Can I Get a Bubbly Bitcoin, Please?

No, you can’t, but not for the reasons you think.

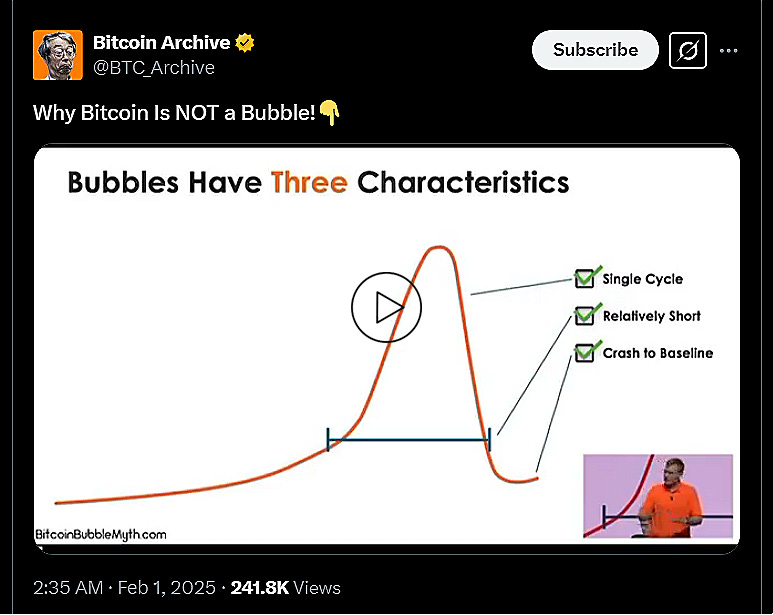

The nice thing about X is there is no shortage of myths in the world of finance that need to be debunked. Today, we will review a video that has been circulating on X lately. As is the case with many financial opinions that are circulating, this one is on shaky ground. Have a quick watch:

Now, let’s start with the three premises:

Single cycle

There is nothing in the bubble literature that we are aware of that says there needs to be a single cycle.

Relatively short

Where in the world does this speaker get the idea that bubbles are relatively short in duration? They can go for a long time.

Crash to Baseline

Of all three premises, this one is actually correct. It may not happen in a single cycle, and it may take a while, but the price generally crashes to the baseline.

Which begs the question. What actually is the baseline? How do we know where that is?

This is how we define a bubble:

A bubble is the significant overpricing of a cash-flow-generating

asset relative to its intrinsic value.

The baseline, then, is the intrinsic value of the asset. The process in which the asset “crashes” to the baseline is actually nothing other than the markets doing their magic and the price eventually reverting back to the actual value.

This definition only involves cash-flow-generating assets; Bitcoin does not generate any cash flows. Thus, our definition raises an important question. As far as we are aware, nobody else has even raised this question:

Can Bitcoin be a bubble in the first place?

The answer is no. Contrary to popular belief, a bubble is not just any asset where the price is perceived to be high. It’s a feature of cash-flow-generating assets. The concept of being overpriced is not a gut feeling, nor something you can decide based on the price history. Overpricing can only be measured against the intrinsic value of the asset.

In many ways, a bubble works exactly the same way as margin of safety, only in opposite. Remember, the act of investing starts with valuing the asset, then creating room for safety by purchasing only if the price is sufficiently low. For example, if the value of a stock is $100, and the desired margin of safety is 20%:

Purchases below $80 constitute investments;

Purchases between $80 and $100 are speculative investments; and

Purchases above $100 are speculation.

The concept of “significant overpricing” is a qualitative determination, but one rule of thumb could be: take the desired margin of safety of 20%, apply it to the value, and anything above that would be the bubble territory. So, let’s add a fourth item to our list.

When the price is above $120, we are in bubble territory.

Remember, the headline of the video we showed you above said: “Why Bitcoin Is NOT a Bubble!” We agree with the premise, Bitcoin is not a bubble, but it’s not for the reasons you think.

Bitcoin is not a bubble because Bitcoin is not a cash-flow-generating asset and the intrinsic value is zero. Bitcoin does not deserve to be a bubble.

You might say that we are splitting hairs. You might argue that because Bitcoin’s intrinsic value is zero, at any price it could still technically be called a bubble. We thought about that possibility extensively and concluded that it’s a very slippery slope. We’ll tell you why shortly, so stay tuned.