Prediction Markets Slid Into Investing’s DMs

A crisis in the making

There were two major developments last week:

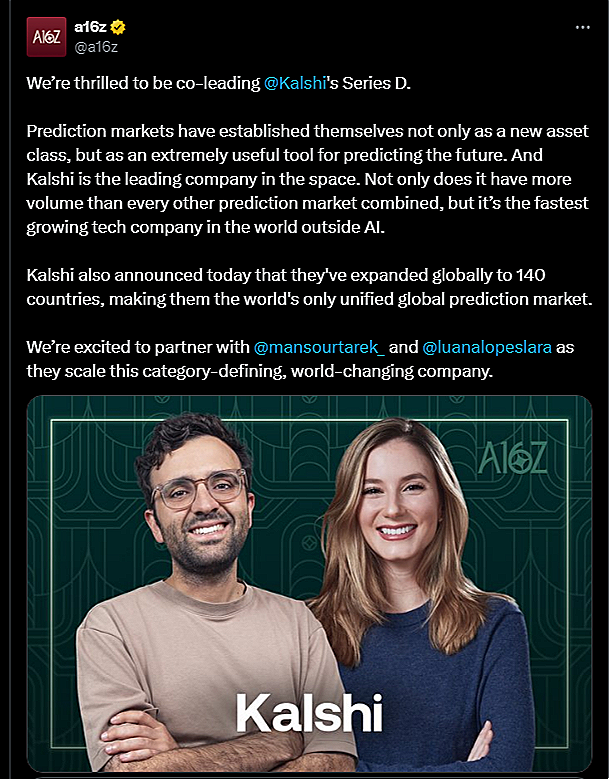

First, Kalshi secured a $300 million Series D investment led by Sequoia and a16z, valuing the company at $5 billion. Kalshi also announced plans to go international, expanding its offering to more than 140 countries and is now the largest prediction market in the world.

That announcement came just a few days after ICE invested $2 billion into Polymarket at a pre-money valuation of $8 billion. We covered that move earlier in detail, then unpacked the legal nuances around federal vs. state jurisdiction on Full Court Press.

A trend emerged across both releases: Investing and prediction markets are flirting with each other. Or, perhaps we should say, prediction markets are trying to woo investing? From the a16z piece announcing the Kalshi investment:

Every question—whether about politics, economics, technology, sports, or the weather—becomes an investable asset.

And from Shayne Coplan, quoted in the ICE press release:

By combining ICE’s institutional scale and credibility with Polymarket’s consumer savvy, we will be able to deliver world-class products for the modern investor.

Coplan’s quote begs the question: What exactly is the product for the “modern investor?” Tokenized stocks perhaps? That seems to be in the works. Or is it prediction markets? Because here’s the thing– tokenized or not, stocks can be investments. Prediction markets can’t because you can lose everything, and there is no margin of safety.

The a16z quote, by contrast, leaves no room for interpretation. It explicitly characterizes prediction market contracts as investable assets. This is heartbreaking to see from one of the country’s leading VC firms. Their job, literally, is to invest. So it’s difficult to believe that some of the sharpest minds don’t realize and/or don’t care that if you can lose everything based on a contingency, you’re not investing.

The lines between finance and gambling were already blurring. Now, apparently, a sports bet is an investable asset. What’s next–parlays in portfolios, or, dare we say it, in retirement accounts? Do you see the absurdity here?

This is not sustainable. Either the courts will intervene (hopefully before a crisis), or Congress will react (likely after one), or AI will call out the increasingly nonsensical positions and repackage them in a way a 5th grader can understand–triggering a backlash strong enough to force change. There’s also a darker possibility: If the courts don’t step in and wrangle this issue, we could soon see gambling style prediction markets entering our school curriculums and potentially financial literacy classes, under the guise of investing. Even more stark, your favorite athlete may get hurt because someone, somewhere, had meaningful money riding on it. We pray it doesn’t come to that–but at this rate, we wouldn’t bet against it.

We don’t believe a16z genuinely thinks a sports bet is an investment. More likely, they’re expanding the definition of investing to make their investment thesis work. Crypto went through a very similar journey, but we digress.

So yes, prediction markets are sliding into investing’s DMs. These two announcements were just the latest opportunities for flirtation. But the seduction has been underway for a while.

Robinhood

Two months ago, Robinhood launched pro and college football prediction markets directly within its app. JB Mackenzie, VP & GM of Futures and International, said:

Adding pro and college football to our prediction markets hub is a no-brainer for us as we aim to make Robinhood a one-stop shop for all your investing and trading needs.

Subtle! Prediction markets and investing in the same sentence. More Coplan than a16z. Technically, it doesn’t say prediction markets are investing–the “out” is that investing refers to stocks and maybe crypto, and prediction markets fall under “trading.” But on the Robinhood app, it’s all casually bundled together.

Interactive Brokers

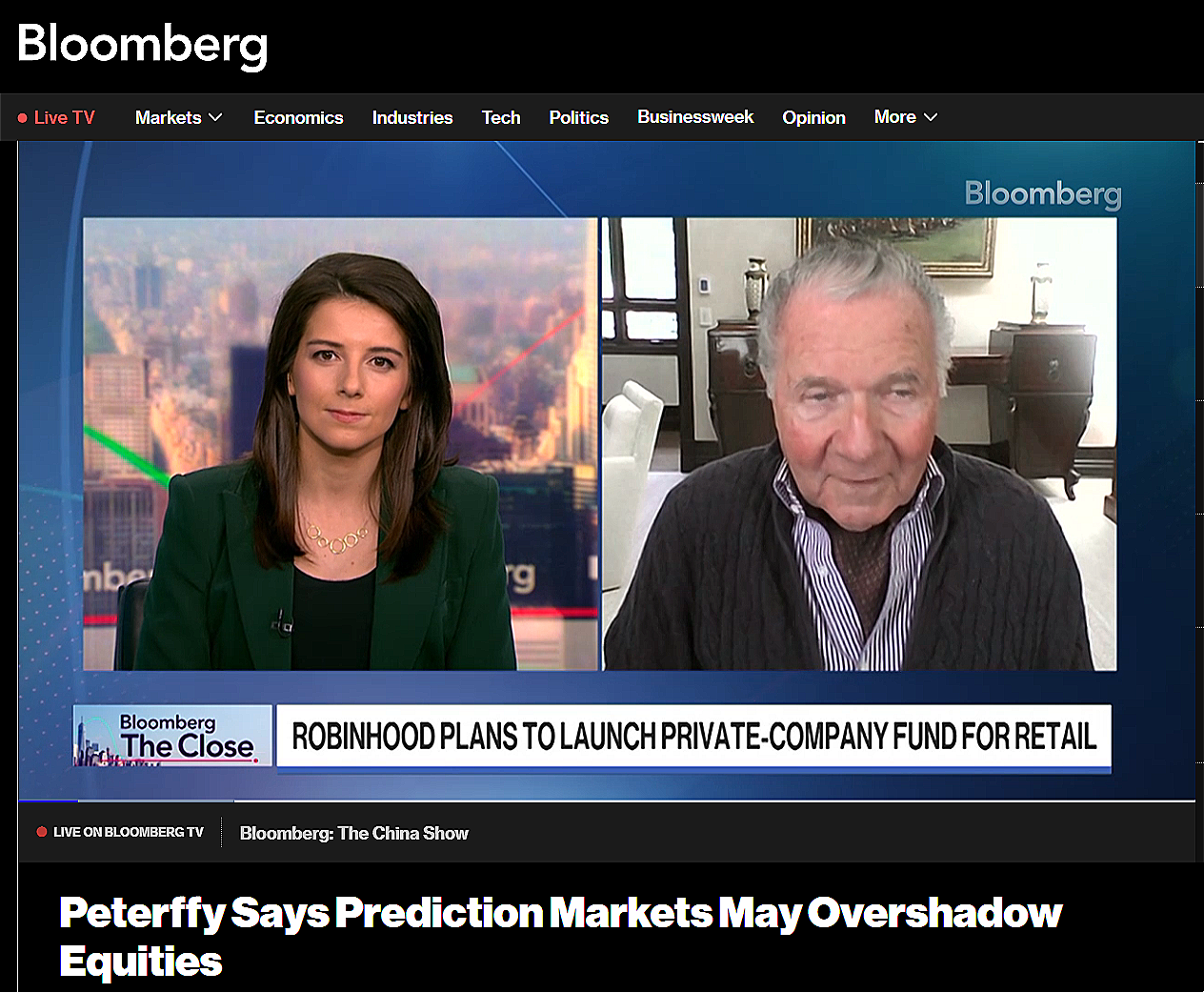

Thomas Peterffy, CEO of Interactive Brokers, is bullish on prediction markets–though he prefers macroeconomic themes over sports.

At 1:35, the host tees up a probing question:

More importantly, the idea of how investment has expanded, Thomas. I’m curious about the idea that the traditional ways of investing have shifted. It’s not just buying the stocks, or buying the bond, or even buying the option. It’s tokenization, securitization, prediction markets, etc. How do you fit in?

Peterffy seizes the moment to make the bull case for prediction markets:

…they are going to become more and more and more important to the point where they will overshadow the equity markets.

But he notably avoids calling them investing.

We respect Peterffy for doing that. A stronger stance would’ve been to correct the host by saying, “Look, this isn’t investing–it’s trading. But the prices generated can be useful, and there are hedging opportunities.” He certainly talked about price discovery and hedging, but remained silent on the investing label; that’s the piece that really matters.

Just when we thought Peterffy might hold the line, he decided to close with:

I think that for serious and analytical investors, prediction markets will be a very very important outlet.

And the lines blur further.

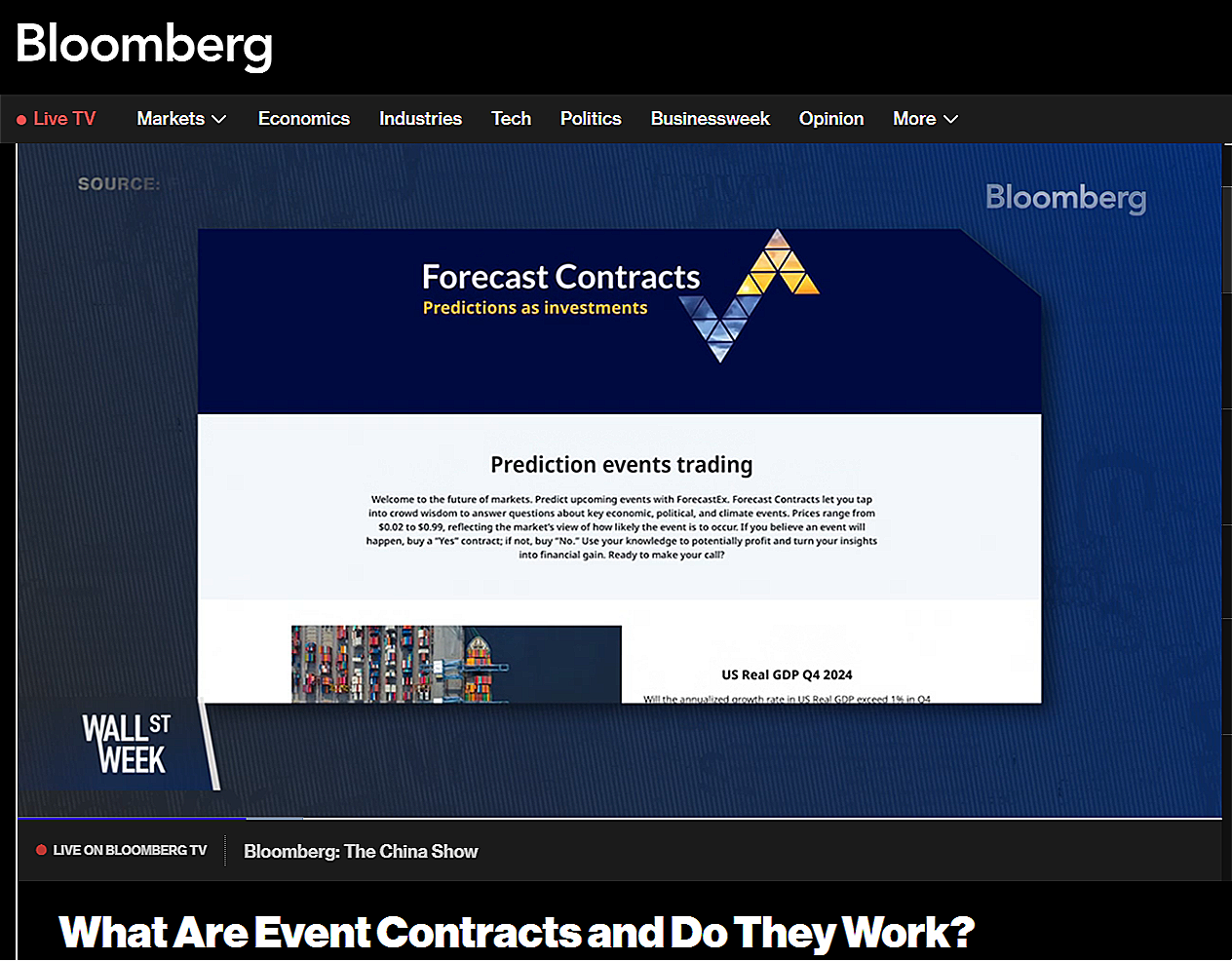

We dug deeper. It doesn’t look like Peterffy plans to distance himself from the “prediction markets as investing” narrative. Quite the contrary. See the snapshot below from Bloomberg’s What Are Event Contracts and Do They Work?

The Markets homepage has changed–we couldn’t find “predictions as investments” on the current version. For a moment, we were hopeful. Maybe Interactive Brokers doesn’t want to be on record saying prediction markets are investing tools.

Scroll a bit further, and hope fades:

Trade the future with ForecastEx’s game-changing Forecast Contracts. Predict economic & climate events, earn from accurate calls by answering “Yes” or “No.” It’s more than trading – it’s a long-term investment strategy, as there’s an opportunity to earn interest even when your prediction isn’t correct. (emphasis added)

So it’s investing not because of the contingency exposure, but because your open position pays interest? Like a money market fund? Interactive Brokers explains: It pays 50 basis points below the fed funds rate. In theory, that could be an investment. Maybe there’s still some hope?

Or, maybe not. Let’s take a look at their About page:

ForecastEx offers a new investment instrument that harnesses the power of crowd-wisdom. Forecast Contracts provide investors with a straightforward way to trade their predictions on economic, political, and climate outcomes, to either hedge against market uncertainty, or profit from their insights. The contracts are simply yes or no answers to questions about future events. Learn more about the contracts on the Forecast Contracts Work page. (emphasis added)

A new investment instrument… And Peterffy’s direct quote sits right below:

Forecast Contracts allow investors to act on the most crucial issues shaping our future. These contracts give traders a direct line to market sentiment on the economy and politics, helping them manage risk or express views on political events. (emphasis added)

And one more:

The only fee charged by ForecastEx is one cent ($0.01) per contract or pair. The fee is included in the pricing, which makes it easy for the investors to know all the risks and costs upfront. There is no exchange, clearing, market data, brokerage, or any other fees. (emphasis added)

Yes, there are mentions of interest payments, but the “this is investing because we pay interest” argument feels incredibly tenuous. Do you really think the average user will make that connection? That’s a bridge too far. If that’s truly the position, the page could’ve been much more explicit.

Bankruptcy happens gradually, then suddenly. Industries–and even countries–are no different. If you want to understand how the lines between investing, speculating and gambling are being shattered, this is how the seeds are planted.

Fortune

You might say expecting clarity from an industry player who profits from ambiguity is asking too much. But what about reputable media outlets? Any hope there?

It doesn’t look promising. Take this Fortune article, which pits investing against gambling:

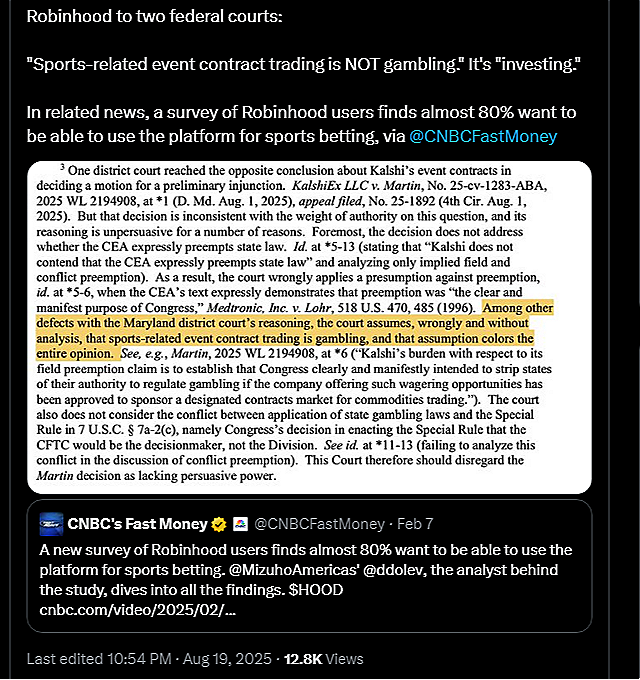

Are sports prediction markets betting or investing? Two new Robinhood lawsuits could define how they are regulated going forward.

What’s your first thought reading that headline? Ours was: Complaints have been filed and either the complaint and/or the associated memorandum takes the position that prediction markets are investing–not gambling.

The first part is true and easily verifiable-complaints have been filed. The second? Also verifiable–these documents are public. But, we reviewed them (for both cases) and guess what? Our expectation was wrong. The actual complaint doesn’t even talk about investing, except in passing when describing Robinhood generally. The memorandum doesn’t either.

Strange, isn’t it? A senior journalist at a respectable magazine puts out a misleading headline. You can chalk it up to clickbait. But the words ‘prediction markets,’ ‘betting,’ ‘Robinhood’ and ‘lawsuits’ already make a strong headline; nothing else is needed.

Dan Wallach broke the lawsuit out on X, and he, too appears to have been lulled into using the word “investing”:

It’s unclear whether the Fortune author saw Wallach’s post and echoed it in the headline, or whether these were two separate events that happened to converge. Either way, the message is clear: Prediction markets are flirting with investing.

Final Thoughts

What we’re witnessing is the 21st-century version of subliminal advertising in finance. The word “investment” floats around like a ghost–mentioned in the same breath as prediction markets, popping up on websites, disappearing, then reappearing in some other form.

Prediction markets are moving fast! When we started drafting this post last week, we wrote: “Seems like nobody is quite ready to take the position that prediction markets are investments just yet, but…” That’s already outdated. a16z, for one, is ready. Interactive Brokers is nearly there. And when a leading VC firm takes that position, and a major brokerage is about to fully embrace it, it’s not hard to guess what comes next:

All the lines between speculation and hedging or gambling and investing are going away.

But let’s remember: Investing, by definition, means disagreeing with the crowd. When everybody else bets, we’ll invest. We’ll invest in ourselves–and in the future of the country.

The idea of national sports gambling becoming mainstream feels overpriced, especially when only seven percent of America thinks it’s a good thing. We’ll short it. We see at least three pathways for price to converge to value: The judiciary, Congress and AI.

We’re happy to be David against the sports gambling Goliath. It’s a fight worth engaging in.

We must succeed.