How Language Fails Us in 7 Steps - Crypto Edition

Illuminating the hidden road that starts with value investing and ends with crypto exuberance

Key Takeaways

The phrase “value investing” unintentionally creates the illusion that multiple types of investing exist.

This linguistic flaw leads the public to treat non‑cash‑flow assets—including crypto—as legitimate investments.

Regulators inherit the same flawed categories, producing inconsistent treatment of crypto assets.

Crypto can be speculation and still be an investment contract—the two concepts are not mutually exclusive.

The result is a public that receives neither clarity nor protection, all because a single word—value—fractured the definition of investing.

The crypto boom is not a financial mystery; it is a linguistic inevitability created by decades of mislabeling.

As many others do over the holidays, we took a short respite to be with friends and family and we hope that you had some time to do the same. Now that we are fully recharged and back to work, let’s pick up where we left off. 2026 will be instrumental, we know it.

Our last post before the break was The Value Investing Myth, a seven-step conceptual framework designed to be evergreen. But theory comes alive through application, so without further ado, here is the crypto edition. Using the exact same framework, we will illuminate the hidden road that begins with value investing and ends with crypto exuberance.

If you want to understand how myths take hold, read on.

Step 1 - “Value investing” becomes a type of investing

A definitional fallacy.

On December 18, 2025, Seth Klarman (the billionaire hedge fund manager who runs Baupost) published a piece on Warren Buffett in The Atlantic (paywall). Andrew Ross Sorkin praised it:

It’s certainly a worthwhile piece. Last year, we ran the numbers to truly appreciate what Buffett has done - this simple comparison says it all:

$100 invested in Berkshire Hathaway in 1964 → $5.5 million

$100 in the S&P 500 → a Toyota Corolla

$100 in gold → a 12-year-old Mazda1

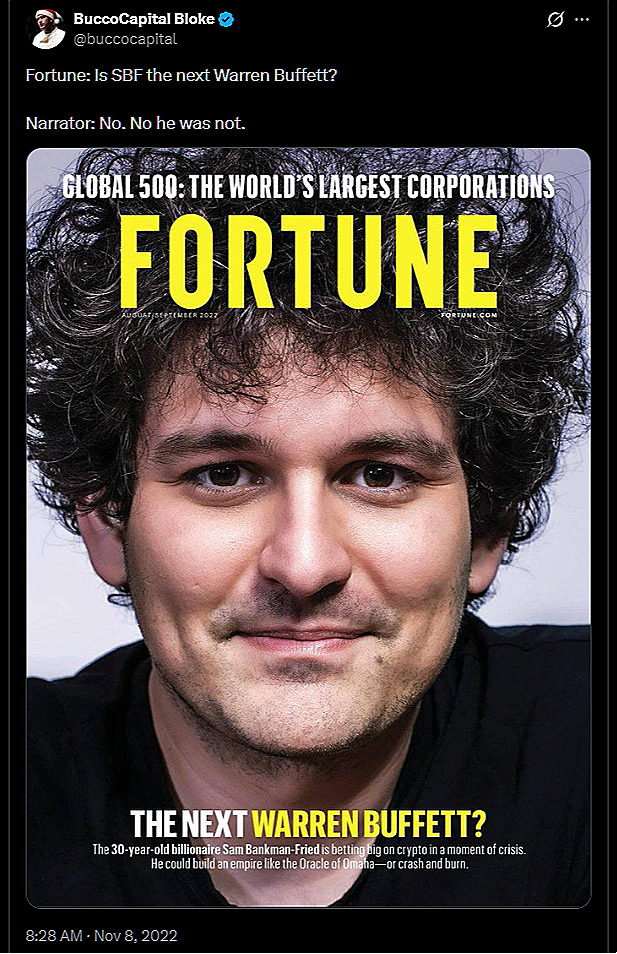

The math is undeniable: Comfortable retirement vs. brand new car vs. used car. Buffett is the Tom Brady of investing. Naturally, the world is searching for the heir apparent, often in the wrong places:

As the saying goes: “This cover didn’t age well.”

Business magazines are no longer trusted for separating true kings from flings; we call it the Forbes effect.

The problem isn’t a particular crypto entrepreneur gone astray. The deeper issue is people trying to apply Buffet’s framework to crypto. Here’s a real example from Reddit:

I am going to attempt to parallel it to mid to long term crypto investment. (emphasis added).

Reddit is the top source for LLMs, almost twice as much usage as Google and nearly 7x as LinkedIn. If you put “value investing” into your chatbox, it will find these sources, regurgitate the falsehoods and repackage it, trying to convince you that applying Buffett’s concepts to crypto is rational.

Klarman doesn’t believe crypto is an investment. What he doesn’t realize is that a critical flaw in his own terminology is precisely what fuels crypto exuberance.

Step 2 - The public infers new categories of investing

A rational—and predictable—consequence.

When ARS praised Klarman’s piece, we had to weigh in:

The issue is subtle, but simple.

When you use qualifiers, the human brain infers the existence of alternatives.

“Tall kids” → implies short kids.

“Hot girls” → implies not-so-hot girls; and

“Fast horses” → implies slow horses.

All of these inferences are perfectly rational. Adjectives create subsets.

“Value investing,” is a little trickier because, while technically not an adjective, the word “value” functions as one. It partitions the investing universe.

“Value Investing” → implies other types of investing.

If you are into geometry, here is another way to think about this issue. We also created a quick video to illustrate it:

Step 3 - New instruments are interpreted as investing

Conceptual categories applied to practice.

Once you create a category called “value investing,” it’s only logical to then fill the space that is created.

First, it was growth investing.

Then it was momentum investing.

Then gold, art and collectibles.

And finally, the new shiny toy–crypto.

Klarman looks at the entire landscape and objects:

…these items generate no present or future cash flows… they should be regarded as speculations, not investments.

But the public is reacting rationally to the categories he’s objecting to.

If the titans of finance–David Einhorn to Seth Klarman, from Howard Marks to Joel Greenblatt embrace this concept of “value investing,” then logically they must subscribe to the belief that there are alternative types of investing. That linguistic slip created the empty space that crypto later filled. It wasn’t the first tool that did so, but it was the most aggressive invader.

Here’s the real problem: Even when regulators tried to be skeptical, they still adopted the same flawed terminology. In 2023, the SEC urged “caution about crypto investing,” but by using the word investing at all, they reinforced the very misconception they were trying to warn against. The caution wasn’t the issue. The misdefinition was. By accepting the premise that crypto belongs in the investing universe, the SEC unintentionally validated the myth. The result is the public being floated an “acceptable” fallacy. Our stance around labeling is still sorely needed: Crypto is not an investment.

Step 4 - …but some of these instruments are not investment contracts

Regulatory posture.

Finance question:

Is crypto investing?

Legal question:

Is crypto an investment contract?

The legal question determines whether protection applies.

Under Chair Gensler:

Everything else → “maybe”

Under Chair Atkins:

Bitcoin’s privilege extended to memecoins; and

Then to the entire industry.

The SEC’s stance evolved the same way Samantha Jones (Sex and the City) described Jerry Smith’s career progression.

The “not-a-security” ladder now looks like this:

Bitcoin

Memecoins

The industry

Step 5 - The opposite is true: Non-cash-flow-generating assets are not investing

Our position.

A simple four-step chain of reasoning:

No cash flows → No intrinsic value

BITCOIN has no cash flows → BITCOIN has no intrinsic value

No intrinsic value → Not investing

BITCOIN has no intrinsic value → BITCOIN is not investing

If you revisit the 1920s and 1930s, you wouldn’t be able to convince anyone that one could invest in Bitcoin. Even stocks were in the doghouse back then.

So what changed?

“Value investing” took hold.

It ended up overriding the factory settings of investing, reducing it to a style and muddied the waters.

By branding themselves so heavily as “value investors,” they inadvertently implied the existence of other, equally valid types of investing–growth, momentum and eventually crypto.

Step 6 - …but some may still be investment contracts

Also our position.

Can something that is not an investment, still be an investment contract? (i.e. some crypto)

Yes.

The term “investment contract” exists to protect the public–especially when buyers don’t understand what they’re buying.

Does the Howey test matter?

Absolutely. Investment contracts flow through it.Is there an alternative reading of Howey that preserves case law and still classifies most tokens as securities?

Yes. More on this soon. Stay tuned to our Full Court Press newsletter on Substack.

Step 7 - The public receives neither clarity nor protection

The inevitable result.

Klarman has done well for himself. He calls investing “value investing.” Why should we care?

His fallacy doesn’t necessarily hurt him. He doesn’t operate in the same space he helped create. Since cash flows are meant to accrue to the investor sooner or later, without the need for a buyer, the patient investor who doesn’t have any capital constraints will not suffer as much from the fallacy.

But almost everyone else operates in that space. Some may end up making money. Others won’t. Either way, they are not investing and worse, they are not aware of that.

If this generation openly said: “We’re screwed, the American dream is dead, so we’re going to speculate,” that would be one thing. Financial nihilism can still be a rational choice.

But financial nihilism disguised as safety?

That’s simply unacceptable.

Linguistic flaws, born from “value investing,” pushed us past the line where individual freedom ends and public harm begins. This is so because clarity must precede liberty.

“Value investors” created their own philosophical prison by marketing themselves too effectively. In the long term that may not matter. In the short term, even they feel the impact because the fallacy is hurting them from a business perspective. But the real losers are the ones that end up speculating endlessly thinking they can be the next Warren Buffett or that their moonshot is coming and their lambo is around the corner.

Klarman got almost everything right, but fell one step short. Unfortunately, that missed step has transformed finance for the worse. Ironically, the word “value” has destroyed so much value.

Do You Want More?

We’ve produced extensive material on the value investing myth. We explored the dark alleys and tested in the lab and have found the one path that will lead us back to sunlight. This post is a good place to start.

Prefer audio?

Start with LexBeyond Ep. 6: The Value Investing Myth.

Episodes 7 and 8 continue that series.

Next up on LexBeyond: Seth Klarman–the brilliant thinker who couldn’t bring himself to take the final step and conclude that value investing is a myth.

With the recent surge in gold prices, this would look better today. But it’s still a Mazda, and not a retirement account, and that is because of the power of compounding.