None of the Top Five Value Investors Believes in Value Investing

Ben Graham, Warren Buffett, Howard Marks, Joel Greenblatt & Seth Klarman

If you look in the right places, it’s really not that difficult to bust the myth of value investing. Recall that we gave you the five notable names in a previous post. Let’s stick with that order and start with Ben Graham:

1. Ben Graham

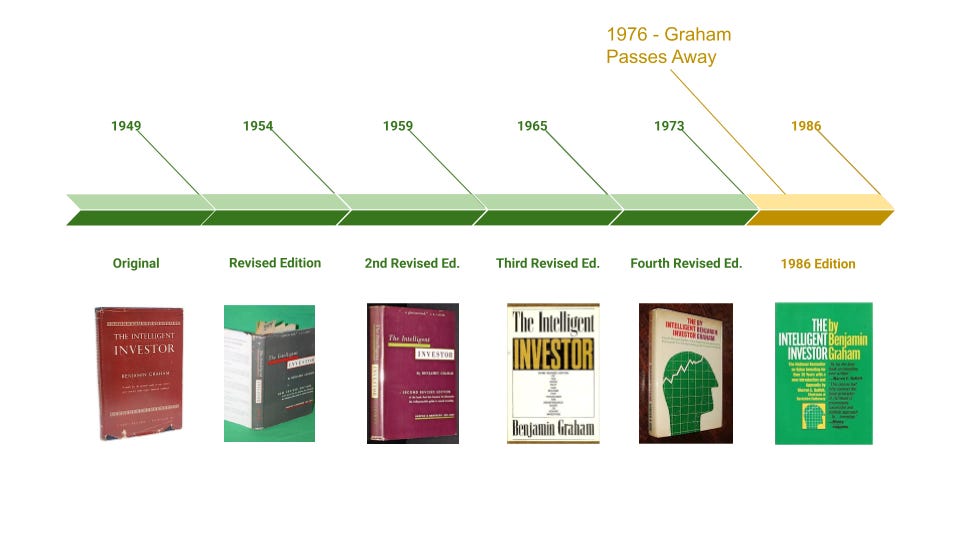

The Intelligent Investor has been enormously successful. Low and behold, many editions have been published since the original 1949 edition. We posted on this story back in 2023, but let’s recap the timeline:

(CLICK TO VIEW LARGER IMAGE)

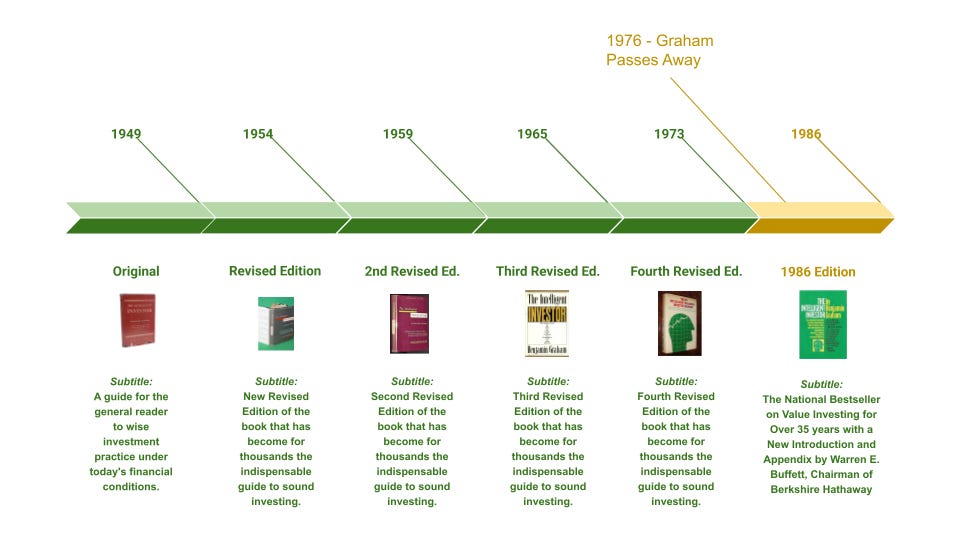

Ok. Let’s superimpose the subtitles on this timeline.

(CLICK TO VIEW LARGER IMAGE)

As both infographics illustrate, Ben Graham passed away in 1976. So:

The phrase “value investing” did not become part of the subtitle

until after Ben Graham passed away.

Think about that for a second. Ben Graham, the “father of value investing,” never actually uttered the phrase in The Intelligent Investor. Moreover, it was never part of the subtitle while Ben Graham was alive. It found its way there posthumously.

But how and why? We are not 100% sure but we do have a theory based on our research.

2. Warren Buffett

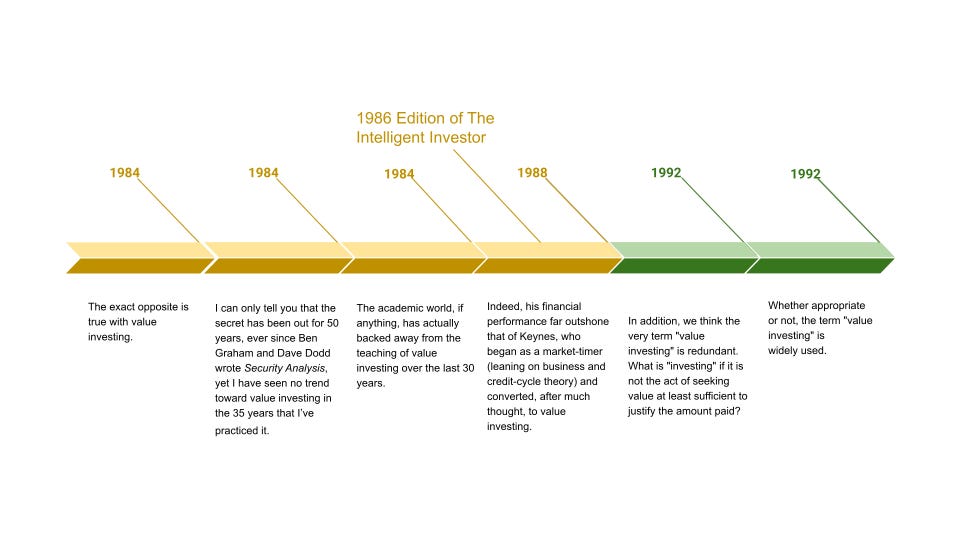

Recall that Buffett collaborated on the 1973 edition with Graham, which Graham had acknowledged. The posthumous 1986 edition was the first time Buffett actually put his footprint on the book, both through the preface and the appendix.

The preface is very good, but there is nothing of consequence there for the purposes of this discussion. The appendix, however, is the piece that changed the trajectory of finance. But how?

Through our research we’ve only been able to count six instances of Warren Buffett uttering the phrase “value investing.” If you happen to see more, please let us know. The first three appear in this appendix, the fourth one appears in his 1988 Chairman's Letter to Berkshire's investors and the final two appear in his 1992 Chairman's Letter. Let’s take a look at this visually:

(CLICK TO VIEW LARGER IMAGE)

We recapped this issue in a previous post:

With that 1992 investor letter, Warren Buffett set the record straight, but the damage had already been done. The “value investing” concept had a life of its own now and it could not be stopped. It did not need Graham (who had passed away 16 years prior) nor Buffett. Buffett must have surely been relieved as he solved the intellectual puzzle in his head, if he hadn’t already. For the rest of the finance community, there is no evidence that Buffett’s 1992 letter registered as more than a blip on the radar. As is unfortunately the case with many corrections, the original error remained the dominant position. The unfortunate state of affairs where we find ourselves is this: Warren Buffett’s true feelings about “value investing” are buried in one of his 58 investor letters. The value investing myth, on the other hand, lives on.

Ben Graham never uttered the phrase “value investing,” and later Warren Buffett denounced it after realizing his mistake. What about Howard Marks, Joel Greenblatt and Seth Klarman? You may recall that we covered this trio in our starting five.

3. Howard Marks

We profiled Howard Marks at length here. Quick recap:

Howard Marks was skeptical of Bitcoin first. Then he started having conversations with his son Andrew, who holds a meaningful amount for the Marks family. This conversation influenced Howard Marks in two ways:

First, Marks came close to seeing through the myth of value investing. That was one step forward for investing. At the same time, he softened his stance on crypto. That was one step backward for investing.

For the purposes of this conversation, the former is what matters. In Something of Value, Marks said:

I’ve written before about how the questions I’m asked give me a good sense for what’s really on people’s minds. These days, one I frequently field is about the outlook for “value” investing. “Growth” stocks have meaningfully outperformed “value” for the last 13 years – so long that people are asking me whether it’s going to be a permanent condition. My extensive discussions with Andrew led me to conclude that the focus on value versus growth doesn’t serve investors well in the fast-changing world in which we live. I’ll start by describing value investing and how investors might think about value in 2021.

See how he puts “value” in quotation marks? Buffett did the same in his 1992 letter. The two finance greats are aligned on this!

More - on page 3:

The two approaches – value and growth – have divided the investment world for the last fifty years. They’ve become not only schools of investing thought, but also labels used to differentiate products, managers and organizations. Based on this distinction, a persistent scoreboard is maintained measuring the performance of one camp against the other. Today it shows that the performance of value investing lagged that of growth investing over the past decade-plus (and massively so in 2020), leading some to declare value investing permanently dead while others assert that its great resurgence is just around the corner. My belief, especially after some deep reflection over the past year – prompted by my conversations with Andrew – is that the two should never have been viewed as mutually exclusive to begin with. We’ll get to that shortly. (emphasis original).

Page 5:

Despite these points, I don’t believe the famous value investors who so influenced the field intended for there to be such a sharp delineation between value investing, with its focus on the present day, low price and predictability, and growth investing, with its emphasis on rapidly growing companies, even when selling at high valuations. Nor is the distinction essential, natural or helpful, especially in the complex world in which we find ourselves today. (emphasis original).

Page 10-11:

Value investing is thought of as trying to put a precise value on the low-priced securities of possibly mundane companies and buying if their price is lower. And growth investing is thought of as buying on the basis of blue-sky estimates regarding the potential of highly promising companies and paying high valuations as the price of their potential. Rather than being defined as one side of this artificial dichotomy, value investing should instead consist of buying whatever represents a better value proposition, taking all factors into account. (emphasis original)

So, it is clear that Howard Marks does not believe in “value investing.”

4. Joel Greenblatt

What about Joel Greenblatt? We profiled him at length here. In there, you will see many examples of him making references to value investing, but his real stance seems to be this:

And you know, as Buffett has said, you know, growth and value are tied at the hip. I mean, part of what makes value is investing in a business that can grow over time. So they are not two different way they are classified by, let’s say, Morningstar or Russell, maybe there is much lower growth in value and much higher growth in growth, and they make it that way. But I’m looking for good businesses that are cheap.

Did Greenblatt just align himself to Buffett? It certainly seems like it:

The rest of the verbiage around value investing doesn’t make a lot of sense to me, that it’s defined the way Russell or Morningstar defines it. It really should just be defined as valuing things, being able to value something, and buying it at a reasonable price or discount price.

Or, said even more succinctly:

There is no growth investing and value investing. There is investing. Ok? Growth and value are tied at the hip, meaning growth is how much a company is going to grow over time, its earnings and its cash flows go into valuing a business. And, you know, the distinction between growth and value investing doesn’t make a lot of sense. (emphasis added).

We understand and agree, Mr. Greenblatt.

5. Seth Klarman

At this point, it should be clear that this whole value investing thing is just a “fallacy” because we don’t think this is an intentional act. Let’s finish with Seth Klarman, whom we profiled at length here.

He does not buy the growth vs. value narrative, either:

In case you want to skip the video, this is what he said:

The academic definition of value is buy the stock that is cheapest by the numbers. But I don’t think that’s what Graham and Dodd wanted, in fact it's clear that they were talking about earnings power and the growth possibilities in a business even if they are hard to determine. So I think value has to be determined for every company. The way I think about the market is not that there are growth stocks and value stocks, but rather that all stocks may hold value. (emphasis added)

Klarman is a smart man. He clearly understands that the growth vs. value distinction does not make sense. Furthermore, If there is no value vs growth, there can be no “value investing,” either. That’s the only logical conclusion.

Yet, Klarman, for whatever reason, stops short of making that conclusion. Why?

The best explanation is combining two snapshots from this video, which summarizes Klarman’s book, Margin of Safety: Risk Averse Value Investing Strategies for the Thoughtful Investor:

Remember, Ben Graham never uttered the phrase “value investing,” Warren Buffett denounced it. Klarman, according to some, was the next in line. If Graham was Mufasa, and Buffett was Simba, Klarman was arguably Kion. Klarman even said that Margin of Safety was meant to be the intellectual continuation of The Intelligent Investor.

Yet, Klarman did something that his predecessors did not do. He committed himself to the concept of value investing. He put the phrase “value investing” in his subtitle. When he edited the 7th Edition of Security Analysis and wrote the preface, he used “value investing” or “value investors” more than 60 times.

It is not easy to come out and say “I was wrong” under these circumstances but it would be the right thing to do and we urge him to do so for our future generations.

If Ben Graham was the “father of value investing,” Warren Buffett was the son and Marks, Greenblatt and Klarman were the grandchildren. That’s three generations of “value investors.”

None of them believed in value investing though. So, why do you?

Given the background on how the phrase “value investing” came about, we are now prepared to explore the Value Investing Lounge. Stay tuned.