An Alternate Reality of Finance

Could a book publisher meeting in the 80s possibly be the moment in time when finance skewed into an alternate reality?

One of our favorite scenes in the Back To The Future franchise is this one (clickable):

We can’t help but draw some parallels. Slightly paraphrasing Doc Brown, it seems that what we are currently experiencing in finance is an alternate reality for Warren Buffett, us, and perhaps a few others, but reality for everyone else. We genuinely believe that we inhabit a world of alternate finance. In this world, “value investing” is an almost universally accepted concept, even though Ben Graham never actually uttered the phrase in The Intelligent Investor. Not even once!

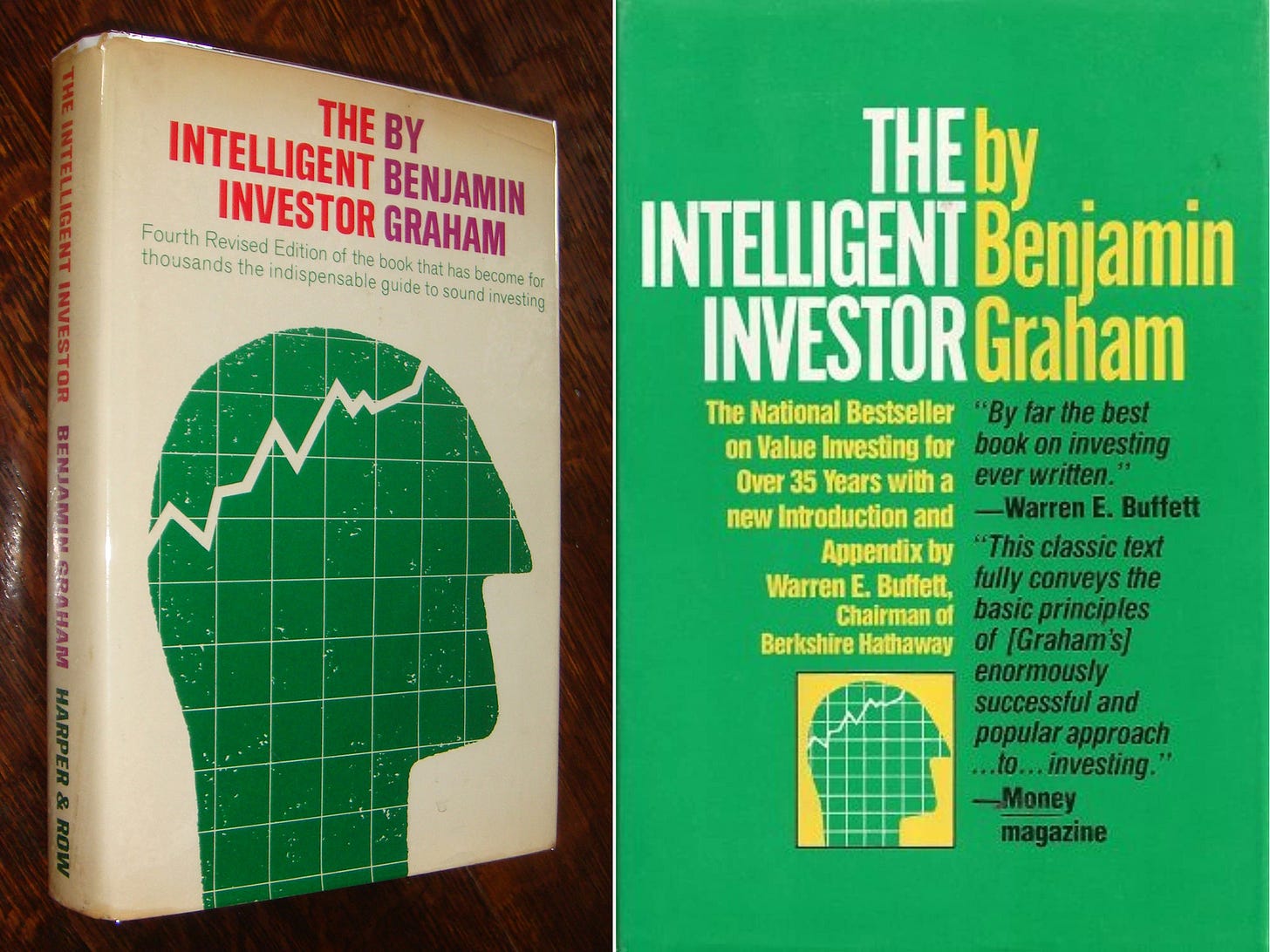

So, what could have possibly transpired here? We have a theory. Let’s place the 1973 edition of The Intelligent Investor (the last one Graham touched before he passed in 1976) and the 1986 edition (which features more visible contributions by Buffett), side by side shall we?

What do you observe here?

First and foremost, let’s start with a very important observation we made about the 1986 edition in our previous post:

That left panel - it appears to be the exact moment that the official introduction of “value investing” came to the finance scene! Certainly, this is the first time that the phrase “value investing” ever appeared in the subtitle.

What else? The image of the green head becomes smaller but is retained. More importantly, the color green takes over as the predominant hue on the cover, which is also a first. When we revisit all the covers of the past, the transformation of The Intelligent Investor “going green” becomes evident. The book acts like the ultimate traffic light of finance; it took 37 years, but it switched from red to green. The signal to potential “investors” is clear: Step on the gas and seize the opportunity to make some money!

It is quite evident that the publisher made two important decisions before releasing the 1986 edition. The first one, adding the phrase ”value investing” to the subtitle, is undoubtedly the most consequential. The color choice is not trivial, either. Intentional or not, it may have contributed to investors developing a false sense of security and inadvertently speculating under the guise of investing, which is precisely what Graham had been cautioning against.

Were these decisions made during a meeting? Oh, how we would have loved to be a fly on the wall in that session! Alas, we weren't, so we are left to speculation. Could something like the following scenario have unfolded? Disclaimer: What ensues is purely a fictional exercise.

Hypothetical Publisher Meeting To Discuss The Intelligent Investor (1986 Edition)

"Everyone, we are meeting today to discuss the subtitle of The Intelligent Investor. What are we going to do about it? Do we keep it?”

“What does it say again?”

“Fourth Revised Edition of the book that has become for thousands the indispensable guide to sound investing.”

“Sorry, could you repeat that?”

“ARE you listening?”

“I’m sorry, I got distracted.”

“Why? Are you saying it's too long?”

“Wayyy too long. You should be happy that I didn’t start snoring.”

“We need something shorter, huh? Something catchier. Any ideas?”

“I have an idea. Can we leverage Warren Buffett somehow?”

“How are we going to do that?”

“He’s very rich. He wrote the foreword. He also contributed this write-up from 1984 as an appendix. Maybe there is something catchy in there somewhere that we can turn into a subtitle?”

“Good idea! Let's spend a couple of minutes reading the foreword. Look for a sexy catchphrase that is short and sweet please.”

The room goes silent as the various employees of the publisher take a few minutes to read the foreword.

“Any takers?”

“It’s great information, but I don’t think there is anything here that we can turn into a catchy subtitle.”

“I agree with that,” concurs another participant.

“Are we sure? If so, let’s move to the appendix and conduct the same exercise.”

The room becomes silent again as they all read the appendix.

“I got it!” one participant shouts a few minutes later, breaking the silence.

“You did? What did you find? Please share with the group.”

“Value Investing. This is our catchphrase. He uses it three times in the appendix.”

“Value investing… I love it. When was the first edition published again?”

“1949. Over 35 years ago.”

“A bestseller ever since,” adds another participant.

“Hold it, folks. Let’s combine these three things. Bestseller, 35 years, value investing… Ok, I think I got it. The National Bestseller on Value Investing for Over 35 Years. What do you think?”

“That sounds excellent! Shall we also squeeze Warren Buffett’s name in there somewhere?”

“Great idea. Yes, let’s do that. We have a winner folks, this will make a difference.”

“Yes, this will be good. Are we done then, boss?”

“Just one more thing. What are we going to do about the cover design?”

“What about it?”

“I don’t love it. I kind of like that green head with the chart but it’s too big.”

“We can make it smaller.”

“That would work, but then what do we do about the color? Do we really want that white background?”

“What is wrong with white?”

“Nothing, but this book is about money.”

“The original was red.”

“Red? I don’t think that works well. The color of money is green. Investors will read this because they want to make money. The background color on the cover should match that emotion. Let’s mock it up with a green background, please.”

“Ok, boss, will do.”

This fictional account is not intended to cast any negative light. To state the obvious, a publisher’s primary focus is not investor protection; it’s publishing! No one could have predicted that what appeared to be a minor adjustment to the subtitle of Ben Graham’s classic would ultimately intersect with the rise of Dogecoin. And even if such a connection was foreseeable, is it really the publisher’s responsibility to be concerned about the resulting consequences? If a more captivating subtitle and a green cover are believed to boost sales, then why not pursue it? After all, that’s literally the job, to sell more copies of the book. Would you approach it differently?

All that said, let us direct you to the saying from Ed Norton Lorenz, an American mathematician and meteorologist:

When a butterfly flutters its wings in one part of the world, it can eventually cause a hurricane in another.

Having its roots in chaos theory, the broader idea is that any small change can cause much larger consequences. We genuinely feel that the 1986 edition was a butterfly in finance. Nearly 40 years later, with a massive speculative interest in crypto, you can now identify a chain of events that takes us from the 1986 edition of The Intelligent Investor to the infatuation with crypto. Investing becomes “value investing,” which leads to speculation encroaching into the investment territory and turning it into something that is much larger than it was supposed to be (if people believe “value investing” is just one type of investing, they would, quite logically, conclude that there must be other types of investing), and millions of people ending up speculating under the guise of investing.

The impact is not limited to finance either. Certain legal questions cannot be resolved properly without concurrently resolving the finance question, so a misconception about the word “investing” could produce erroneous court decisions (our opinion) and an incorrect application of a 75+ year old test developed by the Supreme Court.

We are firmly persuaded that this alternate reality of finance (including the legal interpretations surrounding it) is the context within which we operate today. Moreover, we hold the belief that this alternate reality is advantageous for a privileged few, yet generally detrimental to society as a whole. While some might broadly attribute this to corruption, that is not our perspective. There is no need to seek out nefarious explanations when a much simpler rationale, rooted in basic economics, suffices: Where we find ourselves today is largely a result of individuals responding to the incentives placed before them (beginning with a publisher nearly forty years ago), coupled with the unfortunate reality that many individuals and institutions tasked with making pivotal decisions opt not to engage in critical thinking.

One final request for our readers. If you happened to be present in that meeting, we would greatly appreciate learning whether our hypothesized scenario aligns with what has actually occurred. Your insights could immensely benefit future generations.