What Makes a Shot the Right Shot in Finance?

Margin of safety

After we analogized investing to taking the right shot, we concluded our last post by asking:

What makes a shot the right shot?

That question has been answered by the person who literally wrote the book on investing, Ben Graham, conclusively:

An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.

And his disciple Warren Buffett:

[W]e insist on a margin of safety in our purchase price. If we calculate the value of a common stock to be only slightly higher than its price, we're not interested in buying. We believe this margin-of-safety principle, so strongly emphasized by Ben Graham, to be the cornerstone of investment success.

Investors that are cut from the same cloth understand that principle, too. Howard Marks said:

Serious investing consists of buying things because the price is attractive relative to intrinsic value. (emphasis original)

Joel Greenblatt concurred (start around the 8:45-minute mark):

Figure out what it’s worth, pay a lot less.

Seth Klarman agreed (around the 1 hour 23 minutes mark):

You need to leave room, because you might be wrong, markets might go against you, but if you are patient, you can find a margin of safety and having one means you are likely not [going] to be in tears when a lot of other investors are.

Let’s pay the most attention to the common denominator in those statements: Safety of principal… Margin of safety… Attractive price relative to intrinsic value… Pay a lot less… You need to leave room…

The message is clear: Safety comes first. The right shot is the safe shot.

In basketball, safety comes from being as close to the basket as possible, and/or shooting an uncontested jumper. With investing, safety comes from knowing what the intrinsic value is, buying only when the price is significantly less and having faith in the markets that eventually, the price will converge to its true value; it will happen more often than not. If you employ this method consistently over a long period of time, it may become the difference between turning $1 into $31,000 vs $4.4 million over a lifetime (Berkshire’s 2023 shareholder letter). During the 1965-2023 period, the overall gain in S&P 500 with dividends included was 31,223%. During the same period, Berkshire’s return was 4,384,748%.

What if you feel you are quite adept at predicting trading patterns? Can safety be found that way? In the world of investing, the answer is no. You may feel safe because others are buying but you are still at the mercy of others. Once they stop buying, you have nothing, as the asset is not designed to produce cash flows (We’re looking at you crypto!).

With investing, on the other hand, you can just ignore price action. If you were right in your analysis, the cash will find you one way or another. You never relied on somebody buying the asset from you in the first place (We’re looking at you crypto, again!). It’s great if you can exit your investment by selling it to another trader who can be another investor who values the business higher or a speculator who thinks the price will keep increasing. Either way, that outcome is a bonus for you; it’s one way out of a trade, but it isn’t your only way out. You could stay put and just enjoy the cash flows. Crypto HODLers, of course, do not have that luxury, they must find another buyer in hopes to make a profit.

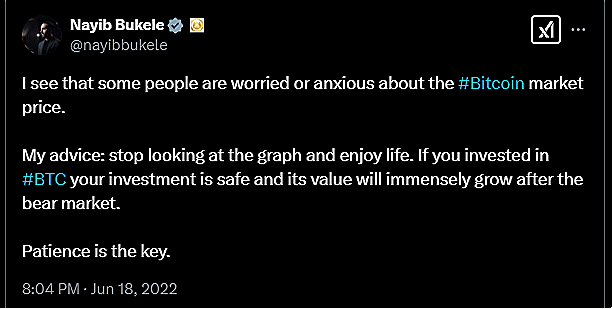

Let’s take a look at a different type of presumed safety that is completely misplaced, shall we?

If the El Salvadoran president had come out and said, “Our country’s GDP is sitting at the bottom of the barrel here; we’re not even in the top 100. I don’t really have any good ideas on how to improve our economy at the moment so, what we’re going to do is take a shot. To be very clear, it’s a long shot; akin to a one-legged stepback jumper. We have never done this before. It may not work out, but if it does work, we might shoot up the rankings. The free advertising we’ll get from the press might also help.”

We are unsure whether it is in a country’s best interest to speculate like that but that would have been at least an honest description of what the objective is.

Investing is about preserving what you have, and if done right, growing it over time in a safe manner.

What if you don’t have much today? Remember, according to Einstein, compound interest is the eighth wonder of the world and even something small can turn into a significant sum through investing, but you need time for that. If you feel you need to leapfrog the competition now, you have to take the long shot.

This is precisely what El Salvador has done. There is nothing wrong with that, per se. The problem is to advertise this as a safety play; it most certainly is not.

At this point, you probably have one more objection left in you. We can almost hear you saying:

What you describe is not investing. It’s called value investing, silly. All the people you cite are value investors. Everybody knows this. I mean, let’s go one by one:

Benjamin Graham, he is the “father of value investing.” Have you ever seen these links?

UCLA Benjamin Graham Value Investing Program

Columbia Business School The Heilbrunn Center for Graham & Dodd Investing

Warren Buffett, are you kidding me? Looks like somebody doesn’t know how to do simple Google searches:

Buy Side from Wall Street Journal

You mentioned Joel Greenblatt. I actually watched the video you linked. You conveniently left out the value investing part. The full sentence is “I mean, my definition of value investing is figure out what it’s worth, pay a lot less.” He is talking about value investing, not investing.

Seth Klarman? Dude! You know he’s the guy who wrote the preface to the 7th Edition of Security Analysis, right? In that preface. he used “value investing” or “value investors” more than 60 times! That’s more than once per page, on average!

Howard Marks is a legend, yes, but this is what he said:

Value investing is one of the key disciplines in the world of investing. It consists of quantifying what something is worth intrinsically, based primarily on its fundamental, cash-flow generating capabilities, and buying it if its price represents a meaningful discount from its value.

You are clueless, aren’t you? Value investing is finance 101. You write a blog on finance and you don’t know that?

We appreciate the feedback. Well, you must have walked by Value Investing Lounge, the business that lost a significant amount of business to Club Moneymakers which has been operating under new management since Halloween night in 2008. Next time you are going out for a night on town, you should pay them a visit and see what is really going on over there; it’s not what you think.