The Speculative Investing Fallacy

Part IV (Finale) - The qualifier that doesn’t save crypto

Many think one can invest in Bitcoin. It’s not only the people that are regarded as bullish on crypto, such as Michael Saylor, Ric Edelman, or Niall Ferguson. Mistakenly, it’s also the Bitcoin critics: Elizabeth Warren, Christine Lagarde, and Bill Gates.

Both of these groups are wrong. One cannot invest in crypto.

There is a third group that takes a slightly different position. They still call it investing, but put the word “speculative” in front. Some examples:

Charles Schwab

Schwab, of course, is one of the largest financial services firms and recently published this article which contains a line that reads:

We suggest clients approach cryptocurrency as a speculative investment outside traditional asset allocation models and consider the high volatility and risks involved.

Financial Conduct Authority (UK)

The Financial Conduct Authority regulates the financial services industry in the U.K. They stated:

While not all cryptos are same, they all pose high risks and are speculative as an investment.

Wall Street Journal

One Wall Street Journal article concluded:

Bitcoin is a highly volatile, almost completely speculative investment.

Brookings/New York Times

In the op-ed titled Bitcoin: The Brutal Truths Revealed (originally published by The New York Times), included a snippet that reads:

While Bitcoin has failed in its stated objectives, it has become a speculative investment.

The tone of all these articles is quite clear. This is not how Michael Saylor or Cathie Wood speak. Rather, these are the words of good-intentioned, concerned voices, trying to warn the public.

Their intentions may be good, but they are still misunderstood and here is why: Adding the word “speculative” in front of “investing” means something in the universe of cash flow generating assets, but means nothing for crypto. The qualifier still implies that one can invest in crypto at some price point. As a result, at best, the warnings fall on deaf ears, or worse, they make the mistaken argument of crypto as an investment even stronger.

The real issue, of course, is the cavalier usage of the word investment. Has everyone forgotten its true meaning? It’s time to get back on track.

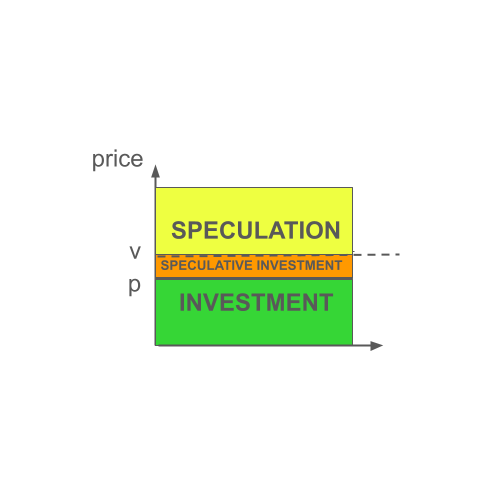

Remember, investing is all about valuing something, comparing the price to the value, and buying it if the gap between the two (with price being less than value of course) is enough to make you feel safe:

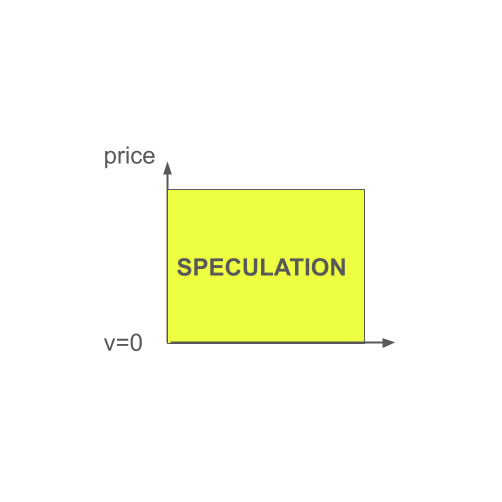

But what if the intrinsic value is zero? Then the trade looks like this:

Two things are true here:

There is no investment zone.

There is also no speculative investment zone.

The investment characterization is not automatic when price is less than intrinsic value. That’s a necessary condition, but is not sufficient. The price must also be sufficiently below intrinsic value, meaning there needs to be a large enough gap between price and value that makes the trade feel safe. All of that works with (most) stocks, but what if the intrinsic value is zero as is the case with crypto? There is nothing below it! There is literally not a single price point which turns a crypto trade into an investment. It’s speculative at any price.

Speculative investing happens where price is less than intrinsic value, but still too close to intrinsic value for comfort. Again, when the intrinsic value is zero, there is nothing below it! There is literally not a single price point which turns a crypto trade into a speculative investment.

Does this look simple? In fact, maybe even too simple? The truth is often not that complicated, and financial truths are no exception. The truth has some good habits; it holds together very well and it can be explained in a few words or in a couple of simple images.

Why, then, is nobody talking about this? Please realize that there are many forces, which, willingly or otherwise, muddy the waters. Some say there is no such thing as intrinsic value. Seasoned investors confuse investing with making money. Renowned VCs tell a tech narrative that appeals to many, but especially to a young, tech savvy generation. It looks something like this: Buffett does not understand technology. Whatever he says on Bitcoin, just ignore it.

Let us elaborate on that last point, because we feel it is important. We can’t shake the feeling that this rather common stance is often opportunistic. The fact that Buffett is saying that Bitcoin is not an investment is an inconvenient truth for many, and so it must be dismissed. How can one dismiss the most successful investor of modern times though? Bringing up Buffett’s age is certainly convenient, but one must try harder to make it stick. The path of least resistance seems to be turning it into a technology story. Buffett readily admits that tech is not within his circle of competence. Mix the two, add a little bit of bravado, and voila! You just created a shallow narrative that easily finds an audience; often young and/or tech savvy, who willingly eat it up. Nevermind the fact that the narrative crumbles under even a moderate dose of logic: Buffett is not offering commentary on blockchain technology. He solely cares about Bitcoin’s perception as an investment tool, a subject that he is certainly qualified to comment on.

At the end of the day, it all boils down to the simple fact that there is no consensus on investing. One can even say that where we find ourselves today is worse than that; that a consensus is building, and it is this idea that, when you trade anything, investing and making money are the same thing.

This is as dangerous as it gets. So, let us be very clear on a fundamental financial truth:

Investing ≠ Making Money

We are not saying that you can’t get rich buying crypto. You might. Your road to riches can happen as a result of you correctly timing the demand outpacing the supply and getting in and out at the right time. Alternatively, you may simply get lucky.

All we are saying is that if you want to buy Bitcoin, understand that you are not investing. You are simply speculating and that is true no matter what the price of Bitcoin may be. The same argument applies to any other crypto that does not produce cash flows. You can’t invest in these things.

The moment you realize that investing and making money are not the same thing, you become Spiderman. You start to see exactly where the media, experts, regulators, etc. have gone wrong. We can produce many examples, but let’s bring back the Brookings/New York Times article we cited above. This paragraph perfectly illustrates our point about being cavalier with the word investing:

While Bitcoin has failed in its stated objectives, it has become a speculative investment. This is puzzling. It has no intrinsic value and is not backed by anything. Bitcoin devotees will tell you that, like gold, its value comes from its scarcity—Bitcoin’s computer algorithm mandates a fixed cap of 21 million digital coins (nearly 19 million have been created so far). But scarcity by itself can hardly be a source of value. Bitcoin investors seem to be relying on the greater fool theory—all you need to profit from an investment is to find someone willing to buy the asset at an even higher price.

This one paragraph is like a microcosm of where the finance train has derailed. This author is far from a Bitcoin maxi, nor is he under the false impression that intrinsic value is a hoax. He is absolutely correct that scarcity itself is necessarily a source of value. How much would you be willing to pay for a blind horse? They are pretty scarce, too.

Rather, where the author fails is that he does not realize that the greater fool theory does not apply to investments. When you are investing, you don’t need anybody else bailing you out at a higher price. You can hold the asset for a long time (or even forever) and simply enjoy what the asset produces, much like an apple tree. It's not that you can't sell the asset to someone else at a higher price, sometimes even without seeing any cash flow—you can. The point is, you don't have to.

Hopefully these words of ours are helpful to you. At the end of the day, though, that’s exactly what they are, words. We need more than words. What's really needed are impactful images that tell the story in different ways and make everything digestible. This is exactly why we decided to write our first book that will feature many slick graphics: Court of Finance.

This wraps up our four-part series titled The Speculative Investing Fallacy and we hope you enjoyed it. Tomorrow, we will start commenting on a piece written by one of the brightest finance writers of our times. Much to our dismay, even he fails to appreciate that investing and making money are not the same thing.