How Goldman Sachs's Crypto Views Evolved

June 9, 2023

Our hypothetical SEC employee’s research efforts on investing and crypto, which started about a week ago, are continuing…

Happy Friday! You are a bit worn out, but you feel things are coming together. You feel that you’ve made great progress and a thesis has started to emerge.

You look at your notes. You have researched three crypto critics so far: Buffett/Munger, Aswath Damodaran and Jamie Dimon. Then you spent time on two pro-crypto parties: Bill Miller and Kevin O’Leary. You need one more for a fair comparison.

You review your list and realize you have just one banker, Jamie Dimon. “What do other bankers, or banks in general think about crypto?” You decide to look at the so-called League Tables, a ranking of the banks. JP Morgan brought in the most fees year-to-date in 2023, and also in 2022. Ranking right behind JP Morgan, in second place, is Goldman Sachs.

Do they have a position on crypto? Or perhaps on Bitcoin, specifically?

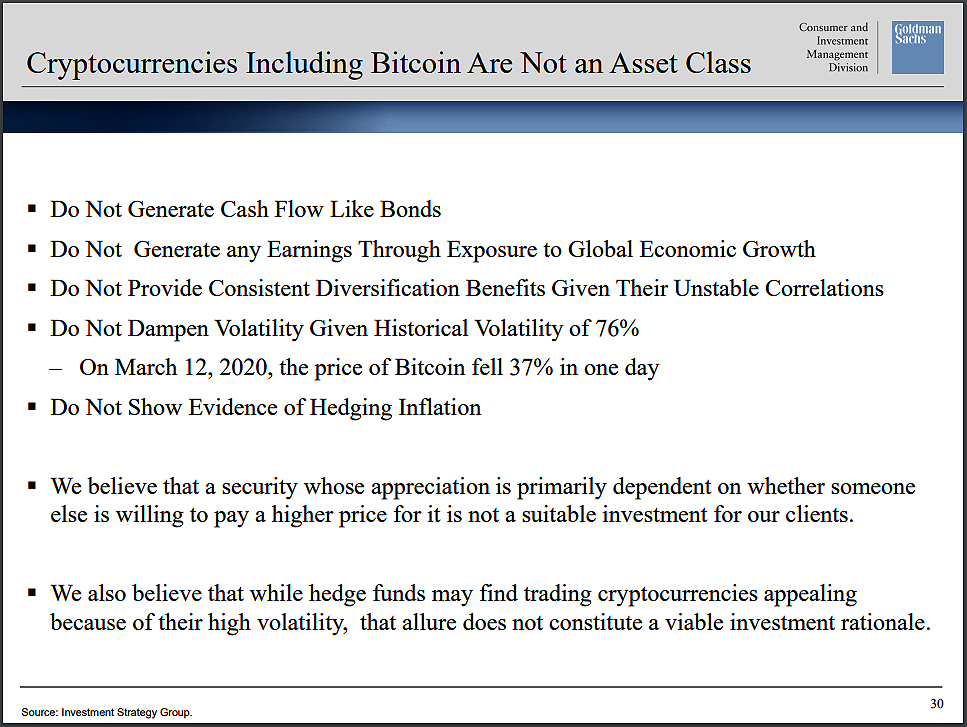

In June 2020, Goldman Sachs prepared a deck and argued that Bitcoin is unsuitable for investment portfolios.

“Here we go again,” you say. You start looking for the deck, but, based on the research you have done so far, you are pretty certain you know what it will include; lack of cash flows and the need to always find someone to pay a higher price. Isn’t that what it comes down to?

You find the slides (PDF)and locate the money slide:

As expected… “Doesn’t generate cash flows,” and of course this:

We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients. (emphasis added)

You clench your teeth. You remember the table you did just a few days ago.

“Well, apparently most everybody is a cash flow-type person until they aren’t,” you say. “Bitcoin has a way of changing these opinions.” Did Goldman stick with their original analysis?

Fast forward to May 2021, just a year later and you can see that they seemed to have reversed their opinion when putting out this research report (PDF) titled “Crypto: A New Asset Class?”

“Ok, sounds like a neutral question.” You consider how charitable you can be. “Yet, they were not neutral just a year ago! They had a very clear point of view. What has changed?” You keep reading.

There is an interview with Nouriel Roubini, or Dr. Doom, as many call him, for his bearish-sounding views on the economy (or perhaps he is just one of the few who is calling things as he sees them). Here is what he thinks of crypto:

Bitcoin and other cryptocurrencies aren’t assets. Assets have some cash flow or utility that can be used to determine their fundamental value... Bitcoin and other cryptocurrencies have no income or utility.

Of course. In other words, same as Buffett/Munger, Damodaran, Dimon and the 2020 version of Goldman Sachs.

Countering Roubini’s view is Michael Novogratz, CEO of Galaxy Digital:

We’ve now hit a critical mass of institutional engagement [in crypto]. Everyone from the major banks to PayPal and Square is getting more involved, which is a loud and clear signal that crypto is now an official asset class.

And, Michael Sonnenshein, CEO at Grayscale Investments:

I have yet to find somebody who has really done their homework on crypto assets that isn’t truly amazed by the potential for the asset class.

What does Goldman say? Here is Jeff Currie, from GS Commodities Research. The title of his piece is “Crypto is its own class of asset.” This is the summary:

Jeff Currie argues that cryptos are a new class of asset that derive their value from the information being verified and the size and growth of their networks, but legal challenges loom large.

“Deriving their value from the network?” Sure. You remember a very important nuance: the difference between having value and being valued. Does he say anything about intrinsic value?

From this perspective, the intrinsic value of the network is the trustworthy information that the blockchain produces through its mining process, and the coins native to the network are required to unlock this trusted information, and make it tradeable and fungible.

This sounds to you like a bunch of words that are cobbled together. “The network is useful to the extent it helps with cash flow generation!”

Then, there is of course the interview with Matthew McDermott, Global Head of Digital Assets at Goldman Sachs. What did he say? You know his opinion will likely be perceived as the official Goldman position. Here is the exchange:

Allison Nathan: There seems to be a debate today about whether or not cryptocurrencies can be considered an asset class. Are clients are viewing it that way?

Matthew McDermott: Increasingly, yes. Bitcoin is now considered an investable asset. It has its own idiosyncratic risk, partly because it’s still relatively new and going through an adoption phase. And it doesn’t behave as one would intuitively expect relative to other assets given the analogy to digital gold; to date, it’s tended to be more aligned with risk-on assets. But clients and beyond are largely treating it as a new asset class, which is notable—it’s not often that we get to witness the emergence of a new asset class.

“Ok, so he is saying that his clients are viewing it that way, maybe that’s not necessarily what he thinks. It is more likely than not that’s not what he thinks?”

You sigh. “It’s a popularity contest. Get enough people to believe it is an investment, and service providers need to follow them. Who, ultimately, is responsible for investor protection when a set of complicated incentives lead us to the wrong outcome?”

Your head is spinning. Bill Miller, Mr. Wonderful and now Goldman Sachs. That’s three for three for change of heart. You need the weekend to wind down and think about which direction you want to go next week.