Buffett is Leaving Us with Gigantic Shoes To Fill

What will happen to the concept of investing?

Some things in life are inevitable, no matter how much you wish they weren’t. The Monday morning alarm. The annual tax filing. Warren Buffett stepping away as CEO from Berkshire.

Humans are not immortal and Buffett is turning 95 this August. So, it’s not exactly a surprise that he has decided to hang up the boots. Long-time executive and Buffett’s right-hand-man, Greg Abel is stepping up to the plate.

Given his track record, Abel will likely do a fine job running Berkshire. The bigger question becomes:

What will happen to the concept of investing?

Being the CEO of Berkshire is one thing. Being the intellectual successor to Ben Graham’s legacy is another. Buffett willingly and successfully carried that mantle for decades. It is not exactly clear who is next in line to carry the Graham torch. Who is the person that will illuminate the sign that says “investing” for everyone to see and learn from?

What is more clear is that the world will be looking for a successor. Buffett has been the penultimate American success story, turning a struggling textile manufacturer into a giant conglomerate, beating the S&P along the way by a ratio of 2:1 over the course of six decades (19.9% to 10.4%). He is humble. He is also very difficult to dislike.

What I find more difficult is trying to explain to my son why there will be a search for a successor. When I told him the other day that people will try to identify a successor, he asked me why. Good question. Admittedly, I didn’t give him a very articulate answer at the time. I mumbled something along the lines of “because the world needs heroes,” but the answer was vague and wasn’t satisfactory to him.

I may not have articulated it well, but I wasn’t wrong. People did not waste time identifying potential candidates. “Pomp” offered his:

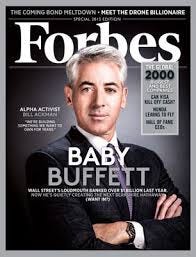

This wasn’t the first time Bill Ackman was nominated for that role, either. Forbes magazine put him on its cover ten years ago.

I’m not sure whether Ackman is the successor. I’m not sure whether there will ever be a successor.

My brain is skeptical but my heart is telling me that there must be a successor. Why do they diverge? Perhaps, I desperately want someone to succeed Buffett, because I am worried that without a successor, the concept of investing, as we know it, will be dead. Without Buffett sharing the stories and the wisdom, the world of investing may never be the same and that’s a scary thought.

If Buffett’s wisdom was successfully reaching the audiences, that’d be one thing, but it is not. Society is still having a very difficult time understanding what Buffett did. It's not that Buffett himself lacked clarity; rather, the very definition of investing has been hijacked—so much so that many people don't even realize it.

The Value Investing Myth… Again

Buffett matters, so it wasn’t a surprise that Matt Levine over at Money Stuff, dedicated a good chunk of his Monday newsletter to him. Matt is smart, funny, and has reach, but his write-up won’t exactly help you understand what Buffett did:

Buffett is by consensus the best investor ever, but he is a particular kind of investor: the normal kind.

The “normal kind”? A question pops up immediately: Who, then, are the abnormal investors?

Levine, like many others, is playing the “Who will succeed Buffett?” game. His successor choice:

If there is a successor to Buffett’s title of greatest investor ever, it’s arguably Jim Simons, who is not known for any particular stock pick but rather as a pioneer in quantitative investing who used algorithms to make lots of trades and win a bit more than he lost, with the results aggregating to a steady long-term winning record that stands comparison with Buffett’s.

Simons is clearly good at what he does, but making money alone is not enough to qualify to run for the greatest investor honor. By this logic, we could just as easily pass the baton to Michael Saylor.

What is the problem here? This is what we said exactly three months ago:

We all live in an alternate universe of finance where every trade, regardless of what is being traded, is considered an investment. Said differently, investing and making money became the same thing. They are synonyms now.

This is why it isn’t Jim Simons. It’s great that he made boatloads of money, but investing is not the same as making money. The accurate description is that Simons was good at quantitative trading, as opposed to quantitative investing; there is no such thing as quantitative investing.

Why can’t there be quantitative investing you might ask? There is, after all, value investing, no? Levine casually invokes the father of value investing reference:

When Buffett started out as a professional investor, he was in some ways working at the cutting edge of investment science: He was a disciple of Benjamin Graham, the “father of value investing,” and used rigorous fundamental analysis to invest more rationally than his competitors and make money. The science has moved on.

You may know that this concept called “value investing” is our pet peeve. We anticipated this challenge before and distilled it into a hypothetical conversation between us and someone who was skeptical about our position:

CHALLENGER: You are clueless, aren’t you? Value investing is finance 101. You write a blog on finance and you don’t know that?

F27: We’re aware of the phrase value investing.

CHALLENGER: Great. Then, you must also know that Ben Graham is the “father of value investing.”

F27: We are aware. Also, Shaq is the “father of the stepback three.”

CHALLENGER: What are you talking about? Shaq barely shot threes; he shot just 22 three pointers over his entire career! He made one, and that was not a stepback three.

F27: You are right, and as far as we are concerned, Ben Graham, never said value investing, either.

CHALLENGER: ???

Ben Graham is not the father of value investing.

The bottom line is that the word investing does not need any qualifiers. Joel Greenblatt is one of the few people who realizes that. Unfortunately, the majority doesn’t believe it or realize the issue at hand. The fact that the world keeps attaching qualifiers to the word investing is precisely why Buffett does not have, and may not ever have, a clear successor.