How Alternate Finance Was Born

At its core, it is just a logical fallacy

Yesterday, we told you a tale. Today, we are going to use some simple logic and Venn diagrams to show you how alternate finance was born.

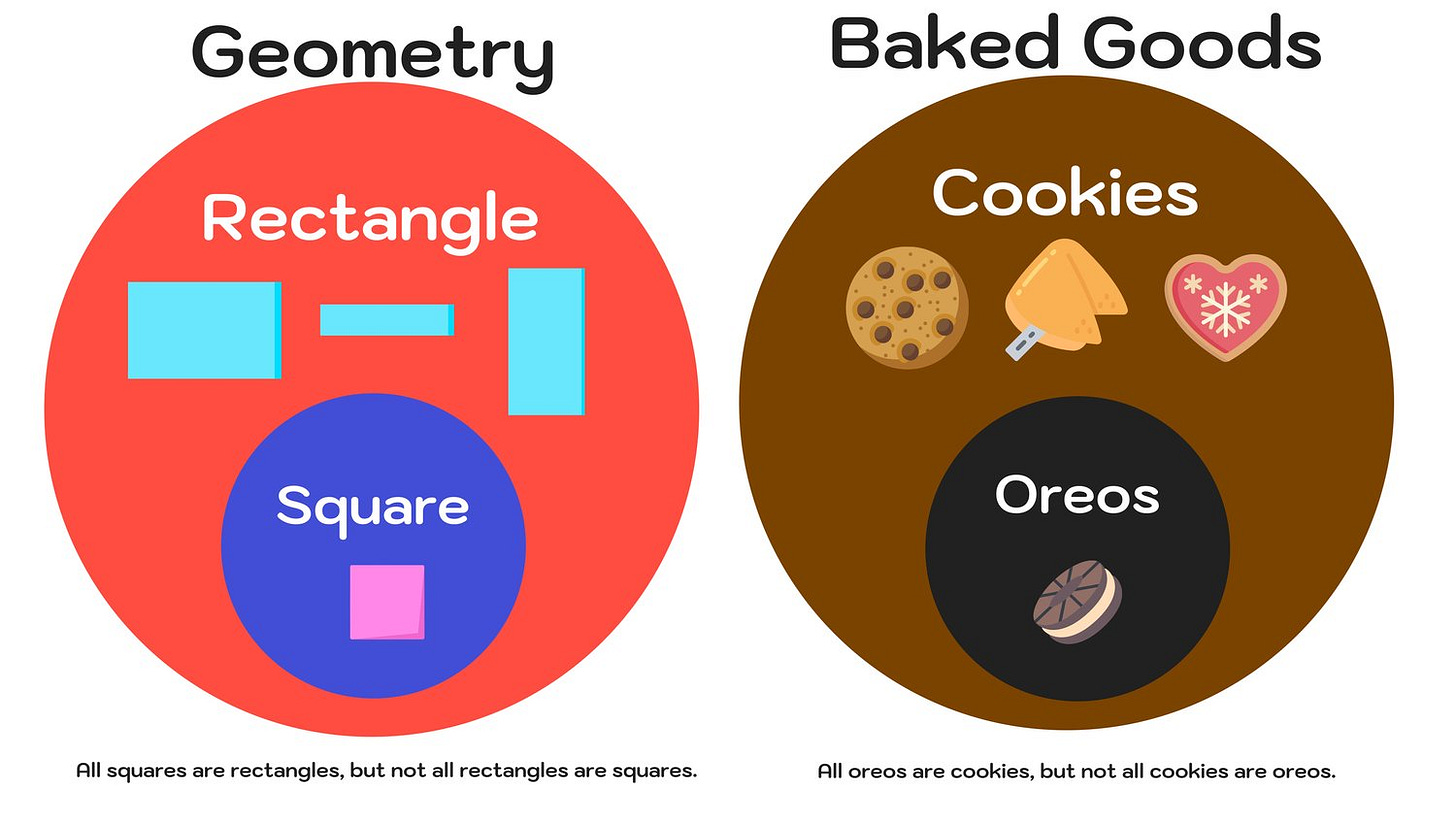

Let us start with a powerful visual we borrowed from MashUp Math.

Source: MashUp Math at www.mashupmath.com. Link to image.

This is a good analogy! Squares are a special type of rectangle, the same way Oreos are a special type of cookie.

You are probably familiar with Venn diagrams, but in case you are not, the big red circle on the left, in its entirety, represents rectangles. It includes everything in the blue circle, namely squares. Similarly, the big brown circle. on the right, in its entirety, represents cookies. It includes everything in the black circle, namely Oreos.

Why are squares special? They are rectangles that have four equal sides. Not all rectangles have that property; only squares do. Said differently, squares are a strict subset of rectangles. They are not the only rectangles in the universe; there are other rectangles that are not squares. In other words:

All squares are rectangles, but not all rectangles are squares.

So how does this have anything to do with investing?

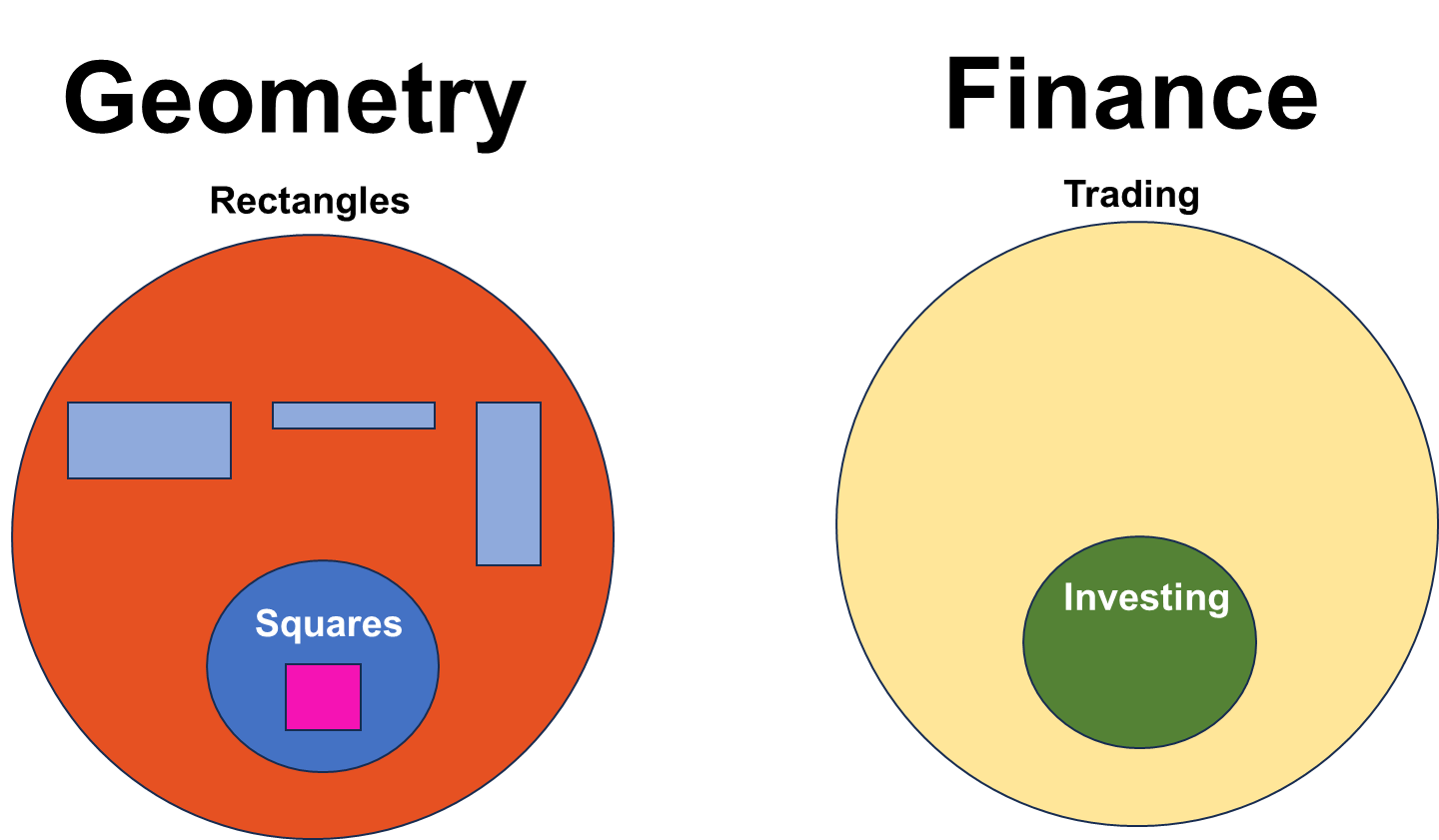

Let’s look at this image, this is ours:

The geometry circle on the left is essentially the same as before, we simply adjusted the title and word placement. The finance circle on the right does two things:

First, it defines the universe we are operating in. Trading refers to any trading activity, i.e. purchasing of stock, bonds, crypto tokens, etc. But only a sliver of this activity can properly be characterized as investing.

Why? Remember, investing is like buying cheap apple trees. For a trade to be characterized as investing, two conditions have to be satisfied:

Buying a cash-flow-generating asset. If an asset does not and cannot generate any cash flows, buying it is not investing.

Margin of safety. Buying a cash-flow-generating asset is a necessary but not sufficient condition. You also need to buy it cheap. What does “cheap” mean? We estimate the value of the asset, compare it to the price and then buy it only if it is cheap enough (if the price is sufficiently lower than its estimated value). How cheap is cheap enough? It really depends on your risk tolerance, but target no less than a 20% discount (relative to estimated value), and ideally more, to give yourself enough room.

So what do we call all this trading activity if it is not investing? Asked another way, what is the area that is part of the big yellow circle but outside the green circle? Basically, what is the equivalent of rectangles that are not squares in the world of finance?

We call it speculation, and it happens in two ways:

Buying NON-cash-flow-generating “assets”. Like crypto tokens or gold.

NO Margin of safety. Not every stock purchase is investing. It matters how cheap you buy it. Blindly throwing your money at “blue-chip stocks” does not make you an investor. Good companies can be bad investments and vice versa.

All right. Where does “value investing” come in?

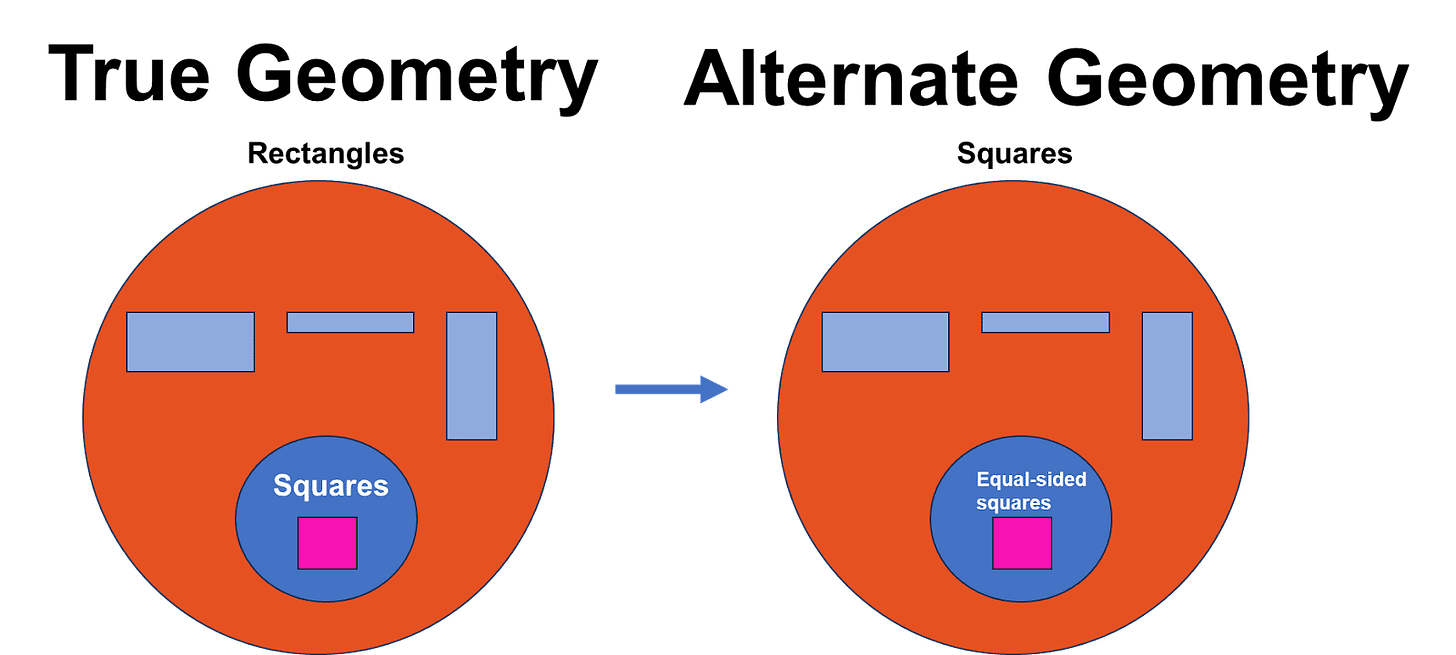

Let's quickly reflect on our tale from yesterday. By introducing the qualifier “equal-sided” in front of the word square, kids in our tale were led to believe there are equal-sided squares and also squares that do not have equal sides. The latter, of course, does not exist. Can you really blame someone for thinking other categories exist, though? If I tell you there are short kids in our class, you will almost immediately wonder about the tall kids. Descriptive qualifiers are great, but they condition us to think about the other possibilities. That’s how humans tend to organize information: comparing, contrasting, and putting them into buckets.

So, when the well-meaning Sultan in our tale adds the correct, but ultimately redundant qualifier “equal-sided,“ the picture in our mind transforms as follows:

You can immediately see the issue here. Equal-sided squares are not a strict subset of squares, they are the squares. By definition, there are no squares that do not have equal sides. The qualifier makes one think there is, however, and rectangles that are not squares become squares!

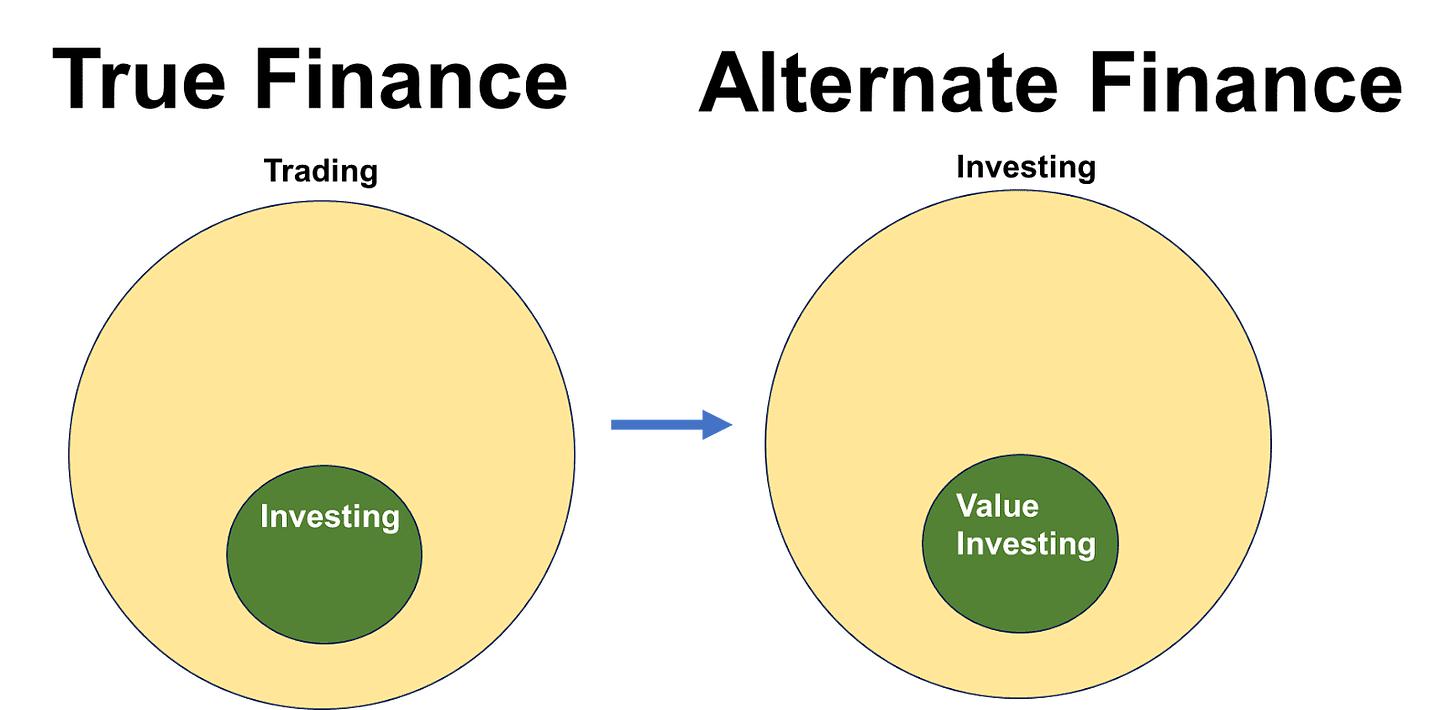

Now, let’s conduct the exact same exercise with respect to finance, which provides the visual foundation to show why the “value investing” concept is a giant misunderstanding.

The picture on the left is a true representation of finance. ALL investing is value investing. That’s not a knock on speculation. If you want to speculate, go for it! However, do that knowingly and willingly, and not because somebody is telling you that it is a great investment opportunity.

The picture on the right is where, unfortunately, most of the finance community finds itself today. Investing was relabeled as “value investing.” That opens the door to all other trades that are not investing, but characterized as such. Value investing is not a strict subset of investing, it is investing. By definition, there is no investing that is not value investing. The qualifier makes one think there is, however, and trades that are not investing become investing!

So, “value investing,” at the end of the day, is simply a logical fallacy; a very costly one, to be sure, but a logical fallacy nonetheless. Ben Graham didn’t fall for that fallacy; he did not utter that phrase once in The Intelligent Investor. Buffett admitted that he engaged in such thinking but he corrected it, some 30 years ago. Charlie Munger did not buy into the fallacy either. And yes, there are some others that saw right through it.

Most of the remaining participants in the finance industry? They either did not think critically about this issue, or, alternatively, found it beneficial to not think critically about this issue. Ambiguous language can be very profitable, after all!

The solution? It is fairly simple. Remember how the Sultan in our tale realized his mistake and put the education of his country back on track by ordering:

From now on, let the teachers of all our schools call a square an equal-sided rectangle.

With that one simple word change, he changed the entire paradigm, reversing what has become alternate geometry, and restoring it back to true geometry. The same can be accomplished in finance.

Had we called “value investing” value trading instead, we would have been just fine. It is true that we’ve lost a few decades to the confusion that “value investing” has caused, but it’s not too late to course-correct as long as we are willing to admit that we collectively made a mistake.

The problem is there are many entrenched interests that are not incentivized to make this change. The market forces are simply not going to get us there. People will believe what they want to believe and some will fight really hard to keep this myth intact.

The real question is: What will YOU do? Will you accept the conventional, but erroneous wisdom that has deep-seated roots in a logical fallacy? Or, will you break out of the herd and use that knowledge for your (and your wallet’s) benefit?