Misinformation Mondays: What Social Media Has Wrong

Calling Bitcoin a bubble is giving it too much credit

This one’s subtle– not overtly offensive, but still misleading. And on Misinformation Mondays, subtlety doesn’t get a pass:

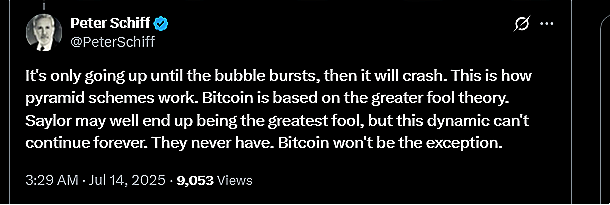

First, let’s start by giving Peter Schiff his due: Bitcoin is the greater fool theory in action. We agree wholeheartedly with Schiff on that front.

But calling it a “bubble”? That’s where things go sideways. We previously defined what a bubble is:

A bubble is the significant overpricing of a cash-flow-generating asset relative to its intrinsic value.

That definition matters. It implies there’s some intrinsic value hiding beneath the hype–a baseline, however flimsy. We’ve illustrated this concept before with a compelling visual analogy.

So here’s the irony: Calling Bitcoin a bubble accidentally elevates it to the status of a financial asset with intrinsic value. It’s not just misinformation–it’s a subtle upgrade that Bitcoin didn’t earn.

If legislation like the Clarity Act passes in its current form, and crypto is exempted from the definition of “investment contract,” or gets favorable tax treatment relative to stocks, this pedestal effect will only grow. Bitcoin had temporarily leapfrogged Amazon for #5 in total market cap (fell back to #6 today)--and may surpass other traditional assets in front of it. Not by merit, but through regulatory sleight of hand. (Multiplying the crypto token’s price by supply and calling it “market cap” is another pedestal contributor for crypto– but we’ll tackle that later.)

⚠️ And here’s the hard truth:

When equal treatment is granted where equality isn’t warranted,

expect even greater inequality in return.

Bitcoin has staged its own PR evolution:

First it was “digital gold”

Then, “an alternative to stocks”

Now? Poised to receive preferential treatment over stocks

Incentives drive behavior. If crypto tokens are rewarded with superior status, more capital will chase them–and less will flow into sectors that actually fuel real economic growth.

Everyone played a role in creating this dynamic. And one day, maybe we’ll all snap out of it. Or maybe AI will tell us plainly: None of this ever made sense.

Until then, expect much more misinformation–and plenty of strategic positioning in crypto’s growing shadow.