Prediction Markets, Portfolio Myths and a Sliver of Common Sense

Will Hargreaves Lansdown & Goldman Sachs be among the last adults in the room?

Like clockwork… sports event contracts are coming to Chicago.

This one stings. In my previous life, I saw that building every day. I’d ride the train from the suburbs into Union Station, walk past the CME building and cross the street to the office. It stood tall, not literally (it doesn’t even crack the top 100 tallest buildings in Chicago)--but symbolically, as the financial hub for futures trading. Now? It’s on its way to becoming the epicenter of sports gambling.

Let’s be honest: Did anyone seriously think this wasn’t going to happen?

FanDuel partnered with CME group. No word on sports event contracts yet, but when a sports gambling platform (yes, daily fantasy sports is gambling, too) marries a derivatives marketplace… you do the math. What do you suppose their child will look like?

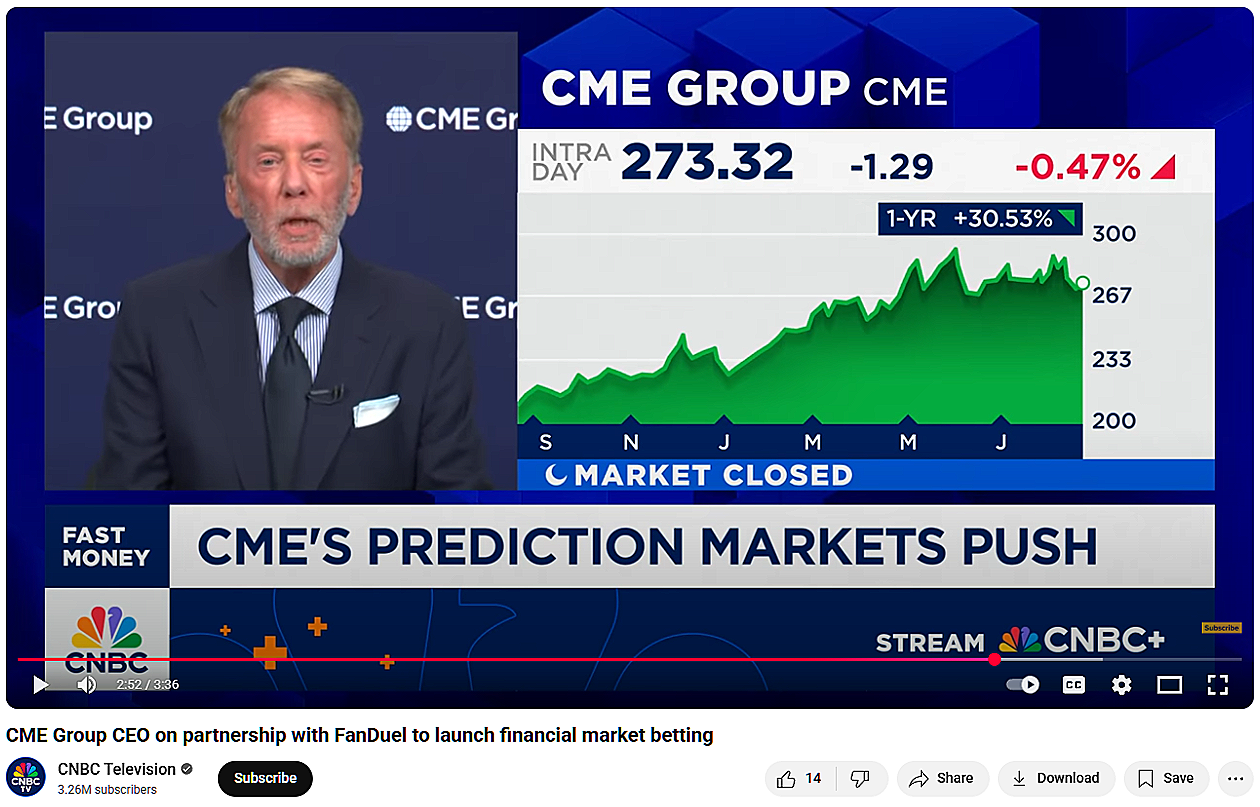

CME is now in the betting–uhm, prediction market–business. Watch how Duffy calls them bets, then corrects himself and switches to “trades,” stealing from Kalshi’s playbook. This is the same Terry Duffy who gave Shayne Coplan the middle finger during the SEC/CFTC harmonization panel, which Coplan capitalized on through social media by responding with: “Hang it in the Louvre.” Word has it they did, but it was stolen during the heist:

So: Are they bets? Trades? Investments?

Here’s what Duffy said when the FanDuel partnership was announced:

Individual investors are increasingly sophisticated and continually pursuing new financial opportunities. To meet this demand, we have created this innovative partnership, which will operate a non-clearing FCM. Together, our event-based products will appeal to the growing public interest in markets, and we will provide education to attract a new generation of potential traders not active in derivatives today.

Subtle one! It doesn’t explicitly call prediction market contracts “investments,” but it does say the deal is designed to meet investor demand for new financial opportunities. Another example of prediction markets sliding into investing’s DMs.

The strategy is clear: Blur the lines between investing, speculation and gambling. Let people trade anything, anytime, from cradle to grave. Robinhood isn’t even pretending anymore.

Crypto deserves an Oscar for Best Supporting Role in making all of this possible. Yet–amid all this noise–some voices of reason remain.

When we saw the headline Bitcoin is ‘not an asset’ and has ‘no intrinsic value,’ says $225 billion investment company–we couldn’t resist. It was screaming: Read me.

The article features a British firm that refuses to board the crypto train: Hargreaves Lansdown. There’s also at least one more on this side of the pond: Goldman Sachs–though their position is more nuanced, as we’ll unpack below.

It’s beyond refreshing. Bitcoin refusal takes courage, discipline and long-term thinking. We’re sure they’re catching heat from customers, shareholders, peers, and who knows who else. But long-term? These firms may turn out to be the real winners.

Let’s give them credit where it’s due:

🏛️ Hargreaves Lansdown

Their position is memorialized in their Crypto Statement:

The HL investment view is that Bitcoin is not an asset class, and we do not think cryptocurrency has characteristics that mean it should be included in portfolios for growth or income and shouldn’t be relied upon to help clients meet their financial goals. Performance assumptions are not possible to analyse for crypto and, unlike other alternative asset classes, it has no intrinsic value.

Not an asset class. Doesn’t belong in a portfolio. No intrinsic value. We’ve been saying the same.123 HL continues:

Despite our investment view, we recognise that some clients will wish to speculate with crypto ETNs…HL will offer appropriate clients to trade in crypto ETNs early next year following careful development of the client journey and appropriateness assessment.

Certainly fair. We’ve never advocated for a crypto ban, either. HL’s stance is: If people want to speculate, they should be able to. We agree, but regulators should adopt HL’s framing–because every single person purchasing crypto is speculating, not investing; and they are naive to the potential harm in not knowing the difference. There is a better way.

🧮 Goldman Sachs

Goldman Sachs Wealth Management released a report earlier this year. It’s not brand new, but the insights are timeless. The section titled Strategic and Tactical Assessment of Gold and Bitcoin (p. 39) is gold (pun intended). Read the whole thing, because it’s a refreshing, consequential take on what’s happening with today’s markets.

It opens with a fascinating statement:

Gold’s 27% return and bitcoin’s 123% return in 2024 have prompted our clients and colleagues alike to ask whether ISG has changed its view of gold and bitcoin as investment asset classes or, at the least, considered a tactical allocation to each asset.

ISG is Goldman’s Investment Strategy Group. Before we get to the answer, let’s unpack two key concepts from that statement.

🏀 Process vs Outcome

Arguably the most critical distinction in the world of investing. We love to use our basketball analogy: It’s not about making the shot–it’s about taking the right shot. If you measure success by the outcome alone, things get weird fast (consider this hypothetical scenario to see how).

Being outcome-oriented is one of our pet peeves. Until recently, it used to be Howard Marks’s too–that was before Bitcoin moonshot and he started listening to his son, who happens to own some Bitcoin. This is the same mindset that led to the questions ISG began to get.

🧩Asset Class vs. Tactical Allocation

Is there a difference? ISG seems to think so. Something may not be an asset class but still be worthy of a tactical allocation. But what is a tactical allocation? Here is a CFA prep video that explains it.

Let’s add some historical context here. Harry Markowitz, Nobel laureate and the father of Modern Portfolio Theory, never mentioned it in his seminal 1952 paper, Portfolio Selection (PDF). Like many things in finance, the concept of “tactical allocation” emerged much later, and arguably was more a tool to serve business needs and less something that was meant to provide clarity to the investing process. This academic paper (paywall), which was published almost 40 years after Markowitz, seems to have helped popularize it. Read that paper and you’ll see that it becomes clear that tactical allocation was about shifting across asset classes, not about adding non-cash-flowing assets to portfolios. From the abstract:

Tactical asset allocation (TAA) is the practice of altering asset class exposures in accordance with model-based risk-reward expectations. An analysis of 17 U.S. managers who use TAA to rebalance between large-cap stocks, long-term bonds and cash equivalents reveals that the vast majority provided positive timing ability at a statistically significant level.

And later:

For stock, bond and cash returns, we used gross S&P 500 total returns, 20-year U.S. bond total returns and three-month Treasury bill returns, respectively. These return series correspond most closely to the benchmarks used by TAA managers.

This is a real portfolio. Notice what is missing there: Gold. There is nothing remarkable about asset managers changing the mix in reaction to changing market conditions, that’s what a prudent investor is supposed to do. Today, tactical allocation may have become a backdoor for non-cash-flow-generating assets to sneak into a portfolio, but there is no historical support for that idea.

What about the idea that one should own gold as an inflation hedge? Well, ISG doesn’t even buy that idea and even backs it up with data:

However, gold does not add value to a well-diversified portfolio. It does not generate income, it does not generate earnings, and-contrary to popular belief-it is not an inflation hedge.

Even if you hold on to gold as “insurance,” that doesn’t mean it belongs in your investment portfolio.

🧭 ISG’s Position

We do not believe that gold and bitcoin (or cryptocurrencies broadly) have a strategic role in clients’ portfolios.

Promising. That’s also HL’s view. We share that view with both of them.

But then comes their hedge and is where we diverge:

However, gold, just like other real commodities, has presented tactical asset allocation opportunities in the past and will continue to do so in the future.

So… Is gold an asset class? The report dances around the question. One chart (Exhibit 63) even labels gold as an asset class–though it’s used to debunk the inflation hedge myth.

Definitions matter. Positions matter. It’s a very simple concept: If gold is an asset class, it might belong in a portfolio. If it isn’t, it doesn’t. The strategic vs. tactical distinction merely muddies the waters.

Then comes their Bitcoin line:

Bitcoin, as we have discussed before, is a speculative digital asset more suited to gambling than investing.

This simple conclusion fails to deliver on two fronts:

Why is gold granted portfolio access (even tactically), but Bitcoin isn’t?

The investing vs. gambling dichotomy is the wrong question.

Yesterday’s NYT opinion piece raises legitimate concerns while at the same time contributing to the confusion.

🎙️ Coming Soon: LexBeyond Podcast

We’re launching a podcast–LexBeyond–that reimagines legal history as a podcast, where forgotten cases, overlooked concepts and hidden conflicts are heard anew. Each episode explores the people and ideas behind key cases–the debates that shaped doctrine, the words that bent policy, the stories history forgot. Designed for lawyers, policymakers, journalists, as well as the legally and financially curious, LexBeyond sits at the intersection of storytelling and scholarship — revealing what happens when law meets life.

Our first episode will tackle why the investing vs. gambling dichotomy is misleading. Stay tuned!