Misinformation Mondays: What Social Media Has Wrong

The failed moment of a finance hero

When we launched Misinformation Mondays just a couple of weeks ago, there were a few names we never expected to feature. People we looked up to. People who stood for clarity in a confusing landscape.

At the top of that list? Aswath Damodaran.

And yet, here we are.

A Shock From the Top. Just three weeks in, the award goes to someone we thought least likely to earn it. Damodaran wasn’t just an intellectual hero–he was a compass. His early analyses, especially around investing principles, helped shape the very foundation of this blog. Throughout our blog posts we cited him extensively. In a world where confusion prevails, Aswath was a guiding light.

Which is why this post hurts to write, but we’ve stated from the beginning that we will challenge misinformation where it exists.

After taking an early public stance against crypto “investing”–writing multiple pieces on why Bitcoin couldn’t qualify as an investment (here and here) and later strongly defending that thesis on live TV–he later went quiet on the matter. Not silent entirely, just quiet about crypto. A Google search of “Damodaran crypto” reveals very little between 2021 and 2025. We wondered if he had simply moved on, Buffett-style, but he, unlike Buffett who continued to pound the table, decided not to come back.

The Misinformation. Seemingly out of nowhere, Damodaran re-emerged with this:

It is true that most investing lessons are directed at those who invest only in stocks and bonds, and mostly with long-only strategies. It is also true that in the process, we are ignoring vast swaths of the investment universe, from other asset classes (real estate, collectibles, cryptos) to private holdings (VC, PE) to strategies that short stocks or use derivatives (hedge funds). These ignored investment classes are what fall under the rubric of alternative investments, and while many of these choices have been with us for as long as we have had financial markets, they were accessible to only a small subset of investors for much of that period.

You heard right: Damodaran now considers crypto and collectibles “alternative investments.”

This is particularly jarring because it's the opposite of what he argued just four years ago:

Have the Facts Changed? Not one bit.

The central point remains: Bitcoin still does not produce cash flows, the fundamental requirement of any investment. Damodaran doesn’t even dispute this. He writes:

The collectible asset class spans an array of investment, most of which generate little or no cash flows, but derive their pricing from scarcity and enduring demand. The first and perhaps the longest standing collectible is gold, a draw for investors during inflationary period or when they lose faith in fiat currencies and governments. (emphasis original)

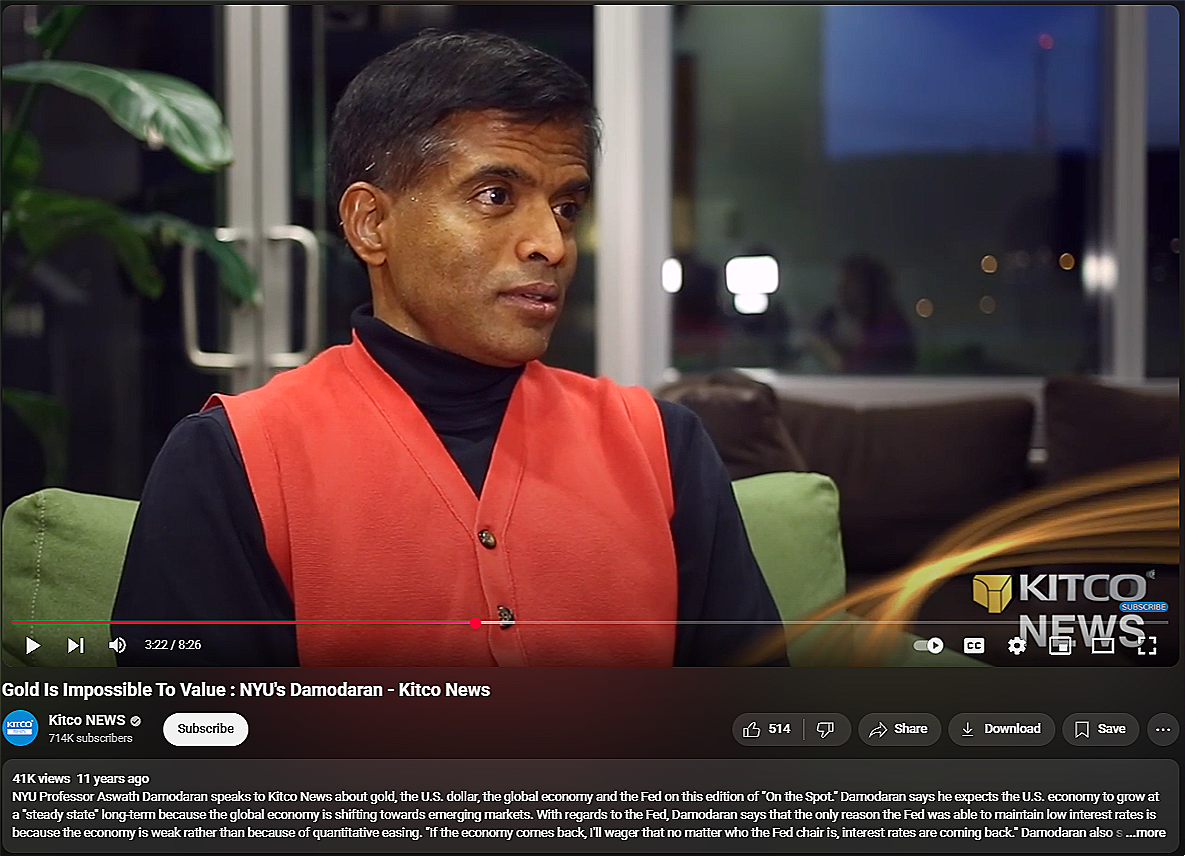

Exactly. That’s what makes these things speculative. And oddly enough, he now appears to suggest gold is an investment too–even though he made the opposite case a decade ago (here and here). Did the facts change around gold since then? No.

Oh, and there is this video, too:

He continued:

The second is art, ranging from paintings from the masters to digital art (non-fungible tokens or NFTs), that presumably offers owners not just financial returns but emotional dividends.

Funny you mention NFTs, Aswath. As we were copying that quote, one of our football NFTs sold on All Day for $2–purchased just two weeks earlier for $1. A few hours later, we sold another one for $111, which was purchased at $86 three months ago. After a 5% commission, that’s a 23% return in three months! Should we now brag that our “football NFT portfolio” is outpacing Bitcoin?

Uhm, no.

Even though these are small-dollar examples, the fact remains the same at any price: This was pure speculation, not an investment because we received no cash flows while owning these Moments. There are no fundamentals to value here. Even if the buy price was $100,000 and we found someone willing to pay even more for it at $105,000, it is still pure speculation and the Greater Fool Theory still applies. You need to close out a trade to access the cash.

Damodaran himself even admits it:

At the risk of raising the ire of crypto-enthusiasts, I would argue that much of the crypto space (and especially bitcoin) also fall into this grouping, with a combination of scarcity and trading demand determining pricing. (emphasis original)

Where the Logic Breaks Down. So where’s the misstep?

Let’s revisit Damodaran’s own words, from p. 10 of Damodaran on Valuation:

We buy most assets because we expect them to generate cash flows for us in the future. In [Discounted Cash Flow] valuation, we begin with a simple proposition. The value of an asset is not what someone perceives it to be worth, but rather it is a function of the expected cash flows on that asset.

Yes. That’s the rock-solid foundation of investing, with a clarification. Intrinsic value is a function of the expected cash flows on that asset. As such, unless there are cash flows to value, there is no such thing as investing.

In one fell swoop, Damodaran seems to walk back decades of principled clarity–with no new facts to justify the pivot.

So Why the Flip? We won’t speculate on motives. But we did feel compelled to get this out in the open and so we left this comment on his Substack post:

Aswath, when you were on CNBC on February 19, 2021, you said Bitcoin is not an investment and not an asset class. And you were right! Why the change of heart? Certainly, the fact that Bitcoin is still trading, even at a higher price, doesn't miraculously turn it into an investment. It was, and still is, pure speculation. Not that anything is wrong with speculation. But it is not an investment, and it doesn't belong to a portfolio, as long as a portfolio is still what we always thought it was: a collection of investments.

We are very disappointed. Your writings have helped us and shaped our thinking so much over the years. You were one of the very few who actually cared about definitions, took a principled approach and questioned everything. You impacted many with those qualities, us included, in a very positive way.

If you don't want to fight the good fight anymore, that's fine, you gave so much to the world of finance and you don't owe anybody anything. But future generations are still watching and we don't believe taking the exact opposite position four years later without a material change in facts is consistent with your brand, intellect and curiosity.

Thank you.

New Finance Institute

Legacy on the Line. Harsh? Not at all. As Buffett nears the end of an era, Damodaran was one of the last luminaries who was capable of carrying his torch on the principles of investing.

Not anymore.

With one inconsistent step, he may have dimmed his legacy–and handed the crypto crowd a win that future students of finance will be stuck parsing for years.