The World Reacts to Katie Martin’s Michael Saylor/Bitcoin Documentary

And it’s not very flattering

Katie Martin is absolutely being slaughtered on the internet.

Who is Katie Martin? She is columnist and member of the editorial board at Financial Times. Yesterday, they released the documentary titled Michael Saylor's $40bn bitcoin bet:

Making herself vulnerable, Katie motivates the documentary by providing an immediate hook:

The FT does this kind of lighthearted thing every year where we have a stock-picking competition. And, in my list of shorts, I put Microstrategy. And I got annihilated.

Then she turns to Michael Saylor, whom she interviewed for this documentary, and asks him:

What I want to do is understand what it is that I am missing here.

In today’s post, we’ll tell you what Katie is missing.

Eye for Eye, Tooth for Tooth

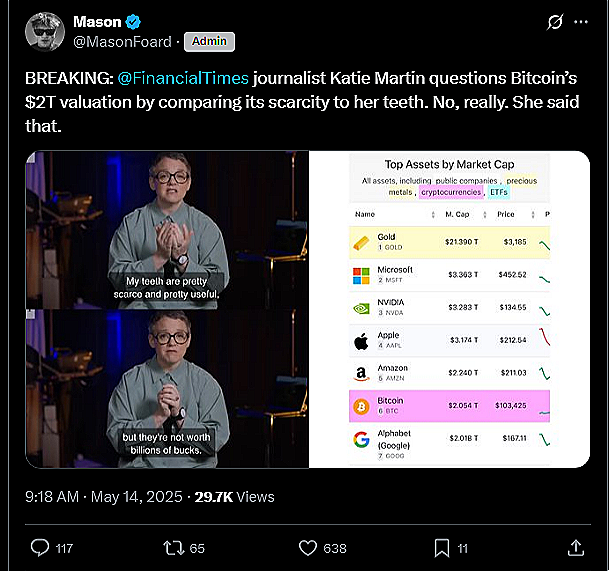

One sound bite that received outsized engagement within the X community was her teeth analogy, which turned Katie Martin into an instant meme:

Was it justified? Let’s take a look.

The logic class I took in tenth grade was a revelation for me. I loved how premises turned into conclusions, like the following argument:

All men are mortal.

Socrates is a man.

Therefore, Socrates is mortal.

Perfectly sensible. Then, in another class when I was a high school senior, I heard a version that was quite … different.

Rare things are valuable.

Blind horses are rare.

Therefore, blind horses are valuable.

I have never heard of a blind horse that was valuable, so that conclusion was puzzling. To be clear, the conclusion was perfectly valid; it did logically follow from the first two premises! At the same time, the conclusion is quite demonstrably wrong. What was going on here?

The problem was the premise itself. More specifically, the first one. It is true that some rare things are valuable. It is not true that all rare things are valuable. If the first premise used the correct qualifier “some,” then we wouldn’t end up with the wrong conclusion.

Let’s see how this works if we replace blind horses with Bitcoin:

Rare things are valuable.

Bitcoin is rare.

Therefore, Bitcoin is valuable.

Unlike blind horses, is Bitcoin actually valuable? Sure, it is trading over $100,000 as we speak. Looking at it through that lens, we got the correct conclusion this time.

Therein lies the exact problem. The Wikipedia page on False Premise explains this issue quite well:

Another feature of an argument based on false premises that can bedevil critics, is that its conclusion can in fact be true.

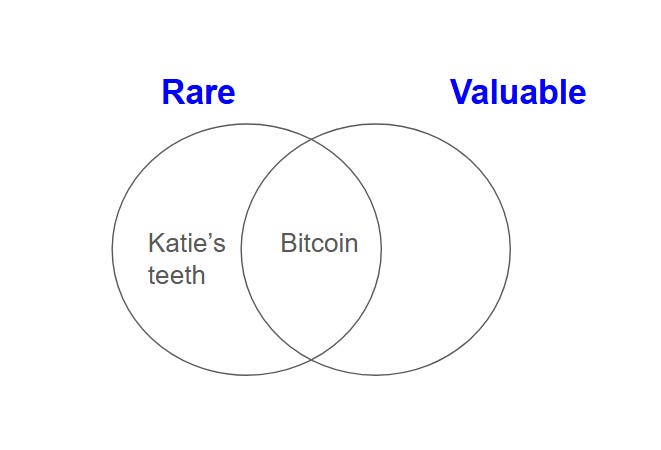

If some rare things are valuable, it means some others are not. These are mutually exclusive sets.

Pick a thing from the rare and valuable set (i.e., from the intersection of the two sets illustrated above) as your second premise (e.g., a painting by a famous artist, Bitcoin, etc.) and you get a correct conclusion. Pick something that is rare but not valuable such as blind horses or Katie’s teeth, and you wind up with the wrong conclusion.

This is an FT documentary, not a logic class. It is not Katie’s job to go through these things in detail. She is catering to a smart audience, is it really too much to expect a genuine effort to understand what she is trying to say, rather than discrediting her?

Katie clearly ruffled some crypto bros’ feathers. Presumably because what they are hearing is a challenge to the value of the Bitcoin, which, in their minds, is clearly refutable.

I am pretty certain that Katie is not saying that Bitcoin does not have value. What she is saying is that whatever value Bitcoin has, is not a result of Bitcoin being rare. She’s not disagreeing with the conclusion. She’s questioning the causation. Sure, the fixed supply does contribute to the narrative and attracts willing buyers, but rarity is simply not a quality that turns everything it touches into something valuable.

What makes Bitcoin valuable is a much bigger issue than a logical fallacy. It’s the incorrect premise that one can invest in Bitcoin. And that, in our opinion, was Katie’s biggest miss. Maybe the better way to describe it would be to call the documentary a missed opportunity.

The Main Miss - Bitcoin Is Not An Investment

Let’s get this out of the way, because it is super important:

Far from a trivial distinction, what seems like a paradox holds the keys to understanding why Bitcoin is not an investment.

Create a market for anything and the supply and demand mechanics will dictate the price. If demand exceeds supply, the price will increase. Any asset you can sell for a nonzero price has value, saying it doesn’t just doesn’t jive with common sense.

Valuing a financial asset is a very different exercise. Remember how Damodaran described it:

We buy most assets because we expect them to generate cash flows for us in the future. In [Discounted Cash Flow] valuation, we begin with a simple proposition. The value of an asset is not what someone perceives it to be worth, but rather it is a function of the expected cash flows on that asset.

What Damodaran means here by value is intrinsic value, which is a function of cash flows. Don’t believe everything you read on the internet. Intrinsic value may be hard to calculate, so people will come up with different value estimates. That doesn’t mean it doesn’t exist. After all, if ten people were to guess my weight, chances are none of them will get it right, and their estimates will differ from each other. That doesn’t mean I am weightless and can float!

Bitcoin doesn’t provide cash flows, so one cannot value it. Considering that investing is the act of estimating value, comparing price to value, and buying if the price is cheap enough, here is the logical result:

Did Katie say that one can invest in Bitcoin? We watched the documentary twice, and no, she does not say that. She does use the word “investor” a few times, but watching the whole thing holistically, we believe it is reasonable to assume that she is referring to the investors of Strategy, and not Bitcoin.

What she actually said was that Bitcoin is a “speculative bet.”

Well, we don’t think “bet” is the right word. “Trade” would have been a better choice. What about “speculative?” She absolutely nailed it with that one.

She wasn’t the only one either. Ilan Solot, Senior Global Markets Strategist at Marex Solutions called it “unquestionably a speculative asset.”

However, this characterization did not sit well with the crypto bros, either.

Bitcoin, unquestionably, is a speculative asset, and yes, it is absolutely correct to say that no one knows what is going to happen. How could anyone? The annals of finance are full of people who expected certain outcomes, only to become grossly disappointed. Nothing is certain except death and taxes.

You might say, well, ok, but even if we agree with you, why are you picking on Katie? She never said one can invest in Bitcoin. She correctly called it speculative. What could she have done better?

The problem was that the message wasn’t tight enough. She also did not differentiate between the possibility to invest in Strategy, the company, and the impossibility of investing in Bitcoin, the cryptocurrency. The documentary will get clicks, but we doubt that it will persuade.

One Can Invest in Strategy. One Cannot Invest in Bitcoin.

Period. Full stop. This is the level of clarity that is needed.

She should have said something along the lines of “Look, Strategy is a company. It’s true that effectively it is a Bitcoin treasury company and the company’s prospects do depend on Bitcoin’s price, but ultimately a share in Strategy represents claims on cash flows to the company. Whether they come from price appreciation of Bitcoin, financial engineering or both, it is something you can build into your valuation model, using appropriate risk assessments. Bitcoin, on the other hand, is purely speculative. You cannot be an investor in Bitcoin, period. If you want to be a speculator, fine, you have the right to do that. We won’t judge, it’s your choice. The simple fact is that you just need to know that you are not investing.”

That should have been the message.

Not that this messaging will persuade everyone, either. It won’t because in today’s world most people think that anything that makes them money can be an investment. That is not the case. Investing is not about making the shot, it’s about taking the right shot. It’s unfathomable for many to voluntarily skip out on what might be a huge money making opportunity (FOMO/YOLO mentality). What that mindset does not appreciate is that there is a pretty large group of people who are just not interested in making money when the risk profile is not favorable. They don’t want to go to the moon as soon as possible. They want to preserve what they have. They are looking for safety, and Bitcoin (or any non-cash-flow-generating asset for that matter) can’t give them that, because safety only comes from being able to value the asset.

Maybe this analogy will help: If you and I both work in the same office and live in the same community 60 miles away, we have choices when it comes to our evening commute. Perhaps for you, going home as fast as possible is the most important thing, risks be damned. I want to go home as fast as possible, too, but I don’t think it’s worth risking my life. So, you can drive at 120 miles per hour and get there in 30 minutes (for the sake of this example, let’s assume speed limits are pretty lax). I’ll stick with 60 miles per hour so it’ll take me an hour. Every single day, you will have 30 more minutes at home. You can even tell me to have fun driving slow (a play on “have fun staying poor”). Chances are though, you will blow up one day and it won’t be pretty. You are choosing speed, perhaps with the Lambo you bought from your Bitcoin profits, and I am choosing safety.

Notwithstanding the fact that speeding up can have an impact on others, there is nothing illegal with either choice (remember, we assumed the speed limits are lax). You are well aware of the risks and you are making a conscious choice. I am doing the same, I am just making a different choice.

The problem with Bitcoin, or crypto in general is that people are not aware of the risks. They do not know that they are speeding. How would they? Virtually nobody is telling them. One man who goes by the name Warren Buffett tried, but he is stepping away, so it’s not even clear what will happen to the concept of investing going forward.

This is where the education needs to happen. This has nothing to do with party affiliations, being old, or not understanding the technology, nor is it an attack on people’s freedoms. The goal is a singular one:

People can buy whatever they want, but they should know what they are buying.

That’s it. Getting there, however, requires being extremely clear about the fact that one cannot invest in Bitcoin. The documentary was good, but it was a missed opportunity in that regard.