Does the Truth Always Swim Upstream?

What is investing? We are putting a stake in the ground.

We are extremely confident that we figured out this investing phenomenon. At the same time, we are well aware that we are swimming upstream, but both of these things can be true at the same time.

We are confident because we believe that our position is internally consistent. As far as we can see, there are no dead ends, no inconsistencies nor any strange outcomes. A purchase of a cash-flow-generating asset at the right price is the pure and proper definition of investing. Using this definition, everything falls into place nicely, forms a solid foundation and is consistent with proven success throughout history.

The other side, if you can call it that, is full of dead-ends and inconsistencies. Gold is a safe asset, says Nouriel Roubini, but not Bitcoin. Why not? What is the difference, other than gold having been around longer? Bitcoin is investing, says Ric Edelman, but Dogecoin is a scam. Why? Because Bitcoin has been around just a few years longer?

If your investment characterization depends on the level of adoption, we, as a society, will never agree whether something is an investment or not, because everybody has a different view of what sufficient adoption means.

Also, if a certain level of adoption is what is needed to earn the “investing” label, there is an unfortunate implication. This interpretation implies that “assets” can dart in and out of the “investment” zone as people’s preferences change - i.e. if a certain asset is in vogue, it becomes an investable asset but if it falls out of fashion, it stops being an investment. Then, if it becomes popular again, it would become an investment again. We submit that doesn’t make any sense.

Ask most people what the tulip mania was, and most of them would say it had nothing to do with investing. Well, we say that with the benefit of hindsight. We are sure it looked like a great investment to many people at the beginning of the mania. Some people must have cashed out at $100,000 a pop, and they did great.

Investing ultimately needs to tie to the design of an asset. It is true that one cannot pinpoint an exact price point below which a purchase of a cash-flow-generating asset becomes an investment. It is a spectrum, but the investing roadmap is clear:

Calculate value based on cash flows;

Compare price to value and buy if price is sufficiently below value.

On the other hand, it should be obvious what the right price is for a non-cash-flow-generating asset: zero.

There is no price at which the purchase of a non-cash-flow-generating

asset becomes an investment.

If we are being honest with ourselves, we don’t really see how any conclusion other than this one is possible. So why is this not the popular opinion?

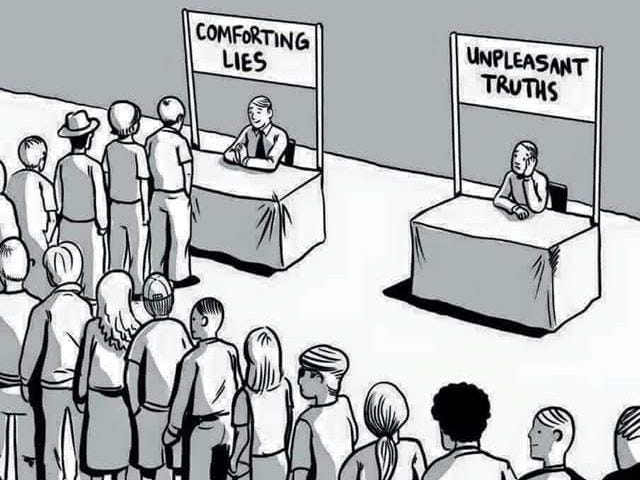

The answer lies in this cartoon:

(Note: We want to give credit to the cartoonist, but we don’t know who they are. The cartoon is circulating on the internet. This copy came from this LinkedIn post.)

Investing is the purchase of cash-flow-generating assets at the right price. Under this interpretation, investing comprises a small subset of all possible trades. That is the unpleasant truth.

When you consider investing to be any money-making opportunity where you can buy low and sell high anything, that is the comforting lie (see the cartoon above) that everyone seems to be okay with.

“Lie” in this case is not a literal deviation from the truth in a verifiable sense, as in, the Los Angeles Lakers won the NBA championship this year (they didn’t). It’s more an opinion that, under scrutiny, doesn’t hold together, as in “the Earth is flat.” You can say the counterposition “the World is round” is verifiable, too, but is it? They will say the pictures are fake. “The Earth is flat” opinion is not that unpopular; in a recent survey, only 66% of the 18-24 age group agreed with the statement “I have always believed the world is round.” Ok, that doesn’t mean that everybody else is a flat-Earther, but still. Please look at the responses broken down by age groups, there is a trend here and it is not headed in the right direction.

In any event, the skeptical stance on the Earth’s shape is not as popular as “Investing is any trade that can make money.” Therein lies the danger. Flat-Earthism may make you an outlier. “Everything is investing” won’t make you an outlier; in fact, it may make you popular, but it may also make you (and/or your offspring) poor and somebody else rich.

So, why do these opinions persist, and sometimes, even become the popular opinion? The answer is very simple. A lie can be extremely profitable (financially), or otherwise beneficial (emotionally). With investing, we have a dangerous combination:

Sellers of Speculation. George Graham Rice, a speculator in his own right, decided it would be more profitable to cater to the insatiable desire in others. The “Jackal of Wall Street” has the distinct honor of being cited in congressional hearings, which culminated in the 1933 Securities Act and the subsequent securities laws. You can look around and see who the sellers of speculation are in the 21st century.

Buyers of speculation. Could that be you? Hey, we don’t think speculation is immoral. We don’t look down on it. We do it ourselves. Go for it, but only if you realize what you are doing. We are not anti-speculation necessarily. We are simply against the selling of speculation as investment, because, honestly, that feels like false advertising.

Regulators/courts/policymakers. You guys are supposed to be the adults in the room. If the buyers are fooling themselves, and the sellers capitalize on that opportunity, you can’t chalk that up to an arm’s length bargain between two unrelated parties. We are all for personal liberties, but only after all the relevant information is made available to all sides. In the case of crypto, that has not been the case; most people are not realizing that they aren’t actually investing, they are only speculating. We recommend a disclosure mandate by requiring a label like cigarettes or organic foods and then letting them make their decisions afterward.

Non-government gatekeepers. Personal finance experts, banks, educators, universities, etc. It is easy to jump on the bandwagon, but it is much harder to take a stance. You need to take a stance and pick a side. You can choose money or truth, but you cannot have your cake and eat it too. The choice is yours.

Non-government gatekeepers. Personal finance experts, banks, educators, universities, etc. It is easy to jump on the bandwagon, but it is much harder to take a stance. You need to take a stance and pick a side. You can choose money or truth, but you cannot have your cake and eat it too. The choice is yours.