“Investment Contract” - The Legal Elephant in the Room

The missing phrase affects Bitcoin and crypto at large. Is it congressional oversight or strategy?

The Senate Agricultural Committee released a draft of the digital assets market structure bill last week, November 10, 2025 (press release, PDF bill).

Some of the terms in the bill are placeholders for future discussion. That said, there’s one omission that really stands out:

The phrase “investment contract.”

That phrase was central to the Responsible Financial Innovation Act of 2025 (“RFIA”), released by the Senate Banking Committee earlier this year–a bill we covered extensively. It also appeared prominently in the House’s Digital Asset Market Clarity Act of 2025 (H.R. 3633), which passed in July.

Yet in this senate draft, the term is nowhere to be found. Maybe it’s a temporary oversight. Maybe later versions will restore it. What’s striking is that, as of now, most coverage doesn’t even mention the omission.

Let us indulge a hypothetical: What if the final legislation never mentions investment contracts at all? Before we explore the consequences, we need to ground ourselves in three positions.

Bitcoin Is Not An Investment

Yes, unpopular opinion. But logic leaves no alternative.

In our inaugural LexBeyond podcast last week, we argued that investing and gambling should never share the same space. Gambling only enters the conversation when the term sheds its legal clothes and dons moral ones. Let’s recall our two critical observations from the podcast and add Bitcoin to the mix for additional flavor:

The stock market: Investing vs. speculation (never gambling);

Prediction markets: Speculation vs. gambling (too much speculation tilts a contract into gambling); and

Bitcoin: Speculation, pure and simple (never investing, never gambling).

Bitcoin is speculation, through and through; and that’s fine–so long as people know what they are engaging in to make informed decisions. As we’ve stated in the past, the government could apply a Surgeon General-like warning to cryptocurrency that states: “This Is Not An Investment” and then get out of the way and let Americans speculate as they deem appropriate.

Bitcoin Is an Investment Contract

Bitcoin is not an investment, but it can be an investment contract? Yes. The former is a finance question. The latter is a legal question. And the moment it is an investment contract, it becomes a security.

Not everyone agrees. In fact, most everyone disagrees. Rob Schwartz, former CFTC General Counsel, now a partner at Morgan Lewis, put it this way:

A number of U.S. exchanges now offer bitcoin futures, and nobody claims it’s a security, so there’s no question that bitcoin is now a commodity. (emphasis added)

Here we are again. Daniel Wallach, a sports betting and gaming lawyer, recently highlighted the defendants’ brief (PDF) in the Ohio case and claimed that nobody “identif[ied] the CEA as a statute affecting sports gambling.” We know that’s false because we raised that issue ourselves in Murphy v. NCAA. (amicus brief PDF). Leveraging on that factual nugget, last week we wrote and published an article titled Kalshi’s Gambit: The Bet That Could Break Sports Gambling.

Schwartz’s “nobody claims it’s a security” statement falls into the same trap. “Nobody” is easy to refute. All it takes is one and we are that one. We agree with the beginning and the end of Schwartz’s statement (more on this below), but not the middle.

We do claim Bitcoin is a security. Not the popular opinion, but consistent with Congress’s investor-protection mandate. Purchasers of Bitcoin deserve protections, and yes, this flows through Howey, via an alternative reading we started to advance in three major crypto cases:

SEC vs. Ripple (amicus brief PDF);

SEC vs. Coinbase (amicus brief PDF); and,

SEC vs. Binance (amicus brief PDF).

Does our position preclude Bitcoin being a commodity? Not at all.

A Commodity Can Be A Security

Let’s continue to explore the rest of Schwartz’s statement.

Is Bitcoin a commodity? Yes.

Does that mean it can’t be a security as a result? No.

The false dichotomy–that securities and commodities are mutually exclusive–has been gaining traction for at least two years now.

The Howey test governs investment contracts. Commodity status is a separate framework. The baskets are not mutually exclusive. On that note, Schwartz’s view conflicts directly with at least three former CFTC Commissioners–a tension we unpacked in The Security “or” Commodity Myth.

Consensus that a commodity can also be a security would be progress, and it is a threshold needed to answer the harder question: Is Bitcoin a security? As noted above, that inquiry runs through the phrase “investment contract.” Its omission from the latest Senate draft is not a minor detail–it’s one of the most consequential gaps in crypto legislation. To understand just how consequential, let’s step forward in time, into the Supreme Court–and imagine how this omission could shape a future legal challenge.

Back to the Future: Time Travel to a Supreme Court Showdown

Imagine Congress never restores the phrase. A Bitcoin purchaser sues, arguing their purchase constitutes an investment contract. They lose in lower courts but the case goes all the way up the chain to SCOTUS. Sports gambling is already resolved. Now the future of crypto is what’s at stake.

The petitioner points to the omission as intentional–a feature, not a bug. The security “or” commodity discussion becomes front and center again, and the petitioner argues that Bitcoin becoming a commodity does not preclude it from being a security.

The counterparty responds: “Not every silence is pregnant.”1 By pointing to certain statements made by the SEC Commissioners, including Gary Gensler’s, they argue that Bitcoin is not a security. They also cite favorable crypto litigation and politicize the debate as a continuation of a Biden-era witch hunt.

The petitioner counters with a classic line from the Supreme Court:

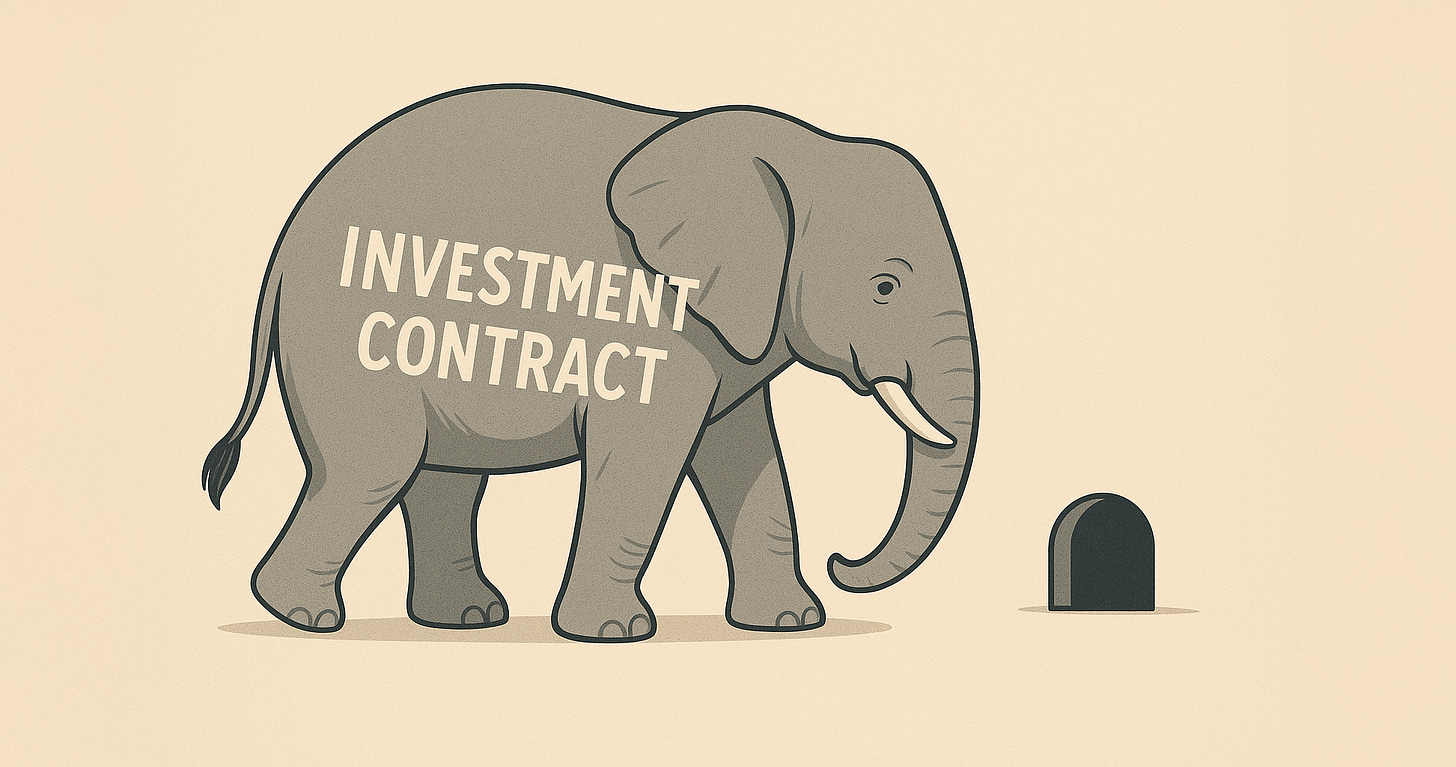

Congress … does not hide elephants in mouseholes.2

And suddenly, the missing phrase becomes the centerpiece of the next great crypto battle. The petitioner elaborates and argues that the phrase “investment contract” is not a mouse, it’s the elephant. They take the position that Congress deliberately omitted the phrase from the final market structure legislation. The logic? Congress was comfortable tasking the CFTC with broad oversight of crypto, but unwilling to go further and strip away the only remaining protection available to the crypto “investor.”

And you know what? They will be right.

Both the House and earlier version of the Senate’s investment contract carve-out never made sense. It rested on the faulty premise that if something is a commodity, it can’t be a security. That false dichotomy gave crypto more ammunition than it deserved. The CFTC as a regulator–even the lead regulator–could work. But pushing the SEC out of the picture through an investment contract carve-out denies the public the protections they urgently need.

Bitcoin at $126,000? That doesn’t make it an investment. Bitcoin at $90,000 (as it most recently nosedived to)? That doesn’t make it gambling or a Ponzi scheme either. Bitcoin is speculation, always and forever. Speculation is about price expectations and crypto prices will fluctuate.

When those prices collapse, purchasers may need a legal vehicle to pursue justice. Yes, they must be accountable for their own actions, but what about the government’s role in providing clarity? To this point, it hasn’t provided the much-needed transparency around what customers are buying, and likely won’t anytime soon. The best legal out, the only one, perhaps–resides in plain sight inside this resilient phrase: Investment contract.

Whether intentional or not, the Senate Agricultural Committee did the right thing by omitting the investment contract language because it prevents Congress from enshrining the flawed premise. Courts and regulators can still apply the Howey test case-by-case, rather than being boxed in by statutory language that narrows investor protections. Sometimes less is more; the missing language enables more investor protection. Let’s hope it stays that way.

Burns v. United States, 501 U.S. 129, 136 (1991) (quoting State of Illinois Dept. of Public Aid v. Schweiker, 707 F.2d 273, 277 (CA7 1983).

Whitman v. American Trucking Associations, Inc., 531 U.S. 457, 468 (2001).