Even a Superstar Financial Historian Loves Bitcoin as An Investment Opportunity

What About Dogecoin?

Believe it or not, our hypothetical employee at the SEC is already two weeks into the job. A lot of progress has been made, but there is still work to do.

This week has been about the many people and institutions at the top of the financial food chain that are all bullish on Bitcoin. One of them recommended that people mortgage their house and buy more Bitcoin. A personal finance expert thinks it’s the first new asset class in 150 years and a once-in-a-generation investment opportunity. The top business school is offering certificate programs on digital assets and teaches about the Fundamental Token Value (FTV) methodology.

You want to pick one more research subject today and use tomorrow to recap and reflect. You want to stay on the academic front. You were on the East Coast yesterday (Wharton), now it’s time to venture to the West Coast. Enter Niall Ferguson, the Milbank Family Senior Fellow at the Hoover Institution, Stanford University, and senior faculty fellow of the Belfer Center for Science and International Affairs at Harvard.

How many books did Edelman have again? 12, right? Ferguson has 16, and is also an award-winning filmmaker, having won an international Emmy for his PBS series, The Ascent of Money, also the name of his famous book. Surely, he has some thoughts on Bitcoin. Yes, indeed he does:

You watch the whole thing, and you are very impressed by the clarity and sophistication of his thinking. This whole video is not about Bitcoin as an “investment” opportunity, but more about payments in the 21st century, personal liberties, the role Bitcoin can play, its appeal in less developed countries and thinking about what to hold in a possible World War III. It's refreshing to hear that there are people who focus on the payment aspects of Bitcoin, or crypto in general, as opposed to the constant noise around asset classes and investing.

That said, you wonder what Ferguson’s views are on that? If he has any, it doesn’t really come out in this video. A few clicks, and you find this:

In a recent interview, when asked “What will be the best investment opportunity coming out of the pandemic,” Renowned financial historian Dr. Niall Ferguson said that he would have to go with Bitcoin.

Another one bites the dust.

I’m going to go with Bitcoin. It has had a stellar year, up 165% year to date. [It’s now above $19,000.] If, at the beginning of the year, you had said, “The pandemic is coming. It’s going to be very disruptive. Should I choose gold or Bitcoin?” you would have been right to choose Bitcoin because gold is only up 21%. So Bitcoin returns have been an order of magnitude higher.”

Sure. Is the highest returning coin the best investment? That seems to you an ex post-justification of a trading decision. “By that logic, Dogecoin could be a much better investment than Bitcoin!”

You wonder what would happen if Ferguson and Edelman faced off, with you being the moderator, at the end of, say, 2021. It would likely go something like this:

You: What will be the best investment opportunity for 2022 and beyond?

Ferguson: I’m going to go with Dogecoin.

Edelman: Oh, please no.

You: Just one second, Mr. Edelman, I’ll come back to you. Mr. Ferguson, you were asked the same question last year, and you said Bitcoin.

Ferguson: Dogecoin has had a stellar year, up 3,542% in 2021. If at the beginning of the year you had said, “The pandemic is still going on. It will continue to be very disruptive. Should I go with Bitcoin or Dogecoin?” you would have been right to choose Dogecoin because Bitcoin is only up 60%. So Dogecoin returns have been an order of magnitude higher.

You: Ok. Mr. Edelman, what do you think?

Edelman: I like Bitcoin better.

You: Looks like it. You said in your latest book The Truth About Crypto, and I quote “When investing, price is what matters-and bitcoin and all other digital assets trade for a price.”

Ferguson: You said that, Ric?

Edelman: Yes, I did.

You: You also said “Bitcoin might not have any value. But it has one helluva price.”

Edelman: Yes.

You: Dogecoin has a helluva price, relative to last year. If price is what matters when investing, why do you disagree with Mr. Ferguson’s investment of choice?

Edelman: I don’t necessarily disagree.

You: You don’t necessarily disagree? That is interesting because you also said in The Truth About Crypto, and I quote again: “Sometimes scams are hiding in plain sight. I’m talking about Dogecoin.”

Ferguson: Ric?

Edelman: I mean, it doesn’t quite have the adoption that Bitcoin has.

You: How much time do we need? It had enough adoption last year to go up 3,542%.

[Calculations by NFI based on historical Bitcoin and Dogecoin prices on Yahoo Finance]

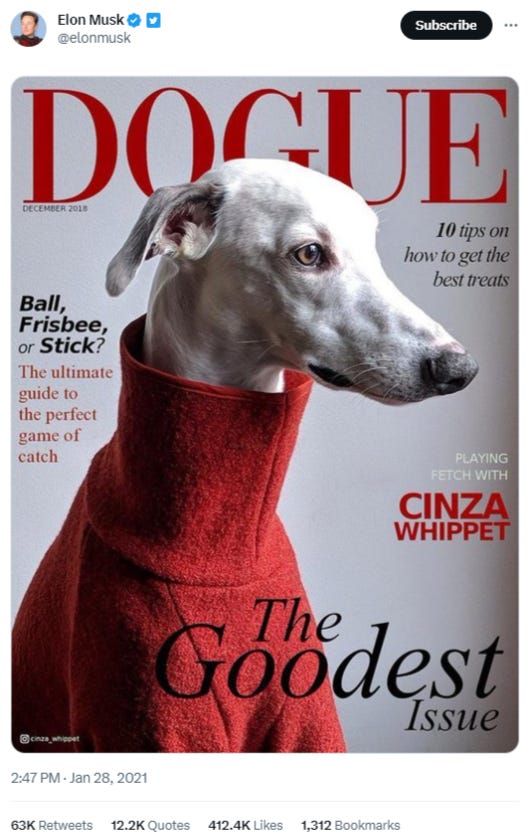

You see how things go off the rails here pretty fast? Dogecoin, of course, had this historic rally primarily because Elon Musk sent what appears to be his first Tweet on Dogecoin:

Let’s see. The timestamp on the tweet is 2:24 AM, April 2, 2019. Was that an April Fool’s joke?

Joke or not, Dogecoin closed at $0.002795 that day. Two days later, it closed 32% higher. It didn’t do a whole lot over the next 20 months, but, at the end of 2020, it was 68% higher, at $0.004682. It kept climbing throughout January; still, on January 27, 2021, it closed at a fairly paltry (by crypto standards) $0.007482. Then, Elon dropped this bombshell the next day:

The closing price that day? 0.034084. It lost a “zero.” That’s a 356% increase in one day.

Elon Musk kept tweeting:

The timestamp on that tweet? 3:25 AM, April 1, 2021. If the 2019 tweet wasn’t an April Fool’s joke, this certainly seemed like one, with the price shooting up 35% within minutes.

Then, things got really interesting. Five weeks later, on May 7, 2021, Dogecoin closed at $0.684777. The return since Elon’s first tweet a mere 25 months ago? 24,400%.

You check your notes. You remember seeing a similar figure a couple of weeks ago. Where was that again? Ah, yes, it must have been the S&P 500 index. Now it comes back to you, you remember seeing this figure in Berkshire’s 2022 investment letter. Indeed, there it is. The S&P 500 (with dividends included) has returned 24,708%. There is only one small detail:

It took the S&P 500 57 YEARS to match what Dogecoin returned in 25 MONTHS.

Are stocks and crypto on equal footing? From Mr. Wonderful to Ric Edelman, people seem to think so. Yet, something doesn’t feel right.

You realize that an investor and a speculator are not really buying the same thing. An investor buys, first and foremost, safety. A speculator wants a Lambo, and they don’t want to wait for 57 years.

Four more days of solid research under your belt and you feel like it’s all coming together. Tomorrow, you want to reflect on all of this and think about what the key issues are.