What Does Investing Have To Do With Geometry?

Looking at the world through a different lens

So, we hope you feel that you know a little bit about us (NFI) by now. You know that we like writing about finance. You probably realized that we are a stickler for definitions. You might have noticed that we take a multi-disciplinary view and we think about not just financial definitions, but about the legal implications of financial definitions.

You might also be wondering who the primary author is writing all of these posts…

While I certainly appreciate that putting a name next to the pen would be helpful, I’m not ready to do that just yet. I need to wait until I transition into this full-time. That doesn’t mean I can not divulge some of my personal stories. So, as we enter a new month with F27, I’d like to do something different and talk about an experience that had an outsized influence on who I am.

I did my PhD in economics. My favorite class, though, was not an economics class; it was Hyperbolic Geometry.

I never heard of hyperbolic geometry until I took it, and I don’t think I’ve heard anything about it since. It was effectively a three-month detour from the world I have always known.

Hyperbolic geometry’s starting point is to relax the fifth postulate of Euclidean geometry, which is the geometry that almost all of us learn in school. The Fifth Postulate states, in simple terms: Parallel lines don’t intersect. People tried to prove it using the first four postulates and it didn’t work. Then, some sharp minds realized that instead of accepting it as a foundational axiom, you can let the fifth postulate go. Indeed, you relax that one thing and it feels like Alice in Wonderland; an entirely new world opens up. It’s a bit weird and fascinating at the same time. Rectangles cease to exist and the angles in a triangle become less than 180 degrees.

By the way, in case you are interested, this is the book that I learned from: Euclidean and Non-Euclidean Geometries: Development and History by Marvin Jay Greenberg. In my opinion, Chapter 8 alone is worth the price of admission if you like math, history and philosophy.

So, what does hyperbolic geometry have to do with investing? Three similarities:

SIMILARITY 1 - Change One Thing, Change Everything

When you relax the parallel postulate you enter a new universe. Until that point, I never realized that the geometric paradigm I learned was so fragile in the sense that you could change one thing and it turns your world upside down.

This newsletter, F27, is ultimately about a similar paradigm shift, and our sister newsletter, Full Court Press, is about presenting the legal implications of that similar paradigm shift. Just like hyperbolic geometry, we challenge one thing at a time, and see where that leads us. You already know that we are going after the definition of investment. More specifically, we disagree with the popular usage of the term investment, which has become more of any money-making opportunity. (if you don’t agree with us concluding that this is the popular definition, please read our June posts. Very few people cling to the narrow interpretation of investing as we do.) We are of the view that investing should be interpreted much more narrowly than how it is being used today. Once we do that, an entirely new universe opens up, one that will rock you to the core.

We strongly believe that once you look at the world through this alternative lens, it becomes much less blurry. Our objective is to make you feel like you are Tobey Maguire, waking up after that spider bite and realizing that you don’t need your old glasses anymore because your vision is fully restored. Both this newsletter and Full Court Press are intended to be that spider bite.

SIMILARITY 2 - Paradigm Shifts Can Be Intimidating Even If You Are the Prince

Called The Prince of Mathematics, Carl Friedrich Gauss was a prodigy who made significant contributions to many fields in math and science. Much of the hyperbolic geometry was developed by János Bolyai and Nikolai Lobachevsky, but Gauss himself made many discoveries. The problem? Gauss considered his findings to be controversial, so much so that he, despite all his might, was averse to publishing them. As Marvin Jay Greenberg states in Euclidean and Non-Euclidean Geometries: Development and History:

It is amazing that, despite his great reputation, Gauss was actually afraid to make public his discoveries in non-Euclidean geometry. He wrote to F.W. Bessel in 1829 that he feared “the howl from the Boeotians” if he were to publish his revolutionary discoveries. He told H.C. Schumacher that he had “a great antipathy against being drawn into any sort of polemic.” (footnote references omitted).

We suspect that the exact same theme is playing out now in finance, in a completely unrelated field and 200 years later. How? Well, this month, we’ll talk a lot about Ben Graham, the OG of investing; the undisputed GOAT. His book, Security Analysis (with David Dodd, first published in 1934), is still considered the Bible in finance, and The Intelligent Investor (first published in 1949), is a top five staple in economics and finance, 70+ years after it came out.

If Ben Graham is the king, Warren Buffett, his most famous protege, is arguably the prince. In fact, Buffett is both the beneficiary of Ben Graham’s insights (the fifth richest person in the world) and also the kingdom’s most influential flagbearer.

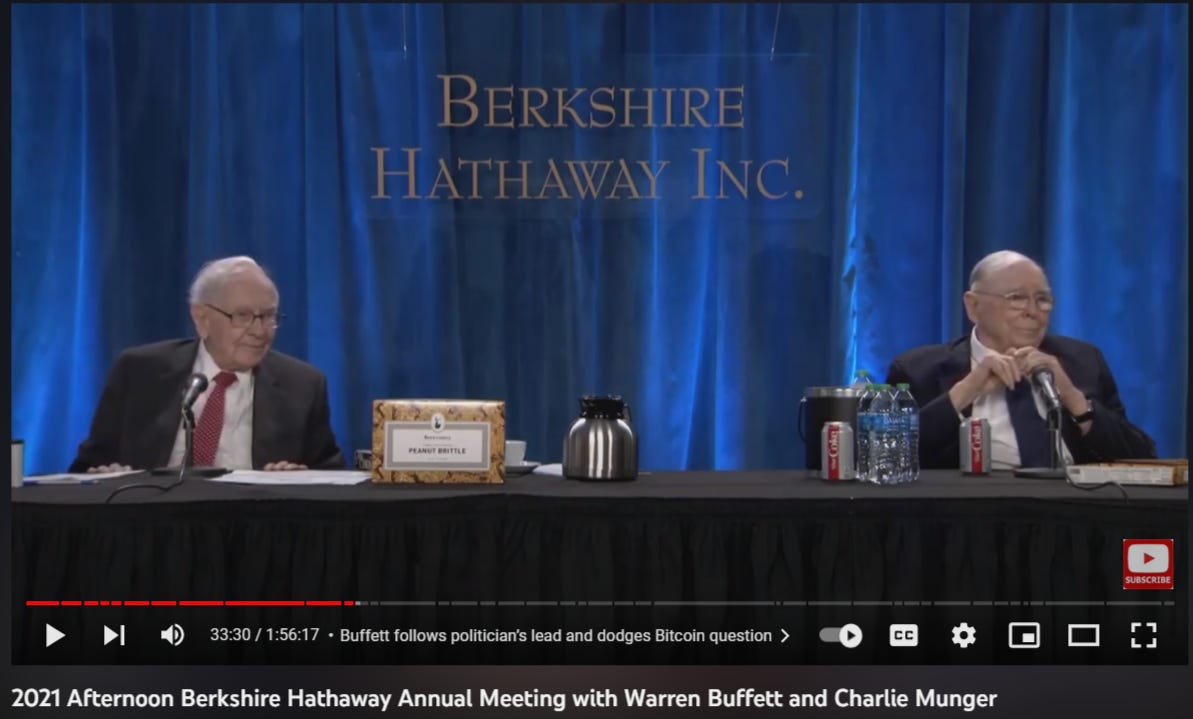

Now, Buffett is not one to pull any punches (and neither is Charlie Munger); he once called Bitcoin rat poison squared. That said, on at least one occasion, it seemed like Buffett, too, may have felt “the howl from the Boeotians:”

The point is not to criticize Buffett; maybe on this one day, he just didn’t feel like being too anti-crypto. The point is if the fifth richest man in the world, even if for just one day, feels that he needs to consider how the truth will be received, what chance does the average Joe have? “Speak your mind” is great in theory, but that’s seldom how it works in practice.

SIMILARITY 3 - Geometry and Finance Are Both About Definitions

This gem is from Chapter 8 of Euclidean and Non-Euclidean Geometries: Development and History, which grapples with the question, “What is the geometry of physical space?”

Here is the famous response of Poincaré to the question of which geometry is true:

If geometry were an experimental science, it would not be an exact science. It would be subjected to continual revision. … The geometrical axioms are therefore neither synthetic a priori intuitions nor experimental facts. They are conventions. Our choice among all possible conventions is guided by experimental facts; but it remains free, and is only limited by necessity of avoiding every contradiction, and thus it is that postulates may remain rigorously true even when the experimental laws which have determined their adoption are only approximate. In other words, the axioms of geometry (I do not speak of those of arithmetic) are only definitions in disguise. What then are we to think of the question: Is Euclidean Geometry true? It has no meaning. We might as well ask if the metric system is true and if the old weights and measures are false; if Cartesian coordinates are true and polar coordinates false. One geometry cannot be more true than another: it can only be more convenient. (removed emphasis by the book author and added ours)

The axioms of geometry are only definitions in disguise… You change an axiom, meaning definition, and you enter an entirely new universe. Similarly, you change the definition of the word, investing, and you enter an entirely new universe. This universe is so vastly different from the one most people think we are in, it gives us enough material to write about in two different blogs.

The reader might object that we are simply creating an alternative universe, but in fact, we are doing much more. It is true that there are commonalities between geometry and investing: the implications of changing one single thing, the intimidation factor, and the central role definitions play. That said, there are two very important differences:

DIFFERENCE 1 - Hyperbolic geometry was new. Our definition of investing is old.

Let us be self-critical here. Is our definition truly using a new lens?

Not exactly. When we call it new, it is new only in appearance. Do you know what the secret is? If most people are not aware of the old, repeating the old sounds like the new. Fun fact: we call ourselves the New Finance Institute, but in many ways, we are, in fact, old school. Paraphrasing Newton, if we see further than others, it’s because we stand on the shoulders of giants, and, in the world of investing, there is no bigger giant than Ben Graham. Much of what we explore around here traces back, one way or another, to Mr. Graham.

Thus, one critical difference emerges between our coverage of the word investing and geometry: Hyperbolic geometry was new. Our starting point is not so much new as much as it is forgotten. Or, rather, should we say, hijacked? Remember, people respond to incentives.

DIFFERENCE 2 - Hyperbolic geometry stands on equal footing with Euclidean geometry. Our definition of investing is the superior one.

We are aware this may sound arrogant, but we won’t make any apologies for concluding things based on years of thinking, searching, researching, and more thinking. If the objection is: “Who are you to tell me how to define investing? I define it this way,” our response would be: “Sure, alternative definitions are possible, but only if they are internally consistent.

Let’s hone in on Poincaré again.

Our choice among all possible conventions is guided by experimental facts; but it remains free, and is only limited by necessity of avoiding every contradiction… (emphasis added)

So, yes, we don’t take the position that our definition is superior to the alternative because it is ours. It is superior because we strongly believe it leads to a framework that avoids every contradiction. If you disagree, feel free to let us know what the contradictions are, so we may refine our views if warranted. If you cannot name any contradictions but still dislike our position, debating this is probably a pointless exercise for both sides. In that case, we likely won’t change your mind and you won’t change ours.

What happens with most people is that they generally wind up falling into one of these two categories:

Ignore the Contradictions

In our previous post, we said:

The other side, if you can call it that, is full of dead-ends and inconsistencies. Gold is a safe asset, says Nouriel Roubini, but not Bitcoin. Why not? What is the difference, other than gold having been around longer? Bitcoin is investing, says Ric Edelman, but Dogecoin is a scam. Why? Because Bitcoin has been around just a few years longer?

Thus, many very smart people, in our opinion, just refuse to go all the way. They diverge from the narrow definition of investing, but stop short of calling any money-making opportunity investing. Where is that line drawn? You have to ask them, but generally, it is some arbitrary level of adoption, or dare we say, popularity. Under this view, Bitcoin, Dogecoin, or anything really, could become an investment one day. We refuse to walk through that revolving door because there is just too much arbitrariness that can seriously harm the investing public.

Whoop - They Could Go All The Way (read this with Chris Berman in your ears if you like)

Well, there is an alternative: Anything can be an investment as long as there is an opportunity to make money. That view appears internally consistent at first glance but doesn’t hold up under scrutiny. When that view is evaluated holistically, it produces a result that is so implausible, it just doesn’t have the chance to stand on equal footing with the much narrower interpretation that we are advancing (again, standing on the shoulders of Ben Graham).

Here is the problem with that view. Expanding the definition of investing to cover everything under the sun, in the long run, can lead to nothing but disaster. In that world, investing and speculation become synonymous; in fact, you could really flush both of the words and their supposed definitions down the toilet and extract them from the dictionary for all of time. In that scenario, is there any reason why we would need both? In that world, stocks, bonds, gold, Bitcoin, Dogecoin, all coins, tulips, collectibles, art, wine, Beanie Babies and monkey jpegs all converge. You can buy low and sell high with any of these! When you don’t draw the line at the point of cash flows, the next stop is: There is no line.

The interesting question to ask is, why is society content with this? Generally, people like boundaries and respect them. Why do they exhibit a different attitude in the context of investing?

We have a theory. When the impact is tangible, when we can see it, taste it and smell it, etc., we have no problem rejecting such generalizations. However, if you try to sell me a coach ticket as business class, and it is clear that is false advertising. We all know what a business class seat looks like. It’s wider, more comfortable, the food is better, you can board the plane faster, etc. That is why it is more expensive and for some people, there is enough value that they will pay for it. For others, there isn’t, so they are content with coach seating. Neither choice is better than the other, it’s not about that. It’s about preferences and budget constraints. In other words, it boils down to Econ 101 with the key being that the consumer knows pretty much exactly what they are going to get when they buy something.

What about regular coffee vs. decaf? We’d like to think most coffee lovers will be able to distinguish between the two, and even if not, they would be upset if they wanted regular but somebody gave them decaf instead. Clearly, a barista cannot knowingly mislead the customer.

Surprise! You can’t sell inorganic food as organic either. There are labeling requirements after all and such deception could land you in jail.

As far as we know, most people are happy with these boundaries. It’s good to have options! Consumers just need to know what they are buying, compare the price against its utility, and then they can make a proper, informed choice.

So, why do these boundaries not work with investing? Why are people unwilling to accept them?

The answer could be that most people want to buy something (more money, lots of it), but don’t realize that the primary selling point of investing is not a lot of money (at least not in the short term), but safety. In fact, they want to have their cake and eat it too. People want to make as much money as possible, (hey, nothing wrong with that!), but they also want to feel safe. When enough people have that preference, a whole industry springs up around satisfying that insatiable desire and packaging it up in a fancy wrapper that gives you the appearance of feeling safe.

The million-dollar question, of course, is: Who is responsible for protecting investors, when many of them naively believe that they are investing when in fact they are speculating?