For America the Bell Tolls

From the crash of 1929 to crypto & prediction markets: The headwinds are stronger, foreshadowing a tougher century ahead

5 Key Takeaways

America’s trajectory: Despite market highs and regulator optimism, public sentiment remains fragile and pessimistic.

Lessons from 1929: Congress reacted late but ultimately gave the public the tools to distinguish investing from speculation.

Crypto regulation: The SEC cannot act as a merit regulator for cash-flow-generating assets, but it can, and should serve as a label regulator for non-cash-flow-generating assets.

Prediction markets: The gambling vs. gaming confusion sustained them; the investing vs. gambling narrative is the next hurdle. The responsible way out hinges on linguistic precision.

The next century may be tougher: Crypto + prediction markets = potential crisis. A 2029 crisis would be a 100-year irony but recovery may be more difficult this time.

Our nation is approaching its 250th anniversary. It has been a remarkable ride, but the question looms: Will U.S. dominance continue or fall by the wayside?

The mood is uneasy. Kyla Scanlon recently published Everyone is Gambling and No One is Happy, arguing that the “vibecession,” a phrase she coined in 2022, still persists. Economic pain is real, driven by cognitive overload and eroding trust. Even Kalshi made its way into her essay:

Kalshi’s co-CEO, Tarek Mansour, recently stated that the “the long term-vision is to financialize everything and create a tradable asset out of any difference in opinion.”

Financialize everything???? Every disagreement, every uncertainty, every future outcome - all of it becomes a betting line?? This is Marx’s commodity fetishism taken to its logical endpoint. It is difficult to have solidarity when every interaction is a transaction and every opinion is a tradable asset.

Scanlon is clearly not a Kalshi fan. We commented to remind her of the root cause that doubles as our thesis:

Almost every major disagreement in law and finance is rooted in these four words: Investing, Speculation, Gambling and Gaming.

The middle class feels the squeeze and the pessimism is real. Yet SEC Chair Paul Atkins struck a very different tone just a couple of weeks ago.

SEC Chair Paul Atkins Rings the Bell at the NYSE

He also delivered a speech titled Revitalizing America’s Markets at 250 (video of full speech, written remarks). In his speech, Atkins tied America’s success directly to investing:

Before the United States was a nation, it was an investment.

He reminded us why the securities laws were enacted:

Shortly before the Securities Act became law, President Franklin Roosevelt explained his vision for this seminal statute in a message to Congress. He rejected the idea that the federal government should be a merit regulator, which is the notion that the government approves an offering of securities as sound for public investment because it expects their value to increase. Instead, President Roosevelt sought to protect investors through a disclosure-based regulatory regime—the idea that companies offering securities to the public should provide all the important information about those securities.

That framework remains true. But how does it translate to the 21st century? Here we diverge sharply from the SEC. Their mission is to protect investors, but they are not taking a position on what “investing” means. That silence begs the question: How can you protect a group of people if you don’t define who is in the group in the first place?

If our thesis is correct, the next 250 years may not resemble the first. Most Americans are being set up to lose.

Lessons from 1929

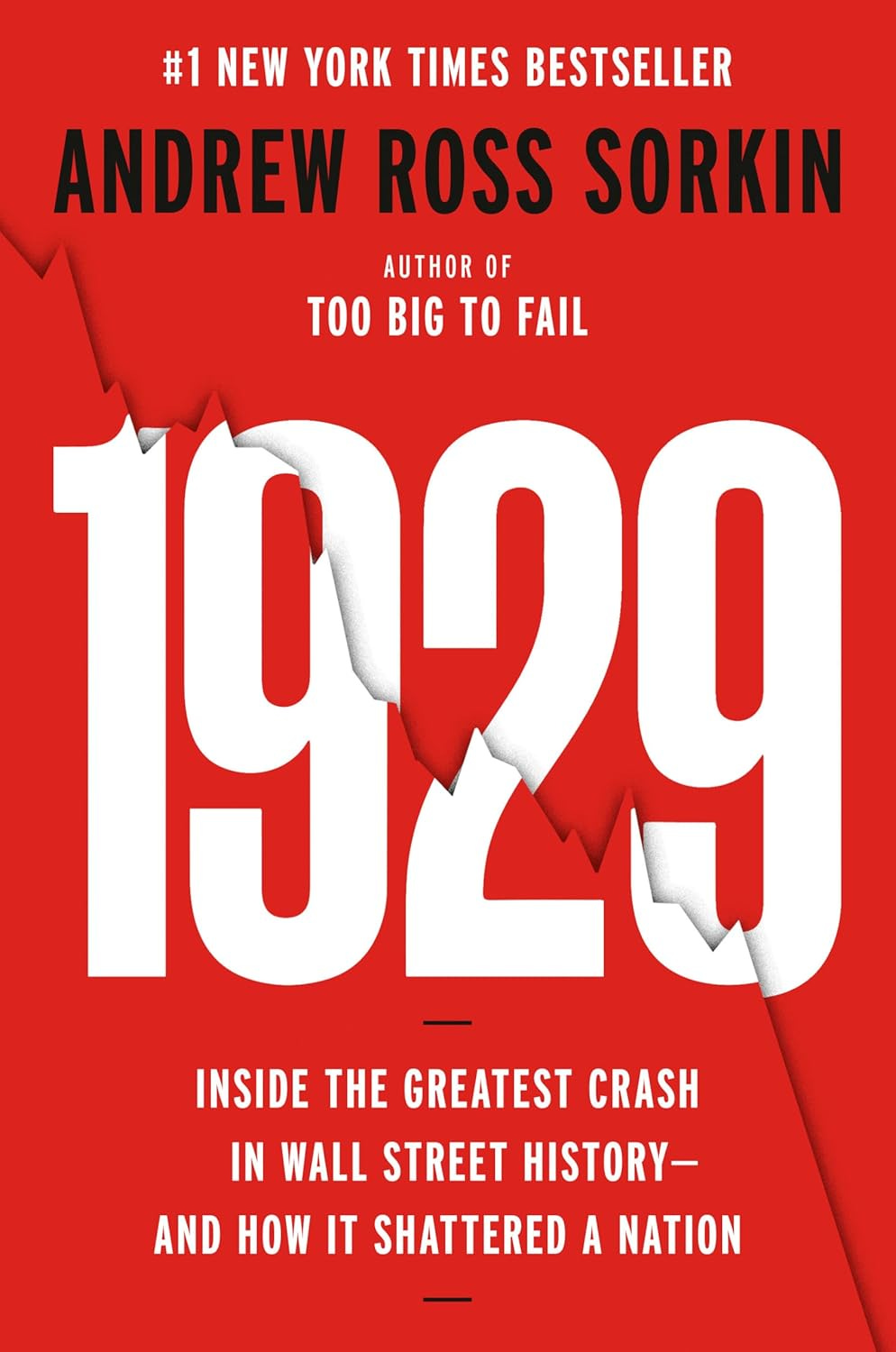

Andrew Ross Sorkin’s new book 1929: Inside the Greatest Crash in Wall Street History--and How It Shattered a Nation revisits the era. His Too Big Too Fail was excellent, and this promises to be another landmark:

Sorkin is now on Substack, too! And his welcome message was heavily commented on, including this commenter who captured the urgency:

This commenter is absolutely on the right track, but allow us to reframe.

Crypto + Prediction Markets = The Next Crisis

This two-headed creature shares one body. When historians look back on 1929 and the next crisis in tandem, they will identify the exact same root cause for both: Lack of sunlight.

1929: Lack of Disclosures → Investing and Speculation Blur → The Great Depression

Investing requires cash flows; without transparency on cash flows and associated risks, valuation becomes tricky and speculation masquerades as investing.

Congress eventually identified the problem, enacted disclosure laws and stepped aside.

The point was not to prevent manias, but to give investors the information needed to properly distinguish between investing and speculation. As former SEC Chair Jay Clayton noted: “We don’t regulate… euphoria.”

The Crux: Better Late Than Never. Congress was reactive, not proactive. Ultimately, they gave the public a fighting chance to separate investing from speculation.

2008: Crypto Arrives → Speculation Becomes Investing → Crisis Brewing?

2008 - Satoshi Nakamoto publishes the Bitcoin white paper (PDF).

Satoshi avoided pitching Bitcoin as an investment, but the public still embraced it as one.

The SEC, tasked with protecting investors, failed to let the sun shine on crypto.

Their finance stance on Bitcoin is flawed, preventing them from making the best argument to support their legal position. They argued Bitcoin was an investment, but not an investment contract. It’s the other way around: It’s not an investment, but an investment contract.

Litigation followed (for some of the other coins)–some wins, some losses. Eventually many crypto cases were dismissed when Trump returned to office.

In the SEC’s eyes, Bitcoin was never a security. According to Atkins, most crypto tokens are not, either.

This disconnect makes a crisis inevitable. Prediction markets only compound the risk. Kalshi even went on-chain recently to offer speculators tokenized prediction markets. A double whammy.

The Crux: The SEC misses the nuance. It cannot be a merit regulator for cash-flow-generating assets, but it can, and should be, a label regulator for assets without cash flows.

2024: Prediction Markets Arrive → Gambling Becomes Trading, Sometimes Even Investing → Potential Crisis Compounds

For over 100 years, U.S. policy held firm: Futures markets are for legitimate trading, not gambling.

The first crack appeared in 2000, when the CFMA repealed the economic purpose test.

The CFTC informally upheld it–until 2024, when they decided to disclaim the authority they have on event contracts on all contingent events, and turned the case into a definitional dispute.

Kalshi seized the opening: Sports event contracts = gaming, election contracts ≠ gaming.

It worked. Now, Kalshi eyes the even bigger prize–nationalized sports gambling. So now, sports event contracts ≠ gaming, either.

The Crux: Linguistic precision remains critical. Gambling vs. gaming confusion sustained prediction markets. The next narrative, investing vs. gambling, could define their survival. It’s a trap (podcast), but the ambiguity is good news for prediction markets who slid into investing DMs.

When Will the Next Crisis Hit?

It’s a matter of when, not if. Nobody knows the timing and predicting it is a fool’s game. Still, 2029 would be quite the 100-year irony:

If the finance gods have a sense of humor, 2029 might be the year. Great Depression Reloaded–exactly one century later.

The deeper concern is that America is being duped and may find it even more difficult to bounce back this time. The headwinds are everywhere:

→ Gains from technological progress and education may not repeat;

→ The economy is arguably more fragile and hyper-connected;

→ Financial literacy is low, confusion is high, and linguistic precision remains at a premium;

→ Regulators are failing the public on crypto and prediction markets;

→ 24/7 trading and “modernization” of disclosure rules risk erasing hard-won protections;

→ Gambling is more prevalent than ever;

→ The national debt has reached catastrophic levels;

→ All three ratings agencies have downgraded the U.S. sovereign credit rating, increasing the possibility of default;

→ Mental health challenges are rising;

→ Reverse brain drain may begin, especially into China;

→ China is investing in AI the right way; and

→ Social safety nets have largely eroded.

A perfect storm? Challenges for America means opportunities for others. China, in particular, is attracting their talent back to the homeland and continues to make progress in core infrastructure for AI, the new foundation of future power. If the stars align, they may eclipse America.

We are as invested in this country as anyone. We genuinely hope we are wrong. But what if we are right?

Bottom line: If we are right, most everybody loses, most everybody in America at least. It will be painful to watch people suddenly realize that this was all preventable, just as our nation’s previous crises were.