically one event, one phrase, one person or one thing that can be characterized as a turning point.

Our thesis, of course, posits that the degradation of the word “investing” began approximately 100 years ago. Even when Ben Graham was sharing his unique insights with the finance community, there were cracks. Investing wasn’t just a small fraction of trading activity associated with prudence and safety anymore. It was already blurring into speculation. Ben Graham observed (excerpt from the book Benjamin Graham on Value Investing by Janet Lowe):

When I came down to the Street in 1914, an investment issue was not regarded as speculative, and it wasn’t speculative. Its price was based primarily upon an established dividend. It fluctuated relatively little in ordinary years. And even in years of considerable market and business changes, the price of the investment issues did not go through very wide fluctuations. It was quite possible for the investor, if he wishes, to disregard price changes completely, considering only the soundness and dependability of his dividend return, and let it go at that -- perhaps every now and then subjecting his issue to a prudent scrutiny.

Ben Graham’s legacy, of course, lies in his insights on various investing-related matters, with the distinction between investment and speculation being chief among them. However, the degradation accelerated. When did that happen? Arguably, the train of finance has already derailed, but when precisely did it shift gears? When did the tide turn?

We believe we have identified the turning point. Over the next few posts, we will share with you what we have discovered. Today, we will provide you with a few clues before diving deeper.

Clue #1 - Ben Graham’s seminal work is The Intelligent Investor. It is the gift that keeps giving. Another excerpt from Janet Lowe:

In 1992, the last full year for royalty reports, The Intelligent Investor sold 6,600 copies. Some books never sell that many copies in their entire lifetime.

Indeed, they don’t. Recently, The New York Times reported that “about 98 percent of the books that publishers released in 2020 sold fewer than 5,000 copies.”

With book sales come royalties. Another excerpt from Janet Lowe talking about the beneficiary of The Intelligent Investor, “Buzz” Graham, Jr., who, according to the author, has owned the royalties after his father’s death:

For years, Buzz received about $50,000 a year in royalties from all of his father’s books, more money than he was earning as a rural physician.

Arguably, The Intelligent Investor is the cornerstone book in that portfolio that has been producing all these royalties. Here is the cover with the catchy subtitle: The Definitive Book on Value Investing.

Clue #2 - The book we have been quoting quite a bit lately (we even referenced it above): Benjamin Graham on Value Investing by Janet Lowe. Here is the cover of that book:

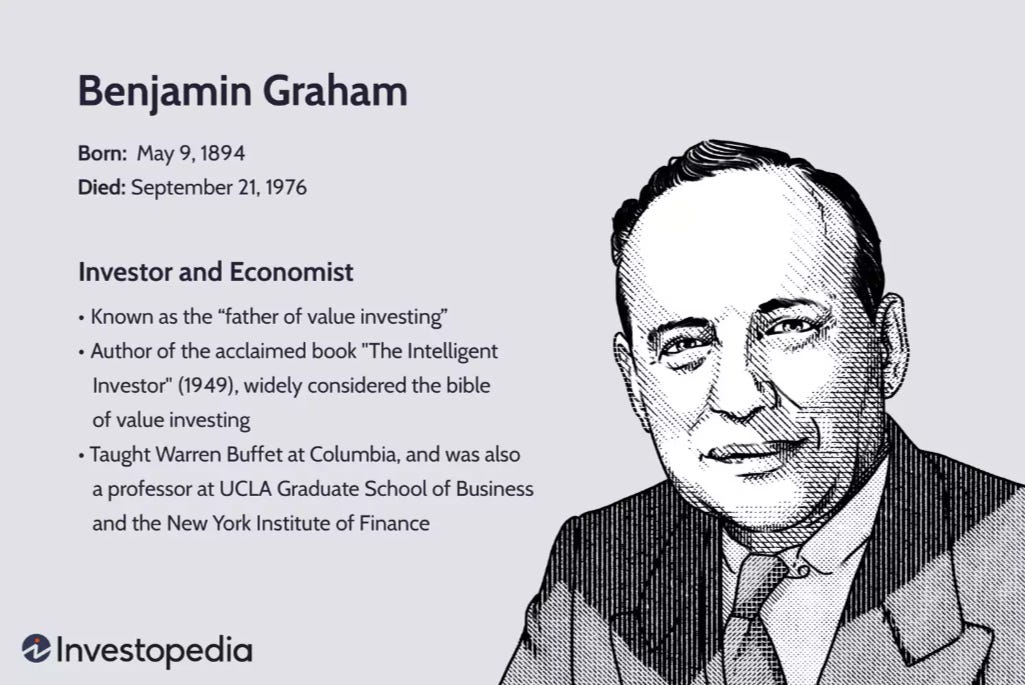

Clue #3 - Ben Graham is widely regarded as the greatest of all time (GOAT) when it comes to investing. Some debate the extent of his contributions (PDF), but even if his thoughts were not entirely original, there is no doubt that he synthesized and repackaged them in a unique way that resonated with the masses.

Do you know his nickname? He has a few, in fact, and you can see one of them in the cover above: “The Dean of Wall Street.” Sometimes, he is called “The Father of Financial Analysis.” However, the nickname that arguably stuck the most is: “The Father of Value Investing.”

Photo Credit: Investopedia

Can you see where we are going with this?