Money or Investment? Bitcoin is Stuck Between a Rock and an Impossible Place

Bitcoin wants to be all things to all people–but reality has a way of catching up

Bitcoin: Trying to be Everything to Everyone–And That Generally Doesn’t End Well. The contradictions in how Bitcoin is presented are astonishing. The Coinbase commercial below doesn’t talk about Bitcoin as an investment at all, the implied message is that it will replace fiat. At the same time, Coinbase promotes crypto with titles like When is the best time to invest in crypto?--yet in legal filings, the same company argues crypto isn’t actually an investment.

So, what the heck is Bitcoin?

Jack Dorsey sees it as a payment system, believing it will fail completely if it doesn’t succeed in that role:

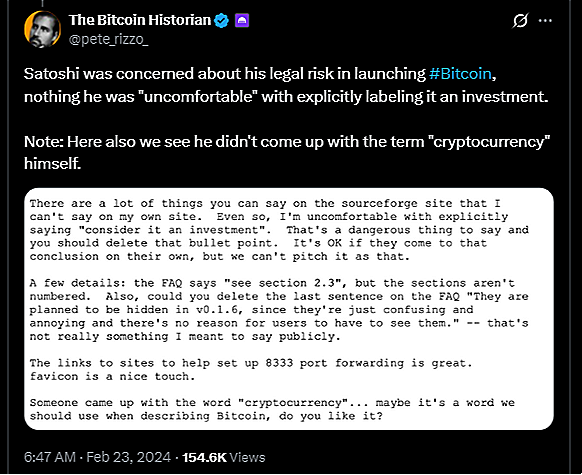

That vision aligns with Satoshi Nakamoto, who was notably hesitant to pitch Bitcoin as an investment.

Fidelity, however, doesn't care if Bitcoin is used as money–they just want it in their client’s “portfolios.” If a portfolio is still defined as a collection of investments -which it should-then Bitcoin shouldn’t belong to a portfolio, retirement or otherwise; you cannot invest in Bitcoin.

Meanwhile, Michael Saylor–the ultimate Bitcoin evangelist–calls it a digital property, explicitly rejecting the idea that Bitcoin is meant for payments:

Reflecting that thinking, Saylor also considers Bitcoin an investment, even quoting Warren Buffett along the way:

But wait, apparently he’s not exactly rejecting the idea of Bitcoin being used for payments. He recently called Bitcoin perfect money. If it’s perfect money, then how can you reject the idea that it’s not currency? So, just like Coinbase, he’s playing both sides.

Do you see a pattern here? Bitcoin may have started as an alternative to currency debasement, something people in developing nations have dealt with for decades. I know this firsthand. As a kid, growing up in a high-inflation country, I worked some jobs tutoring and selling books. Saving in my local currency made no sense, so I converted my earnings to U.S. Dollars–not as an investment, but simply as a way to preserve value.

Having lived through that experience, I’m not going to completely dismiss the possibility that Bitcoin (or another cryptocurrency) could one day replace the U.S. Dollar as the world’s reserve currency. The problem, though, is this:

Bitcoin’s Store-of-Value Status Is Built on a Misconception

The U.S. Dollar is considered a store of value because:

✔️ The U.S. government backs it

✔️ It serves as a medium of exchange

✔️ It functions as a unit of account

Bitcoin, by contrast, is considered a store of value mainly because it’s mistakenly treated as an investment.

🚫 It’s not a medium of exchange—at least not yet

🚫 It’s not a unit of account—at least not yet

The U.S. Dollar is legal tender, so it naturally functions as a medium of exchange and a unit of account–prices practically everywhere are quoted in U.S. Dollars.

Bitcoin, on the other hand, has gained its “store of value” label not because it serves as a medium of exchange or a unit of account, but simply because it’s been aggressively marketed as an investment.

The Real Risk? A False Narrative

Yes, inflation is bad.

Yes, national debt has achieved dangerous levels.

Yes, some people today are exchanging their local currency for Bitcoin–similar to how I once exchanged my earnings for U.S. Dollars.

But this is where things have changed: Many aren't thinking of Bitcoin as a currency alternative anymore. They believe that they are investing.

And why wouldn’t they? That is what is being sold to them.

Fidelity, Michael Saylor, Ric Edelman and Niall Ferguson all tell them Bitcoin is an investment.

Even critics–like the SEC and Elizabeth Warren–mistakenly frame Bitcoin as something one can invest in.

Bitcoin hasn’t become a store of value because it’s a strong medium of exchange or unit of account. It’s perceived as one because it’s marketed that way. We aren’t saying that it can’t ever become a store of value, but note that it’s simply incredibly difficult to get there without the world’s leading governments backing it.

The Numbers Don’t Lie. A recent survey revealed that 93% of Bitcoin holders use it as an investment, this was the finding:

What's more, pretty much all of the crypto users — 92.6% of them — held it as an investment; only 4.4% used it to buy stuff. Which, for a thing that calls itself a "currency," really does not sound very much like money, much less a futuristic alternative to the hegemony of the global banking system.

This is an FDIC survey, mind you, not some random mom-and-pop outfit. Yet, the FDIC clearly presumes a conclusion--that one can hold crypto as an investment--when it asks the question:

…How did you or others in your household use crypto? Was it to…

Build savings

Hold as an investment

Send or receive money from friends or family

Buy items online

Buy items in person

Receive money from work, retirement, or a government agency

Pay bills like rent, mortgage, utilities, or child care

OTHER (SPECIFY)

DK/REFUSE

The numbers don’t lie, but one of the possible answers does, the one that happened to be the most popular answer!

Future of money? Visionaries, meet the finance industry. You may be holding onto a romantic vision of Bitcoin’s future. But the reality is, unless that vision materializes, the financial gatekeepers will continue shaping the narrative–selling Bitcoin as an investment while knowingly profiting from the speculation on it.

Until Bitcoin truly functions as a medium of exchange and a unit of account, its store-of-value status remains a product of perception, not utility. And for those betting their financial future on it, the losses could be far greater than 4% inflation a year.

Bitcoin wants to be all things to all people–but reality has a way of catching up.